"Hi-Yo Silver! How we called the massive move up in this precious metal"

By Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- Weekend Report - October 17-19, 2025

Image Source: Bestweather, Inc.

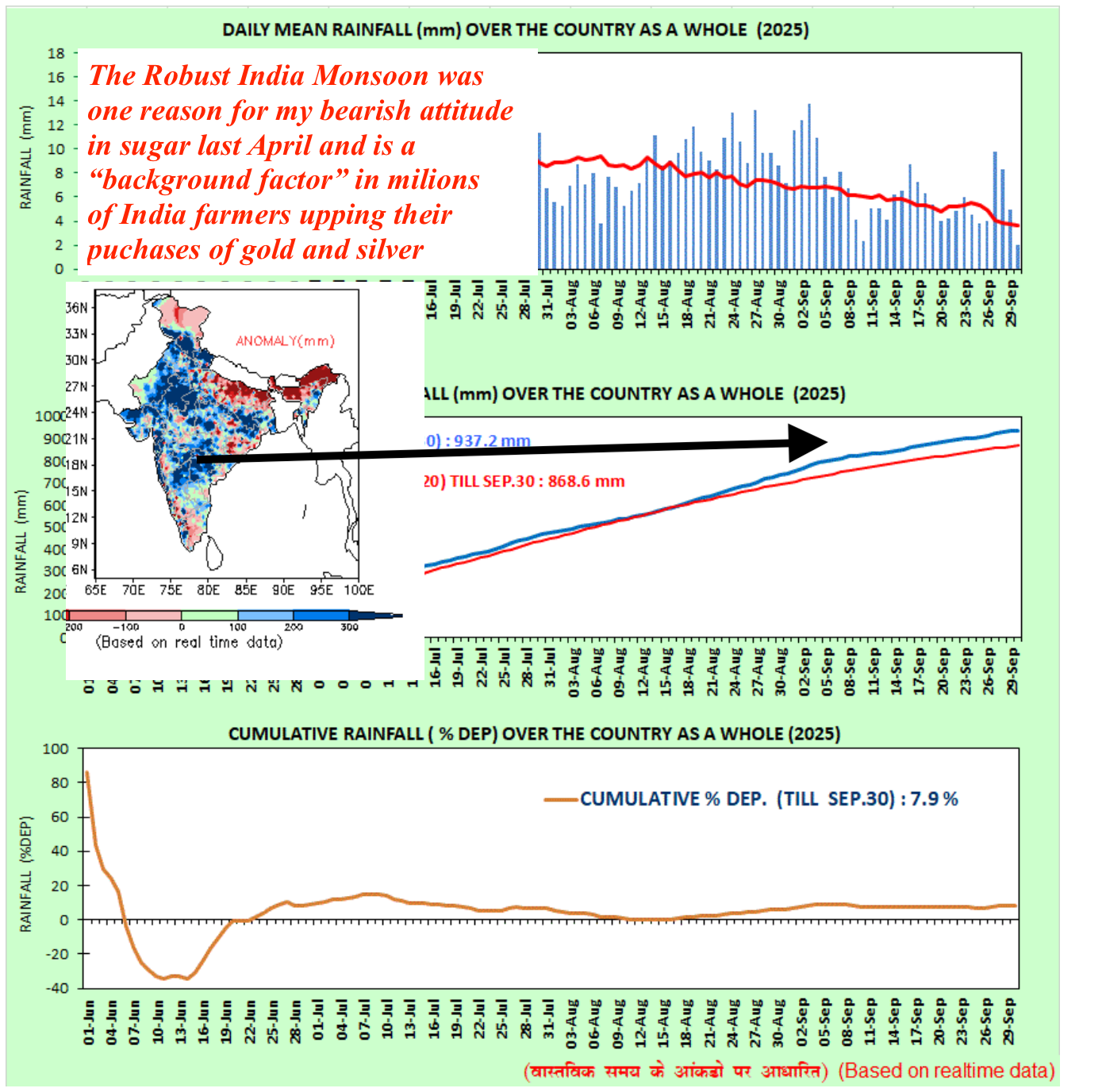

Silver prices have risen sharply in October 2025 due to a combination of high industrial demand, increasing investor interest in precious metals as safe havens, and a persistent supply deficit. I normally do not advise on precious metals, but this was a trade I was pretty confident about. The weather is a slight background factor.

A positive Indian monsoon season, which can boost rural demand for silver during the festive season, is a contributing factor, though it is one of several key drivers.

It is for these reasons and given the chart formation, that back in April. I mentioned that I thought silver prices would soar

Factors driving silver prices in October 2025

High industrial demand

- Renewable energy: The clean energy transition, led by the growth of solar photovoltaic (PV) technology, is a primary driver. Silver is a critical component in solar panels, and increased global installation has significantly boosted demand. This is something pretty close to my heart.

Image Source: Bestweather, Inc.

- Electronics and vehicles: Demand for silver is also rising in other industrial applications, including electric vehicles (EVs), 5G technology, and high-tech electronics.

Safe-haven investment

- Geopolitical and economic uncertainty: Escalating global tensions and concerns over a growing U.S. fiscal deficit have prompted investors to seek refuge in precious metals.

- Inflation hedge: With persistent inflationary pressures and the potential for a weaker U.S. dollar, investors are turning to silver as a store of value.

- Amplified movement: As a more volatile asset than gold, silver has historically seen larger price swings during bull runs, which can attract momentum-driven investors.

Structural supply deficit

- Production lagging demand: For several consecutive years, the global silver market has experienced a supply deficit, meaning demand is consistently outpacing mine production and recycling.

- Byproduct production: The supply issue is compounded by the fact that roughly 70% of silver is a byproduct of mining other metals like zinc, copper, and gold. This limits how quickly silver output can increase in response to higher prices.

- Inventory drawdown: Visible inventories in key trading hubs, such as London, have dwindled as industrial and investment demand have absorbed available supplies.

Indian monsoon and festival season demand

Image Source: Bestweather, Inc.

- Monsoon’s effect on rural income: India is a major consumer of silver, especially in rural areas. A strong monsoon, as experienced in 2024, boosts agricultural yields and, consequently, rural incomes.

- Increased purchasing power: This higher disposable income often translates into increased purchases of precious metals for personal consumption, weddings, and as a store of value.

- Coincides with peak demand: The monsoon season’s end coincides with India’s peak festival and wedding seasons (September–December), a period of strong traditional demand for precious metals like silver.

A supporting, not primary, driver: While a positive monsoon contributes to robust seasonal demand, particularly in the Indian market, it is a smaller piece of the puzzle compared to the fundamental issues of global industrial demand and the persistent supply-demand imbalance.

Image Source: Bloomberg News

For an interesting video about why silver has soared…

…please click here > > > > https://www.youtube.com/shorts/3Oc8b33OelM?feature=share

In summary, while the monsoon’s positive effect on rural demand in India helps, the significant surge in silver prices is fundamentally driven by a combination of booming global industrial usage, safe-haven investment during economic uncertainty, and a structural deficit in the worldwide market. Again, as I mentioned back in April, I think prices will reach $100 an ounce within two years. There is a present “short squeeze” at play.

Want to know how to use options to trade silver or where the next big moves in markets such as coffee, sugar, grains, and natural gas?

Request a 2-week free trial to WeatherWealth for $1 >>> PLEASE CLICK HERE

Thanks for your interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)