With a market cap of $27.3 billion, General Mills, Inc. (GIS) is a leading global packaged foods company best known for its iconic brands like Cheerios, Pillsbury, Betty Crocker, Häagen-Dazs, Blue Buffalo, and Nature Valley. Headquartered in Minneapolis, Minnesota, the company operates across North America and international markets, offering a wide portfolio of cereals, snacks, yogurt, baking products, frozen meals, pet food, and more.

Companies worth $10 billion or more are typically referred to as "large-cap stocks." GIS fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the packaged foods industry. With a strong distribution network and household brand recognition, General Mills generates stable cash flows and emphasizes innovation, cost efficiencies, and expansion into growth categories such as natural/organic foods and premium pet nutrition.

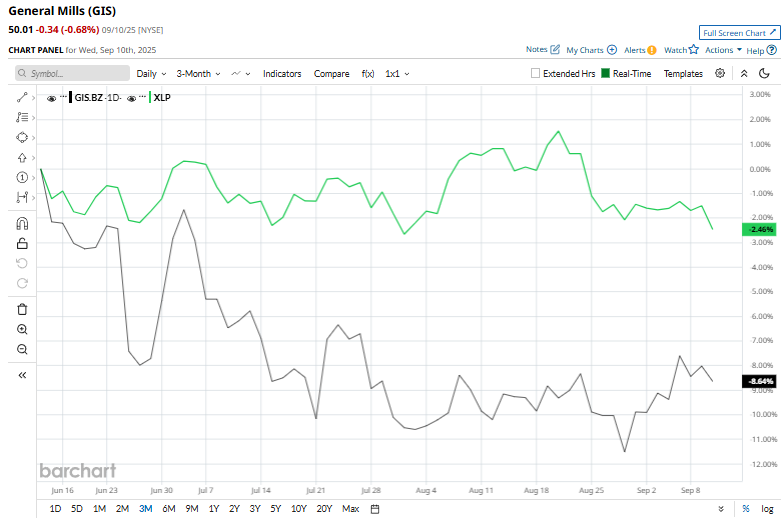

Despite its notable strengths, shares of GIS have dropped 33.9% 52-week high of $75.66, touched on Sept. 18 last year. In the past three months, GIS stock has declined 8.2%, lagging behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.3% drop during the same time frame.

The stock’s performance looks grim over the longer term as well. GIS stock has fallen 33.2% over the past 52 weeks and 21.6% on a YTD basis, underperforming XLP’s 4.4% drop over the past year and a 1.7% rise in 2025.

Confirming its bearish trend, GIS has remained under its 200-day moving average since early November 2024 and has also traded below its 50-day moving average since early April.

Extending its downward trend, GIS shares fell 5.1% on June 25 following the release of its fiscal fourth-quarter results. The company posted net sales of $4.89 billion, a 6% year-over-year decline driven by softer volumes and pricing pressure. Operating profit dropped 8% to $805 million, while adjusted EPS slid 6% to $1.08.

Its peer, The Kraft Heinz Company (KHC), has declined 13.2% in 2025 and 25% over the past year, surpassing the stock.

Among the 20 analysts covering the GIS stock, the consensus rating is a “Hold.” Its mean price target of $54.68 suggests a robust 9.3% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)