/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

After a blistering rally, Palantir Technologies (PLTR) has finally taken a breather. The stock has slipped nearly 18% from its recent high of $190, a sharp move lower that raises questions about whether it’s time to buy the dip.

Even with the recent pullback, Palantir remains the year’s best performer in the S&P 500 Index ($SPX), soaring more than 107% since January. Moreover, it has increased by over 415% in the past 12 months. However, such dramatic gains raise valuation concerns, and here Palantir stands out in ways that could prompt even the most bullish investors to pause.

Palantir Stock: The Valuation Concern

Palantir’s price-sales ratio has skyrocketed to 133.2x, a level that not only dwarfs its peers in the artificial intelligence and software space, but also surpasses some of the largest and most profitable technology companies in the world. Snowflake (SNOW), UiPath (PATH), and C3.ai (AI), all prominent names in AI-driven software, trade at far more modest multiples of 17.9x, 4.1x, and 5.8x, respectively. Even the large tech giants with high profitability look inexpensive by comparison. For instance, Alphabet (GOOGL) stock trades at a P/S ratio of 7.2x, Microsoft (MSFT) at 13.3x, and Nvidia(NVDA), despite its dominance in the AI hardware space, trades at 34x.

This stark contrast highlights the market’s lofty expectations for Palantir. Investors are effectively betting that the company will deliver explosive growth for years to come, justifying today’s price tag. So far, Palantir has given them reason to believe. Its government contracts remain robust, while its commercial business is expanding rapidly as more enterprises turn to AI-driven solutions.

Palantir’s Strong Fundamentals Back the Rally

For instance, Palantir just delivered one of its strongest quarters to date, surpassing $1 billion in quarterly revenue for the first time. The momentum in its business is accelerating, with overall revenue climbing 48% year-over-year in the second quarter. This surge comes as demand for its AI Platform (AIP) remains strong and is driving growth in its customer base.

Every major metric of Palantir’s business remains solid, suggesting strong growth ahead. Palantir recorded its highest-ever bookings in Q2, with $2.3 billion in total contract value (TCV) and $684 million in annual contract value (ACV). Deal activity also remained robust, providing a solid platform for long-term growth. It closed 157 deals worth $1 million or more, including 66 worth at least $5 million and 42 exceeding $10 million.

Adding to the positives, existing customers are expanding their relationships with Palantir. Its top 20 customers now generate an average of $75 million each in trailing 12-month revenue, up 30% from a year ago.

Palantir’s U.S. business continues to fire on all cylinders, and the solid AIP demand indicates that this momentum will sustain in the quarters ahead. Its U.S. revenue rose 68% year-over-year in Q2 and 17% sequentially. Within that, the U.S. commercial segment stood out, with 93% year-over-year growth and 20% sequential growth.

Bookings tell an even stronger story about demand. U.S. commercial TCV hit a record $843 million in the quarter, up 222% year-over-year. Over the past 12 months, U.S. commercial bookings totaled $2.8 billion, marking a 141% jump from the prior year. This reflects just how quickly enterprises are adopting Palantir’s AI solutions for real-world production use cases. The U.S. commercial business also saw its total remaining deal value increase by 145% year-over-year, while the customer count reached 485, representing a 64% rise from the previous year.

Government business also remained a strong pillar of growth. U.S. government revenue rose to $426 million in the second quarter, up 53% year-over-year. This was driven by both continued execution in existing programs and new contract wins.

Palantir’s net dollar retention rate reached 128%, representing a 400-basis-point improvement from the prior quarter. At the close of Q2, Palantir’s total remaining deal value stood at $7.1 billion, up 65% year-over-year, while remaining performance obligations rose to $2.4 billion, a 77% increase.

Is Palantir Stock a Buy Now?

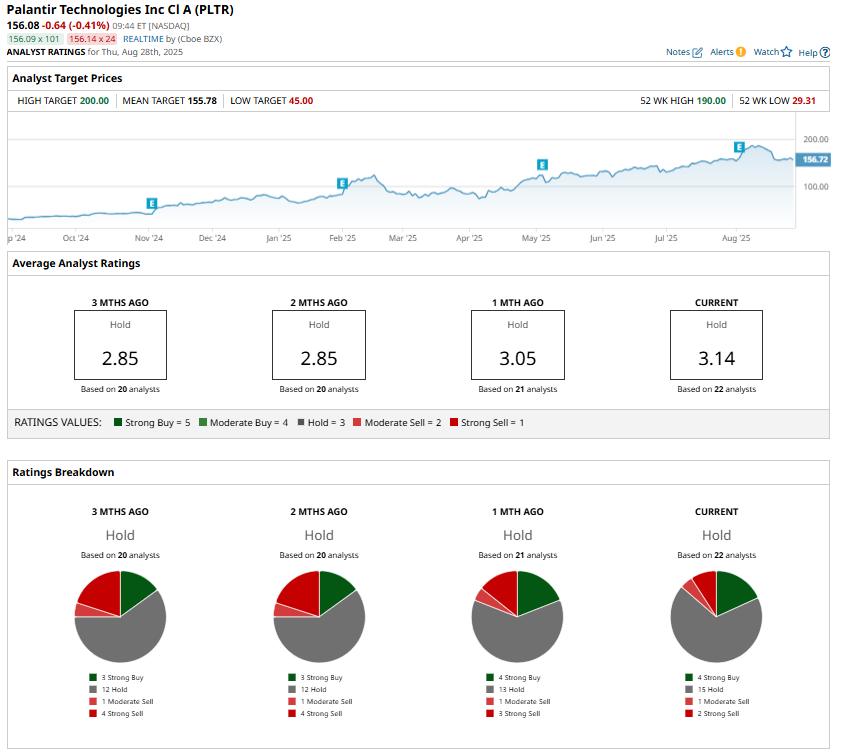

Despite the solid tailwinds, Wall Street sentiment remains cautious, mainly due to Palantir’s premium valuation. However, with the accelerating adoption of its AI products in both commercial and government sectors, record bookings, and continued expansion among its largest clients, Palantir is well-positioned to deliver solid growth in the future. While near-term volatility may persist, the recent pullback looks more like a buying opportunity.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)