Detroit, Michigan-based DTE Energy Company (DTE) engages in regulated and unregulated energy businesses. With a market cap of $29.1 billion, DTE Energy generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

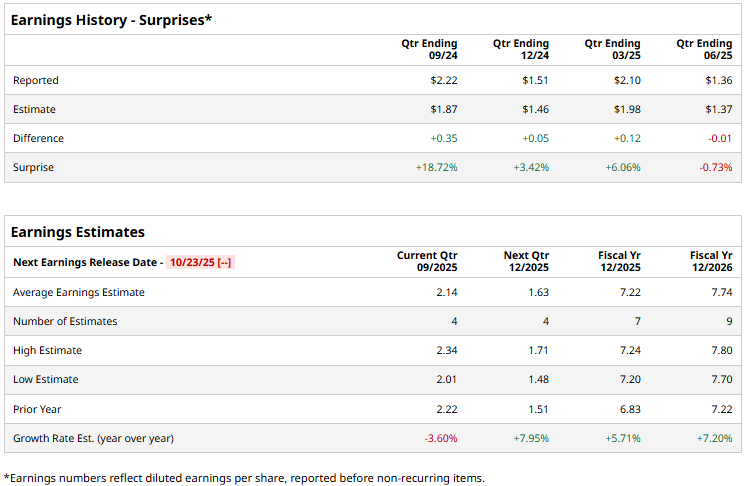

The utilities giant is expected to announce its third-quarter results before the market opens on Thursday, Oct. 23. Ahead of the event, analysts expect DTE to deliver an adjusted profit of $2.14 per share, down 3.6% from $2.22 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

For the full fiscal 2025, DTE is expected to deliver an adjusted EPS of $7.22, up 5.7% from $6.83 in 2024. In fiscal 2026, its earnings are expected to grow 7.2% year-over-year to $7.74 per share.

DTE stock prices have gained 11.6% over the past 52 weeks, outperforming the Utilities Select Sector SPDR Fund’s (XLU) 10.4% returns, but lagging behind the S&P 500 Index’s ($SPX) 17.2% surge during the same time frame.

DTE Energy’s stock prices observed a marginal dip in the trading session following the release of its mixed Q2 results on Jul. 29. The company observed a massive growth in non-utility operations and a notable increase in utility operations sales, leading to an 18.9% year-over-year surge in overall revenues to $3.4 billion, exceeding the consensus estimates by a large margin. However, the company’s margins remained under pressure, leading to a 4.9% year-over-year decline in operating earnings per share to $1.36, missing the Street’s expectations by a marginal 73 bps.

Meanwhile, the company remains on track to invest $4.4 billion into its utilities infrastructure in 2025 to improve supply reliability and transition towards cleaner energy sources.

Analysts remain optimistic about the stock’s prospects. DTE maintains a consensus “Moderate Buy” rating overall. Among the 18 analysts covering the stock, opinions include eight “Strong Buys,” one “Moderate Buy,” and nine “Holds.” Its mean price target of $147.54 suggests a modest 4.1% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)