With a market cap of $108.8 billion, Comcast Corporation (CMCSA) is a global media and technology conglomerate headquartered in Philadelphia, Pennsylvania. Founded in 1963, Comcast has evolved from a regional cable provider into a diversified entity with significant operations in broadband, wireless, video, and voice services. Its primary consumer-facing brands include Xfinity for broadband and cable services, Sky for European entertainment, and Peacock for streaming.

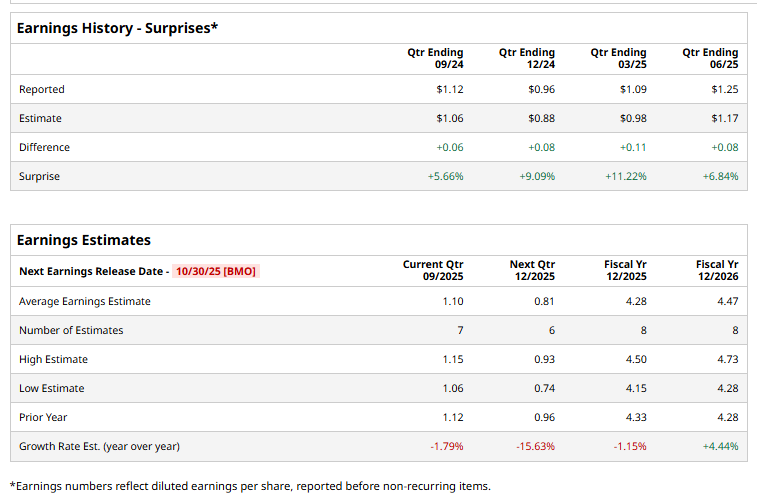

The company is expected to announce its third-quarter results before the markets open on Thursday, Oct. 30. Ahead of the event, analysts expect CMCSA to deliver a profit of $1.10 per share, down 1.8% from $1.12 per share reported in the year-ago quarter. However, the company has surpassed the Street’s bottom-line expectations in each of the past four quarters.

For the current year, analysts expect Comcast’s earnings to drop 1.2% from $4.33 per share reported in 2024 to $4.28 per share. However, in fiscal 2026, its earnings are expected to grow 4.4% year over year to $4.47 per share.

CMCSA stock has dropped 28.7% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 14.4% gains and the Communication Services Select Sector SPDR ETF Fund’s (XLC) 25.9% surge during the same time frame.

On Oct. 10, CMCSA shares fell 2.1% following Bernstein analyst Laurent Yoon’s decision to maintain a “Hold” rating on Comcast, with a $36 price target.

The stock holds a consensus “Moderate Buy” rating overall. Of the 32 analysts covering the CMCSA stock, opinions include 15 “Strong Buys,” 15 “Holds,” and two “Strong Sells.” Its mean price target of $39.91 represents a 35.7% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)