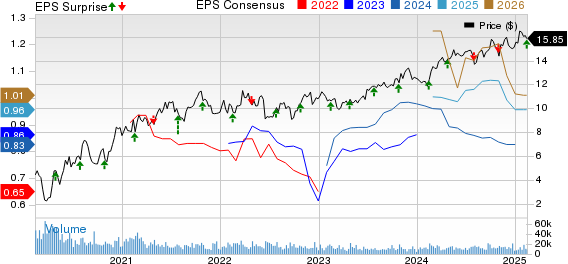

Antero Midstream Corporation AM reported fourth-quarter 2024 adjusted earnings per share of 26 cents, which beat the Zacks Consensus Estimate of 23 cents. The bottom line increased from 24 cents in the prior-year quarter.

Total quarterly revenues of $287 million beat the Zacks Consensus Estimate of $270 million. The top line increased from $260 million recorded in the year-ago quarter.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The strong quarterly results can be attributed to increased freshwater delivery volumes and higher average fees realized across all segments.

Operational Performance

Average daily compression volumes were 3,266 million cubic feet (MMcf/d) compared with 3,343 MMcf/d in the year-ago quarter. The reported figure was lower than our estimate of 3,358 MMcf/d. On a per-Mcf basis, the compression fee was 21 cents, which remained flat year over year.

High-pressure gathering volumes totaled 3,045 MMcf/d, down from the year-ago level of 3,047 MMcf/d. The figure was also below our estimate of 3,057 MMcf/d. On a per-Mcf basis, the average gathering high-pressure fee was 23 cents, higher than the year-ago quarter’s 21 cents. The reported figure also beat our estimate of 22 cents.

Low-pressure gathering volumes averaged 3,276 MMcf/d compared with 3,377 MMcf/d a year ago. The figure was below our estimate of 3,346 MMcf/d. On a per-Mcf basis, the average gathering low-pressure fee was 36 cents, higher than the prior-year level of 35 cents. The reported figure was in line with our estimate.

Freshwater delivery volumes were registered at 114 MBbls/d, up approximately 21% from the prior-year figure of 94 MBbls/d. On a per-barrel basis, the average freshwater distribution fee was $4.31 compared with $4.22 a year ago. The figure was also above our estimate of $4.22.

Operating Expenses

Direct operating expenses amounted to $55.9 million, up from $50.8 million recorded a year ago.

Antero Midstream’s total operating expenses totaled $109.7 million, up from $104.5 million recorded in the corresponding period of 2023.

Balance Sheet

As of Dec. 31, 2024, the company had no cash and cash equivalents. As of the same date, the company had $3,116.9 million in long-term debt.

Outlook

Antero Midstream projects net income in the range of $445-$485 million and adjusted net income (adjusted for amortization of customer relationships and effective tax rate impact) in the band of $500-$540 million.

The capital budget for 2025 is expected to be in the $170-$200 million range.

Zacks Rank and Key Picks

Currently, AM carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector may look at some better-ranked stocks like SM Energy Company SM, NextDecade Corporation NEXT and Range Resources Corporation RRC. While SM Energy and NextDecade presently sport a Zacks Rank #1 (Strong Buy) each, Range Resources carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SM Energy is set to expand its oil-centered operations in the coming years, with an increasing focus on crude oil, especially in the Permian Basin and Eagle Ford regions. The company’s attractive oil and gas investments should create long-term value for shareholders.

NextDecade is an emerging player in the LNG space with its Rio Grande LNG project in Texas. As demand for LNG continues to grow, NextDecade’s strategic investments in infrastructure and its planned liquefaction capacity provide strong upside potential. With the global LNG market expanding, NextDecade is well-positioned to tap into the increasing export demand from the United States.

Range Resources is among the top 10 natural gas producers in the United States. Its diversified portfolio is spread between low-risk and long reserve-life Appalachian assets. The company’s extensive inventory of Marcellus resources with low breakeven points is a significant asset. With expanded LPG export capacity, RRC is well-positioned to meet the rising global demand, capitalizing on natural gas' role as a cleaner-burning fuel amid a low-carbon shift.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Range Resources Corporation (RRC): Free Stock Analysis Report

SM Energy Company (SM): Free Stock Analysis Report

Antero Midstream Corporation (AM): Free Stock Analysis Report

NextDecade Corporation (NEXT): Free Stock Analysis Report

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)