Popular investor Cathie Wood sold shares of software company Unity Software (U). Wood’s investment machine, Ark Invest (ARKK), shed over 486,000 shares of Unity’s stock, most likely to reduce exposure to the software industry. Additionally, Ark Invest has expanded its exposure to crypto-linked platforms, fintech, and gene editing.

The software industry is facing growing concerns about artificial intelligence (AI) replacing software use. The market faced renewed concerns after AI firm Anthropic released new tools for its Claude “Cowork” AI agent. The market has reacted strongly, fearing an AI “apocalypse” that undercuts traditional software business models.

However, not all analysts or tech executives think the same. For instance, analysts at Wedbush Securities believe the “Armageddon scenario” of AI eating up software is “far from reality,” even though the technology is a near-term headwind.

Therefore, should you consider investing in Unity Software’s stock against this backdrop?

About Unity Software Stock

Unity Software is a pioneering developer of the Unity real-time 3D platform, enabling creators worldwide to build immersive games, applications, and experiences across industries like entertainment, film, automotive, architecture, and beyond. Headquartered in San Francisco, California, the company delivers a comprehensive game engine that supports 2D, 3D, VR, and AR content creation, complemented by tools for project management, monetization, hosting, and AI-enhanced asset generation.

Through an online store, field sales teams, and global partnerships with distributors and resellers, Unity drives innovation and collaboration from its network of offices spanning North America, Europe, and Asia. The company has a market capitalization of $8.03 billion.

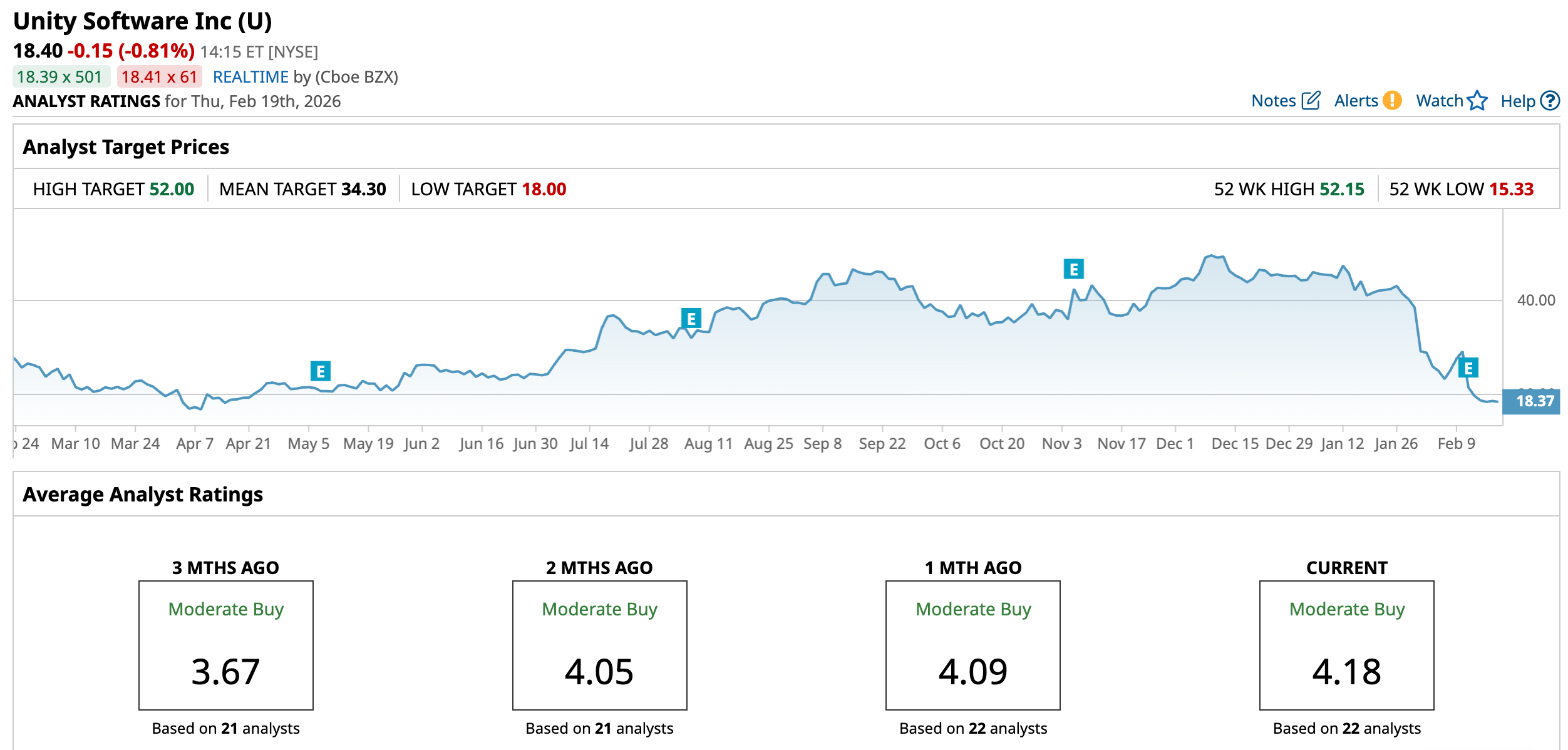

Investor concerns over AI advancements raised fears of disruption to Unity's dominance in the game engine market. Over the past 52 weeks, Unity’s stock has declined by 15%, while it is down 58.65% year-to-date (YTD). Just for comparison, the S&P 500 Index ($SPX) is down only marginally this year. The stock reached a 52-week high of $52.15 in December 2025, but is down 64.72% from that level.

Unity’s forward-adjusted price-to-earnings ratio of 19.14x is cheaper than the industry average of 23.12x.

Unity Software’s Stock Dropped Despite Better-Than-Expected Q4 Results

On Feb. 11, Unity reported its fourth-quarter results for fiscal 2025. The company’s revenue increased 10.1% year-over-year (YOY) to $503.09 million, which was higher than the $492.10 million that Wall Street analysts had expected. Unity President and CEO Matt Bromberg stated that the company’s Vector offering is experiencing rapid growth and that Unity 6 adoption is at its fastest rate. Adjusted EPS grew 20% from the prior-year period to $0.24 versus the $0.21 estimate, while free cash flow improved by 12.2% YOY to $118.68 million.

Despite this growth, the stock dropped 26.3% intraday on Feb. 11, as investors were unimpressed by Unity’s outlook. For the first quarter, the company expects revenue to be in the $480 million to $490 million range, below the $492.10 million analysts’ estimate, signaling sluggish demand for its software.

By shutting down its legacy ironSource Ad Network, the company is compelling its customers to move toward the AI-powered Unity Vector platform. This has raised doubts about a possible revenue “air pocket,” as old revenue declines before new revenue can pick up.

Wall Street analysts are robustly optimistic about Unity’s future earnings. They expect the company’s EPS to climb by 105.3% YOY to $0.01 for the current quarter. Moreover, for the current year, EPS is projected to increase 120% YOY to $0.11, followed by a 172.7% increase to $0.30 in fiscal 2027.

What Do Analysts Think About Unity Software Stock?

Recently, BTIG analyst Clark Lampen reiterated a “Buy” rating on Unity’s stock and kept a $41 price target, citing the company’s advertising momentum and strategic repositioning. Lampen sees Unity ads/Vector business maintaining strong growth. He also views the phase-out of the less efficient, higher-cost ironSource ad network as a beneficial portfolio adjustment that will gradually boost Unity's overall profitability. The company is expected to benefit from growing generative AI content creation.

Needham analysts also maintained a “Buy” rating on the stock, but lowered the price target from $50 to $35. Despite the positive execution of Unity’s Vector product, the price target was lowered due to a lower target multiple. Wedbush analysts also maintained an “Outperform” rating, but lowered the price target from $37 to $30, citing the threat of AI and a shift in the company’s strategy.

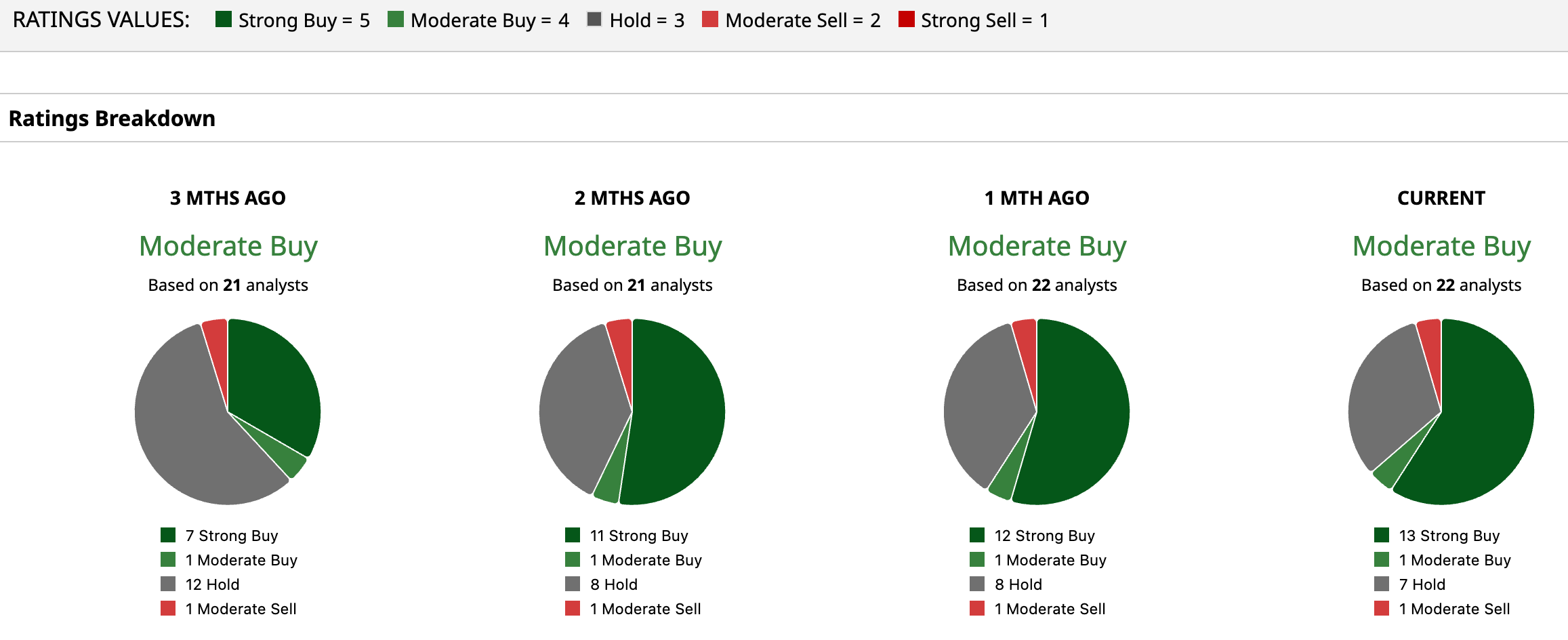

Wall Street analysts are still moderately bullish on Unity Software’s stock, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 22 analysts rating the stock, 13 analysts have rated it a “Strong Buy,” one analyst suggests a “Moderate Buy,” while seven analysts are playing it safe with a “Hold” rating, and one analyst rated the stock “Moderate Sell.” The consensus price target of $34.30 represents an 86% upside from current levels. Moreover, the Street-high price target of $52 indicates a 180.6% upside.

Key Takeaways

Despite fears of software being overshadowed by AI, analysts have not actually turned their backs on Unity Software’s stock. Moreover, the company’s AI-powered advertising and user acquisition Vector platform shows solid prospects, as it sheds its legacy ad network. Therefore, keeping one eye on the stock to monitor its progress might be prudent.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)