"Seasonal tendencies in commodity trading"

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- Weekend Report - November 7-9, 2025

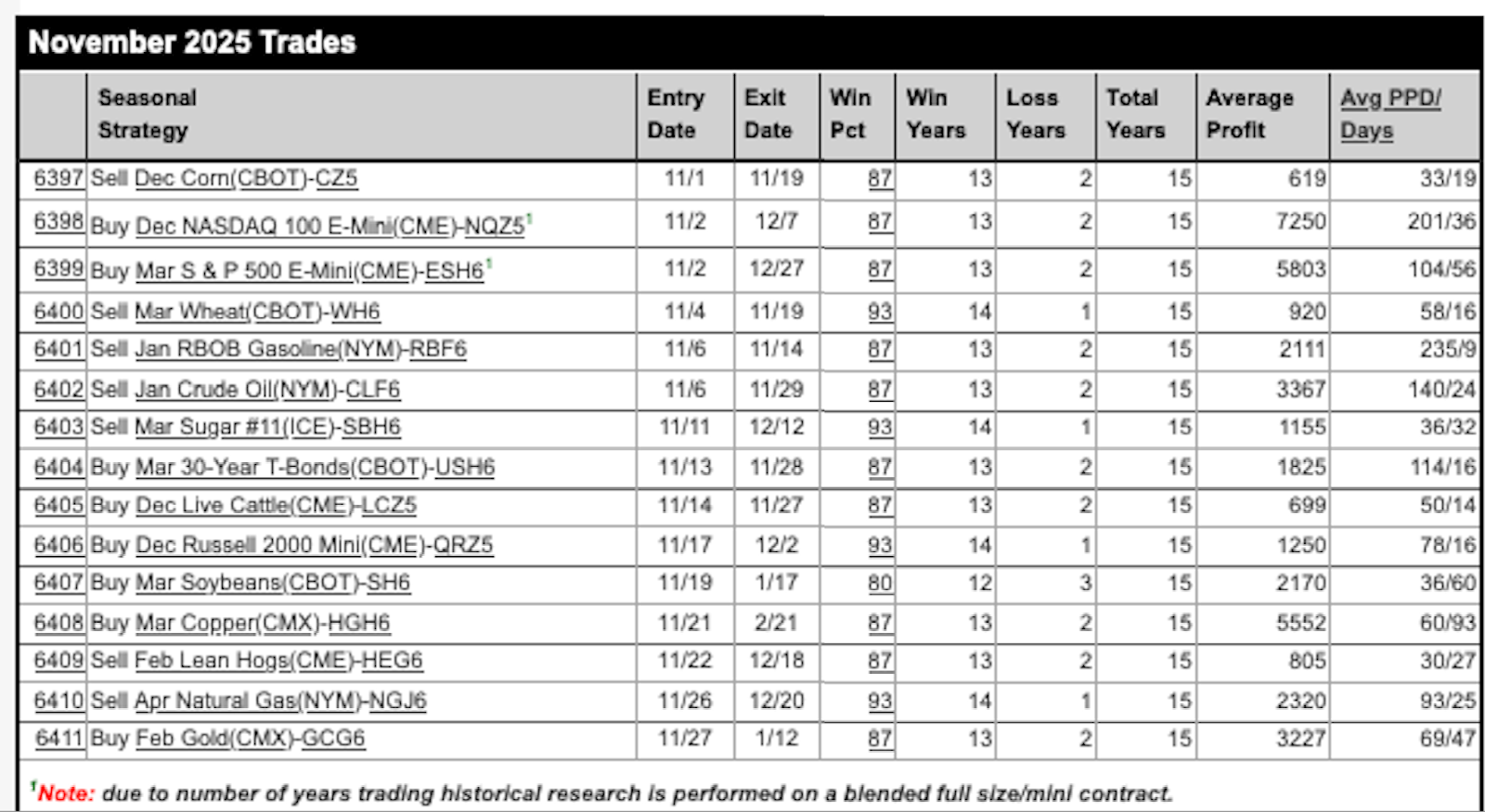

Table Image Source: mrci.com Used by permission

To trade seasonal commodity patterns:

- First, identify recurring historical price trends using seasonal charts and data

- Then, develop a strategy, which may involve entering trades a few weeks before the typical seasonal peak, and backtest it with historical data.

One of the most reliable November seasonal commodity trades is selling wheat futures. This is something I suggested to WeatherWealth subscribers this past week following the spike in the price of wheat futures.

Let’s consider the seasonality in the copper market… Taking a long position in copper (during November) has turned out profitable in 13 of the past 15 years(!) provided that the long position is entered in November and liquidated in mid-February.

Remember, however, "nothing is written in stone” (except in the cemetery). 🙁

One must also analyze the chart patterns, global economic indicators, and a host of other fundamental variables. However, when you have a strong conviction about a specific commodity market direction, using seasonality could help confirm your viewpoint and allow you to adjust risk management procedures. It can also help with your “timing” as to when to possibly exit out of a profitable trade position… (and when to liquidate a loser)

Image Source: rocksolidsayings.com

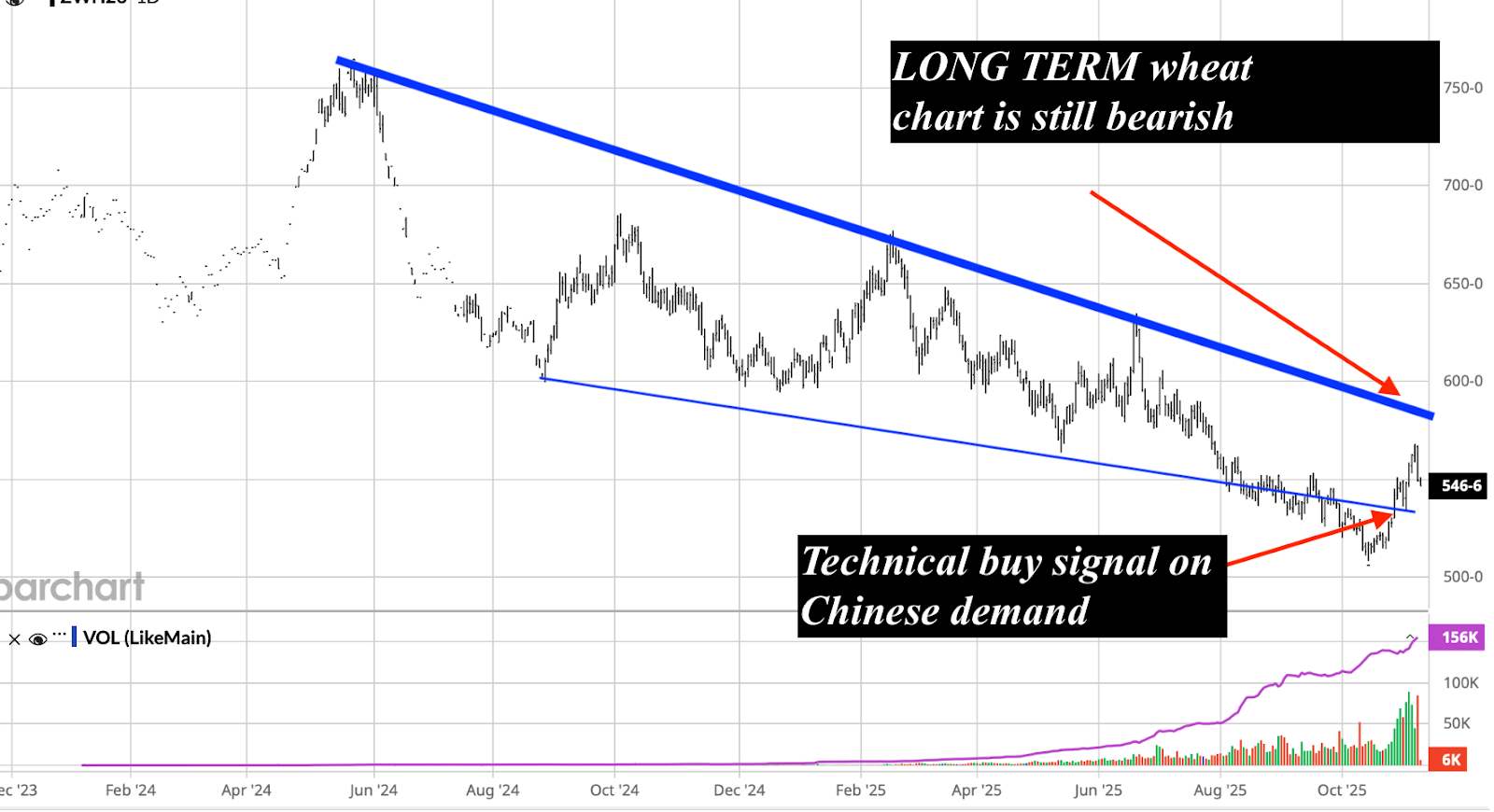

Currently, global crops are generally ideal, and rumors of Chinese buying that helped the market may have caused a false technical buy signal early in the week. Notice, in the MRCI table above, wheat prices went lower in November in 14 out of the last 15 years.

Image Sources: Barchart.com and WeatherWealth Newsletter

It is vital to combine seasonal analysis with fundamental factors (such as weather forecasts or reports from industry publications or Wall Street research) and technical indicators (like moving averages, or indices such as relative strength or stochastics) to confirm trades. This is something I often suggest for farmers and commodity traders on six continents who subscribe to the WeatherWealth Newsletter.

You can receive a 2-week FREE trial for $1 (you may cancel at any time) > > > > > CLICK HERE

- Again, with my 40+ years of experience in the weather and commodity game, you can gain valuable insight from my expertise, my weather skills, and my trade ideas. Why not give it a shot? Just request the free trial via the link shown above.

Remember when trading commodities, always use risk management, such as stop-loss orders and position sizing, and consider using spreads to isolate the seasonal component of a particular market move.

Thanks for your interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)