/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Artificial intelligence (AI) chip stocks have been under pressure due to a combination of factors including new export restrictions to China, valuation concerns after massive 2023-2024 rallies, and increasing competition as Intel (INTC) aims to regain market share. While Nvidia (NVDA) maintains a dominant market share in AI chips and Advanced Micro Devices (AMD) shows strong growth potential, investors are recalibrating expectations amid geopolitical tensions and regulatory uncertainties, particularly ahead of new AI chip export rules taking effect in May 2025.

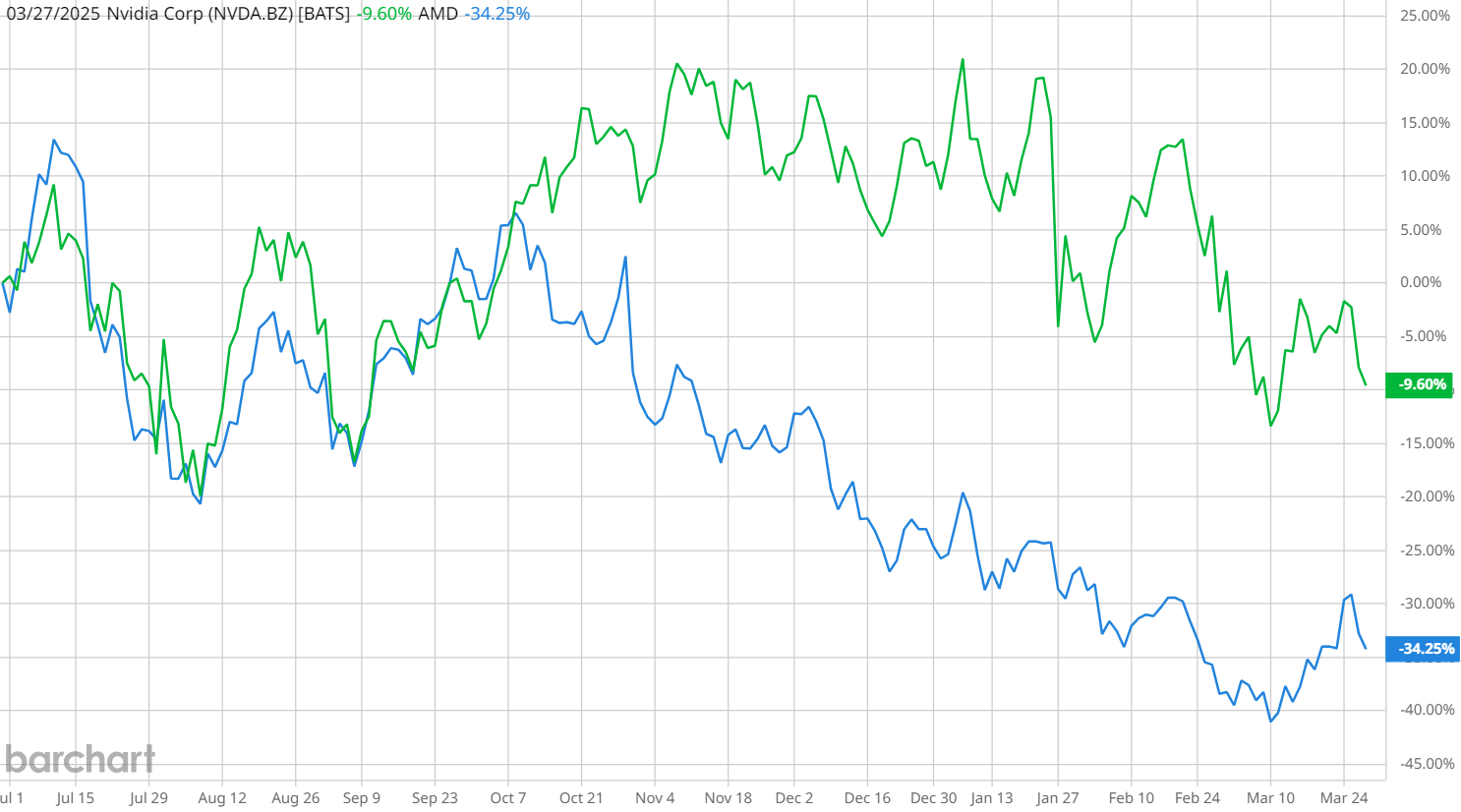

With both AMD and NVDA pulling back from recent highs, should bargain-hunting investors opt for industry giant Nvidia - or try to scoop up shares of AMD on the cheap? Here’s a closer look at these top semiconductor stocks right now.

Why is AMD Stock Underperforming?

AMD's significant stock decline of over 40.6% in the past year, coupled with increasing competition from both Nvidia and Intel, raises concerns about its near-term growth potential. AMD holds just 10.3% market share, compared to Nvidia's commanding 89%, and faces additional pressure from Intel's rejuvenated management team, particularly in the CPU market from 2026 onwards.

Notably, AMD continues to trail behind Nvidia's pace of expansion and technological capabilities. The company's MI300x GPU underperforms compared to Nvidia's H200 in real-world applications, primarily due to Nvidia's superior software ecosystem, leading Jefferies to downgrade AMD stock today to "Hold" with a price target of $120.

Possible Growth Drivers for AMD Stock

On the positive side, AMD’s nearly 50% decline from its peak has brought valuations to more reasonable levels at 23.58 times forward adjusted earnings, which is a slight discount to NVDA’s 25.10.

AMD showed strong growth in its data center segment with a 69% year-over-year revenue increase to $3.9 billion last quarter, and data center revenue nearly doubled in 2024 to exceed $5 billion, accounting for approximately 20% of total revenue. The pending $4.9 billion acquisition of ZT Systems represents a strategic move to strengthen AMD's position in AI-optimized data centers, though catching up to Nvidia's technological advantage remains a significant challenge.

Looking ahead, AMD's upcoming MI350 and MI400 GPU launches could provide new opportunities for market share gains, though the chip company has recently struggled to live up to Wall Street’s growth forecasts.

AMD vs. NVDA: Which Stock Stands Out?

Based on the current analysis, NVDA stock appears to be the better buy after the recent price decline, given its overwhelming market share in AI chips and superior financial metrics, with a remarkable 55.85% profit margin compared to AMD's 6.36%.

Nvidia's dominance in AI infrastructure, showcased by its new Blackwell architecture and projected data center revenue growth to $450 billion by 2028, provides a more compelling long-term investment thesis, despite current geopolitical challenges.

While both stocks have faced recent pressure, Nvidia's higher-conviction consensus rating from analysts reflects greater confidence in its market position and growth prospects. Although both companies face headwinds, Nvidia's superior market position, stronger financials, and clearer path to future growth make it the more attractive investment option at current prices.

However, investors should be prepared for continued volatility in both stocks through mid-2025 as regulatory and trade issues evolve.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor had a position in: AMD , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)