Valued at a market cap of $22.7 billion, Texas Pacific Land Corporation (TPL) is one of the largest landowners in Texas, with over 870,000 acres primarily located in the oil-rich Permian Basin. Headquartered in Dallas, the company generates revenue through oil and gas royalties, land and resource management, and water services, rather than directly producing energy.

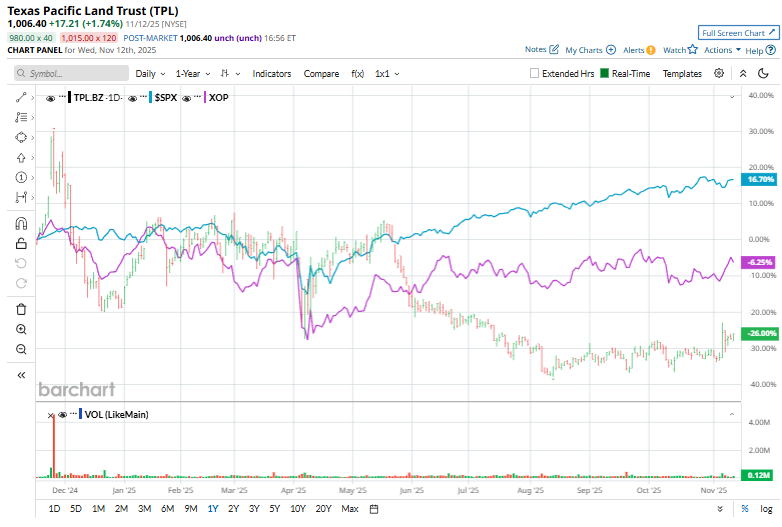

TPL shares have substantially underperformed the broader market over the past year, dipping28.5% over the past 52 weeks and 9% in 2025. Meanwhile, the S&P 500 Index ($SPX) has soared 14.5% over the past year and is up 16.5% on a YTD basis.

Narrowing the focus, Texas Pacific also outpaced the SPDR S&P Oil & Gas Exploration & Production ETF’s (XOP) 6.2% decline over the past 52 weeks and marginal fall on a YTD basis.

Texas Pacific released its third-quarter earnings on Nov. 5, with revenue rising to $203.1 million and net income reaching $121.2 million, or $5.27 per share. Growth was driven by solid performance in both the Land & Resource Management segment, which generated $122.3 million, and the Water Services & Operations segment, which brought in $80.8 million amid higher water sales and strong oil and gas royalty volumes.

The company maintained a robust cash flow of $122.9 million and strengthened its financial flexibility through a new $500 million revolving credit facility. Additionally, TPL announced a three-for-one stock split and completed strategic land and royalty acquisitions worth $505 million, reinforcing its long-term growth outlook in the Permian Basin. As a result, its shares jumped 10% in the following trading session.

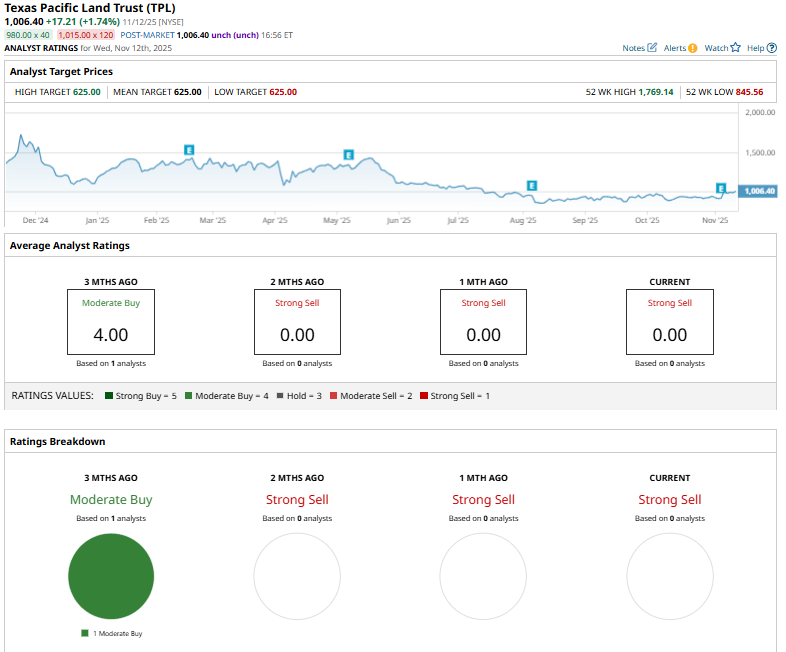

TPL stock has a consensus “Strong Sell” rating overall.

TPL currently trades above its mean and average price target of $625.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.