/Amcor%20Plc%20logo%20on%20building%20by-%20jetcityimage%20via%20iStock.jpg)

Amcor plc (AMCR), headquartered in Zurich, Switzerland, is a global player in the world of packaging solutions. Its Global Flexible Packaging arm supplies polymer, aluminum, and fiber-based products to food, healthcare, and personal care industries. Alongside this, the Global Rigid Packaging division produces containers, closures, and devices specifically tailored for the food and beverage markets.

With a market capitalization of $11.9 billion, Amcor sits comfortably in the “large-cap” bracket, a category reserved for companies valued above $10 billion. It primarily targets customers through its direct sales network, which has supported its size and market presence.

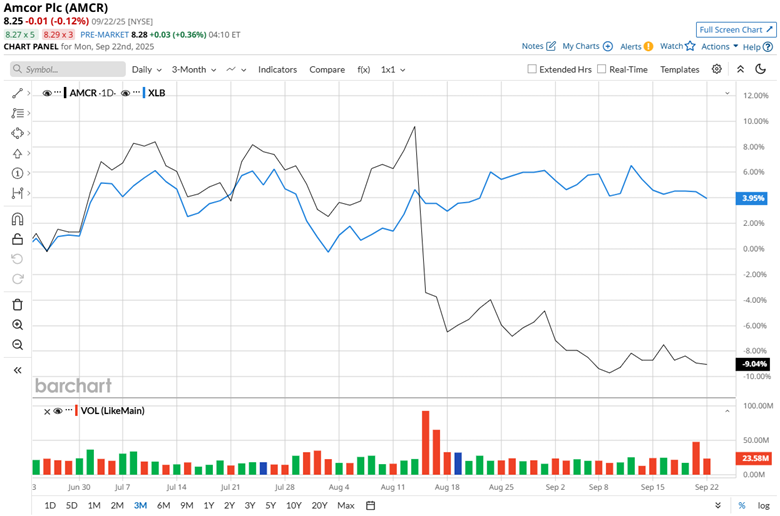

AMCR shares currently trade nearly 28.1% below their 52-week high of $11.48. Over the past three months, the stock has plunged close to 8%, lagging behind the Materials Select Sector SPDR Fund’s (XLB) gain of 4.6% during the same period.

The broader picture tells a more sobering story. Over the past 52 weeks, AMCR stock slipped 24.3%, and year-to-date it is down 12.3%. By contrast, XLB declined only 3.9% across 52 weeks but is up 7.4% so far this year.

The stock slipped below its 200-day moving average as early as March, establishing a prolonged downtrend, and has remained under its 50-day moving average since mid-August, reinforcing the bearish outlook.

On August 14, AMCR shares plummeted 11.9% after the company announced its Q4 fiscal 2025 results. Revenue grew 43.8% year over year to $5.08 billion, but analysts had penciled in $5.17 billion. Adjusted EPS came in at $0.20, down 5.2% from the prior year and shy of the $0.21 Street’s forecast. Despite the stumble, management reaffirmed that Amcor is well-positioned to achieve total pre-tax synergy benefits of $650 million by the end of fiscal 2028 from its all-stock acquisition of Berry Global. The teams are on track to deliver $260 million of pre-tax synergy benefits in fiscal 2026, translating into 12% accretion as a direct outcome of the integration.

Looking forward, Amcor expects adjusted EPS of about $0.80 to $0.83 for fiscal 2026. Free cash flow is projected to be between $1.8 billion and $1.9 billion, even after deducting nearly $220 million in net cash integration and transaction costs associated with the Berry Global acquisition.

Ball Corporation (BALL), a close competitor, has seen its stock drop 26.6% over the past 52 weeks and fall 11.7% year-to-date, mirroring AMCR’s performance.

Still, analysts hold an optimistic stance on AMCR. Out of 14 analysts covering the stock, the consensus rating is “Moderate Buy”. The mean price target stands at $11.10, implying a premium of 34.5% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)