Monro (MNRO) shares closed more than 15% higher on Nov. 5 after legendary activist investor Carl Icahn increased his stake in the automotive services firm by another $9.7 million.

Icahn now owns roughly 4.4 million shares of the company in total, which makes him the largest MNRO shareholder, a position previously held by BlackRock Fund Advisors.

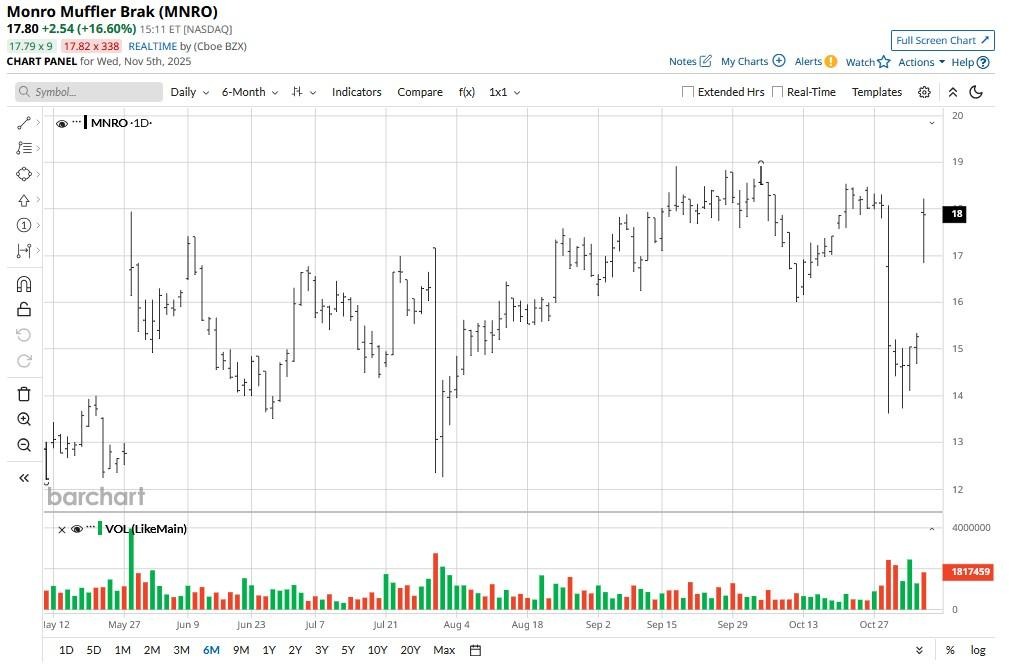

Despite a massive move to the upside on Wednesday, Monro stock remains down over 25% year-to-date.

Does Icahn’s Involvement Warrant Buying MNRO Stock?

Icahn’s involvement is largely bullish for MNRO shares since it signals strategic changes and value creation opportunities may be on the horizon.

His substantial stake validates the Nasdaq-listed firm’s turnaround potential and offers assurance that experienced activist oversight will likely drive performance improvements.

Carl Icahn has previously led successful activist campaigns in renowned names like Herbalife (HLF) and eBay (EBAY). He’s even credited with unlocking remarkable shareholder value in giants like Netflix (NFLX) and Apple (AAPL).

Monro’s better-than-expected earnings in its latest reported quarter offer another notable incentive to investors to follow Icahn in his footsteps.

Technicals Suggest Further Upside in Monro Shares

Monro shares are worth owning on the Icahn news since they are currently trading at a compelling price-sales (P/S) multiple of only 0.38x.

Today’s rally has pushed MNRO stock well past its 200-day moving average (MA) as well, further indicating bullish momentum ahead.

Meanwhile, options traders are pricing in continued increase in the company’s share price to about $20.50 through Jan. 16 as well. Historically, Monro has delivered a 5.54% return on average in November and another 1.60% in December.

Finally, the automotive aftermarket continues to demonstrate remarkable resilience despite broader economic headwinds that bolsters the case for owning MNRO heading into 2026.

How Wall Street Recommends Playing Monro

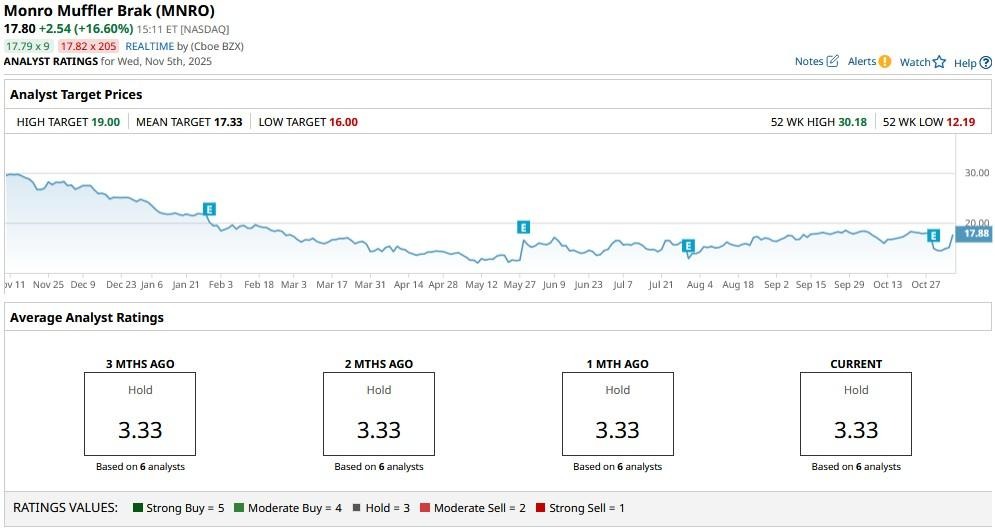

Wall Street analysts aren’t entirely bearish on Monro stock either.

According to Barchart, the consensus rating on MNRO shares currently sits at “Hold” only, but the price targets go as high as $19, indicating potential for 7% upside from here.

More importantly, firms may revise their estimates (upwardly) for the automotive services business following Icahn’s involvement in the coming sessions.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)