/Berkshire%20Hathaway%20Inc_%20logo%20on%20phone-by%20FelloeNeko%20via%20Shutterstock.jpg)

Berkshire Hathaway Inc. (BRK.B) is a globally recognized conglomerate with a market value of $1.1 trillion. The Nebraska-based company is distinguished by its conservative investment approach, emphasis on long-term shareholder value, and autonomous management structure, overseeing a vast portfolio of operating businesses and equity holdings across multiple industries.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and BRK.B definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the insurance-diversified industry.

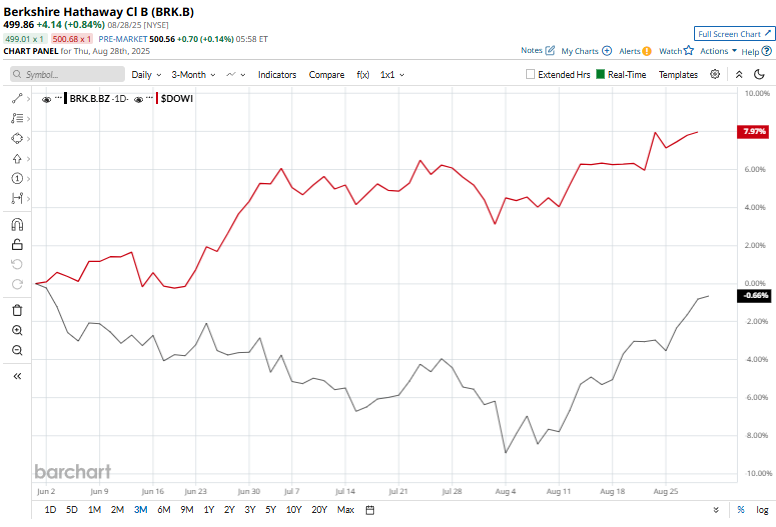

Berkshire slipped 7.8% from its 52-week high of $542.07, achieved on May 2. Over the past three months, BRK.B stock declined marginally, underperforming the broader Dow Jones Industrial Average’s ($DOWI) 8.4% rise during the same time frame.

Moreover, in the longer term, shares of Berkshire rose 10.3% on a YTD basis and climbed 7.6% over the past 52 weeks, compared to $DOWI’s YTD return of 7.3% and 11.1% gains over the last year.

Berkshire has been trading above its 200-day and 50-day moving averages since mid-August, indicating an uptrend.

On Aug. 2, Berkshire Hathaway released its fiscal 2025 second-quarter earnings and its shares dipped 2.9% in the next trading session. Its net income dropped to $12.4 billion from $30.4 billion a year ago due to a $3.8 billion Kraft Heinz write-down, while operating earnings held steady at $11.2 billion.

Top rival, JPMorgan Chase & Co. (JPM), has taken the lead over Berkshire, showing resilience with a 36.1% uptick over the past 52 weeks and a 25.6% gain in 2025.

Wall Street analysts are moderately bullish on BRK.B’s prospects. The stock has a consensus “Moderate Buy” rating from the seven analysts covering it, and the mean price target of $537.75 suggests a potential upside of 7.6% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.