/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla’s (TSLA) ambitious push into humanoid robotics is no longer just a far-off concept—it’s starting to be factored into Wall Street valuations. According to new analysis from Stifel, the firm has raised its 12-month price target on TSLA to $483, assigning $29 of that valuation—about 6%—to the company’s Optimus robot project. That may not sound like much, but for a product still in development and years away from commercialization, it’s a meaningful acknowledgment of its potential.

The move signals growing confidence among some analysts that Tesla’s long-term story extends far beyond electric vehicles. From artificial intelligence-powered driver assistance and autonomous robotaxis to humanoid robotics, Elon Musk has repeatedly emphasized that Tesla’s future lies in AI and automation. Stifel’s valuation update suggests that Wall Street is starting to take those ambitions more seriously—at least partially.

Still, questions remain. Is the market underestimating Tesla’s robotics potential—or is Stifel getting ahead of itself by pricing in a project that’s still in development? And most importantly, what does this newfound confidence from Stifel mean for TSLA stock? Let’s take a closer look!

About Tesla Stock

Tesla is a prominent innovator dedicated to accelerating the global transition to sustainable energy. The Elon Musk-led powerhouse designs, develops, manufactures, leases, and sells high-performance fully electric vehicles (EV), solar energy generation systems, and energy storage products. It also offers maintenance, installation, operation, charging, insurance, financial, and various other services related to its products. In addition, the company is increasingly focusing on products and services centered around AI, robotics, and automation. TSLA has a market cap of $1.37 trillion.

Shares of the EV maker have gained 6.6% on a year-to-date basis. TSLA stock pulled back from its recent high near $460 in early October despite posting stronger-than-expected Q3 deliveries, as investors chose to sell on the “good news.” Last Thursday, TSLA stock came under pressure after the National Highway Traffic Safety Administration (NHTSA) launched a probe into the company’s Full Self-Driving (FSD) driver-assistance technology. And on Friday, the stock slumped along with the broader market amid flaring trade tensions between the U.S. and China.

Stifel Remains Bullish on Tesla, Assigns 6% of Price Target to Optimus

Last week, Stifel analyst Stephen Gengaro boosted his price target on TLSA stock to $483 from $440 while maintaining a “Buy” rating. The analyst pointed to growing confidence in the company’s advancements with FSD and its emerging Robotaxi network. However, he noted that Tesla has “high expectations for its camera-based approach,” aiming for “Unsupervised FSD to be available for personal use in the United States by year-end 2025,” a target that “appears to be a stretch but seems more likely in the medium term.”

Gengaro explained that the updated valuation is based on “20-25x projected 2025 EBITDA for the core business,” along with partial weightings for the anticipated upside from FSD, Robotaxis, and Optimus. Notably, the analysts assigned $213 per share in value to FSD, $140 to Robotaxis, and $29 to Optimus.

Since Optimus accounts for just about 6% of Tesla’s price target, I think that’s a fairly reasonable assumption considering the product is still in development and likely years away from generating revenue. With that, let’s take a closer look at what’s already known about Optimus and the potential Elon Musk envisions for it in shaping the company’s future.

Optimus Robots Poised to Become Tesla’s Biggest Product

The Optimus project initially started as something of a curiosity. When Musk introduced it at Tesla’s AI Day in 2021, the project was widely ridiculed, particularly after a person dressed in a robot suit danced on stage. The Tesla Optimus robot is a humanoid machine capable of walking on two legs and interacting with the environment using its arms and hands. Optimus is built to automate tasks across manufacturing, logistics, and household settings, with the goal of easing labor shortages and improving workplace safety.

Fast-forward to 2025, and reports indicate that Optimus has advanced to internal testing, with several prototypes operating at Tesla facilities. In a September post on X, Musk stated that “~80% of Tesla’s value will be Optimus.” He reiterated, “I predict it will be the biggest product ever.” Musk made the prediction soon after Tesla released its latest “master plan,” a periodically updated corporate roadmap that, for the first time, included references to robots. Optimus “is changing not only the perception of labor itself but its availability and capability,” Tesla said in its “Master Plan Part IV.” In mid-2024, Musk projected that Optimus robots could eventually make Tesla a $25 trillion company—over five times the valuation of Nvidia (NVDA), currently the world’s most valuable company.

Back in March, Musk said that Tesla intends to produce 5,000 Optimus robots this year. And in its first-quarter shareholder deck, Tesla stated that it remains on track to begin “builds of Optimus on our Fremont pilot production line in 2025, with wider deployment of bots doing useful work across our factories.” During Tesla’s second-quarter earnings call in July, Musk said, “It’ll probably be prototypes of Optimus 3 end of this year and then scale production next year.” He added that the company will “try to scale Optimus production as fast as it’s seemingly possible... to try to get to a million units a year as quickly as possible.” He estimated that the company could reach that milestone in under five years, calling it an “achievable target.”

It’s worth noting that the foundation of all this is Tesla’s long-term bet on autonomy. Musk has consistently asserted that AI—and particularly autonomous mobility—will be the primary source of Tesla’s value, including its highly touted FSD software. And that same autonomy software is being adapted for an entirely different type of hardware—humanoid robots. Tesla said that the same neural network and sensor fusion technology used in its vehicles is being repurposed to enable Optimus to navigate human environments, learn from experience, and adapt to new tasks with minimal programming. This integration of Tesla’s software into robotics is a key reason Musk believes the company could gain a significant edge over competitors in the field.

Skepticism Persists Over Tesla’s Optimus Ambitions

Some investors, analysts, and robotics experts remain skeptical that Musk will achieve his lofty goals, particularly considering his long track record of missed predictions and unkept promises. The first reason for skepticism arises from the difficulties surrounding the production of Optimus robots. Even CEO Musk has recently emphasized the complexity of the Optimus project. Musk stated on the All-In Summit podcast last month that the Optimus humanoid robot is the most difficult engineering project Tesla has ever undertaken. “It’s more difficult than any of those projects—much harder… only Starship is tougher,” he said when asked how Optimus compares to Tesla’s most challenging vehicle programs. The Information reported this summer that Tesla has been facing challenges in meeting Musk’s pledge to build 5,000 Optimus units this year. Also, Optimus engineering chief Milan Kovac left Tesla in June after serving nine years with the company. In addition, some nearly completed Optimus units were reportedly left without hands as Tesla continues to refine their manual dexterity. Notably, Musk said that for Optimus, “the hands, inclusive of the forearm, are a majority of the engineering difficulty of the entire robot.”

Another source of skepticism is Musk’s insistence on a humanoid design, which risks creating a machine that’s a jack of all trades but a master of none, according to experts. “Humanoids will be useful some of the time, doing some tasks,” said Gur Kimchi, the former head of Amazon’s (AMZN) drone delivery program. “But to be good all the time on all tasks is extremely challenging, and often the humanoid morphology makes it unnecessarily complex,” Kimchi noted. Chris Walti, the former head of the Optimus team, expressed similar concerns, telling Business Insider earlier this year that mimicking human form was “not a useful form factor” for industrial applications.

Also, some are questioning whether the race to develop humanoid robots is even worth running. Prescott Watson, a venture capitalist at RedBlue Capital, told The Independent last month that in predictable, specialized settings like factories, it’s uncertain whether a general-purpose humanoid robot can outperform specialized industrial robots. However, he noted that humanoid robots can thrive in unpredictable environments, where flexibility and adaptability matter more than speed or efficiency.

Finally, competition can’t be overlooked, as Tesla will need to beat the low-cost humanoid robots already offered by Chinese manufacturers, some priced below $6,000, compared to Musk’s projected range of $20,000 to $25,000.

That said, skepticism is understandable. Tesla will need to resolve all production challenges to make the robot good enough for mass-market use while staying competitive against lower-cost rivals. Still, the ongoing growth of the robotics sector actually reinforces Tesla’s bet. According to Precedence Research, the global advanced robotics market was valued at $44.74 billion in 2024 and is projected to grow from $53.74 billion in 2025 to around $280.01 billion by 2034, representing a compound annual growth rate (CAGR) of 20.13% over the period.

What Do Analysts Expect for TSLA Stock?

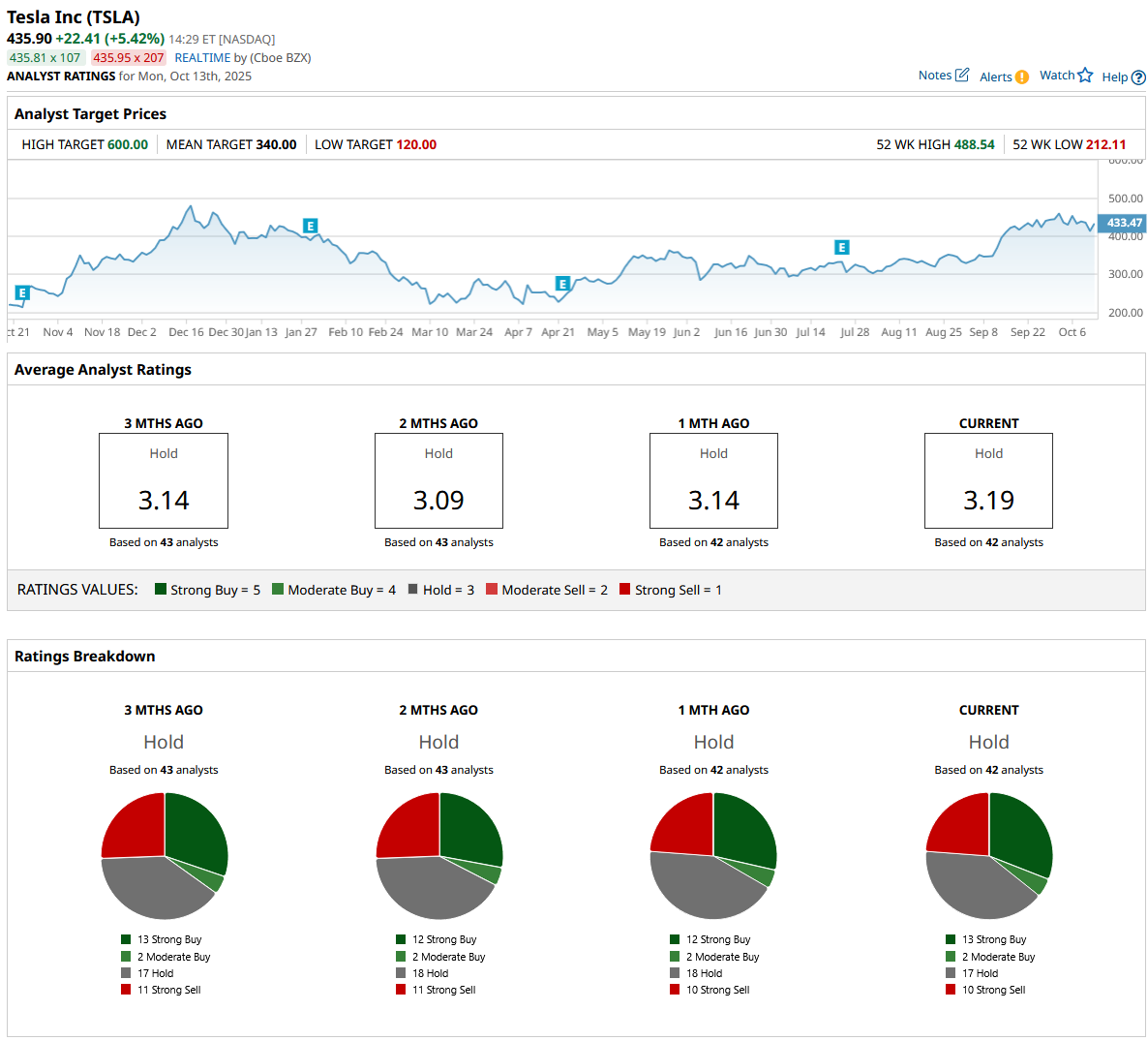

Wall Street analysts remain divided on TSLA, as reflected in the stock’s consensus “Hold” rating. While 13 analysts rate TSLA as a “Strong Buy” and two as a “Moderate Buy,” 17 suggest holding the stock, and 10 issue a “Strong Sell” rating. Tesla bulls remain largely optimistic due to Musk’s bold promises around AI, robotics, and self-driving technology, while bears emphasize the company’s weakening fundamentals and damaged brand image. Notably, TSLA stock is currently trading above its mean price target of $340.

Putting it all together, I believe Stifel’s attribution of 6% of its TSLA price target to Optimus is quite reasonable. Although the project is likely still years from generating revenue, its continued progress warrants inclusion in TSLA’s valuation. If the project continues to advance, we’ll likely see Stifel raise its price target again, reflecting a greater valuation contribution from Optimus. We’ll likely hear new updates on the Optimus project from Musk during Tesla’s Q3 earnings call on Oct. 22, so I recommend that investors keep a close watch.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)