The beginning of 2026 has been characterized by volatility in equities. Amidst this, the S&P 500 Index ($SPX) has remained sideways. While the technology sector dominated headlines last year, it might be time for some stock and sector rotation.

It comes as a surprise that SoftBank Group (SFTBY) has closed out its holding in Nvidia (NVDA). SoftBank also pared its holding in T-Mobile US (TMUS) as it looks to “capitalize on its ‘all in’ bet on ChatGPT maker OpenAI.”

At the same time, SoftBank acquired new stakes in Circle Internet (CRCL), AbCellera Biologics (ABCL), and TwentyOne Capital (XXI). These names are under-the-radar and can surprise in terms of returns if fundamental developments are positive.

New SoftBank Stock #1: Circle Internet (CRCL)

Headquartered in New York, Circle Internet Group is a financial technology company that supports businesses to use digital currencies and public blockchains for payments, commerce, and financial applications. The company aims at building a robust stablecoin network through USDC and EURC stablecoins.

CRCL stock listed in June 2025 at $31 and subsequently surged to 52-week highs of $299. While there has been a significant correction, CRCL stock still trades 98.7% above the listing price.

From a valuation perspective, CRCL stock trades at a forward price-earnings (P/E) ratio of 72.56. Valuations might seem stretched, but it’s worth noting that analyst estimates point to earnings growth of 187.64% for FY26. The price-earnings-to-growth ratio is therefore less than one, implying headroom for stock upside.

For Q3 2025, Circle Internet reported total revenue and reserve income of $740 million, which was higher by 66% on a year-on-year (YoY) basis. For the same period, the adjusted EBITDA was $166 million. It’s worth noting that the Circle Payments Network is present in important markets of the United States, India, China, Hong Kong, and Brazil. Further, upcoming launches are expected in the European Union, Singapore, UAE, and United Kingdom. This will ensure healthy growth and market share upside.

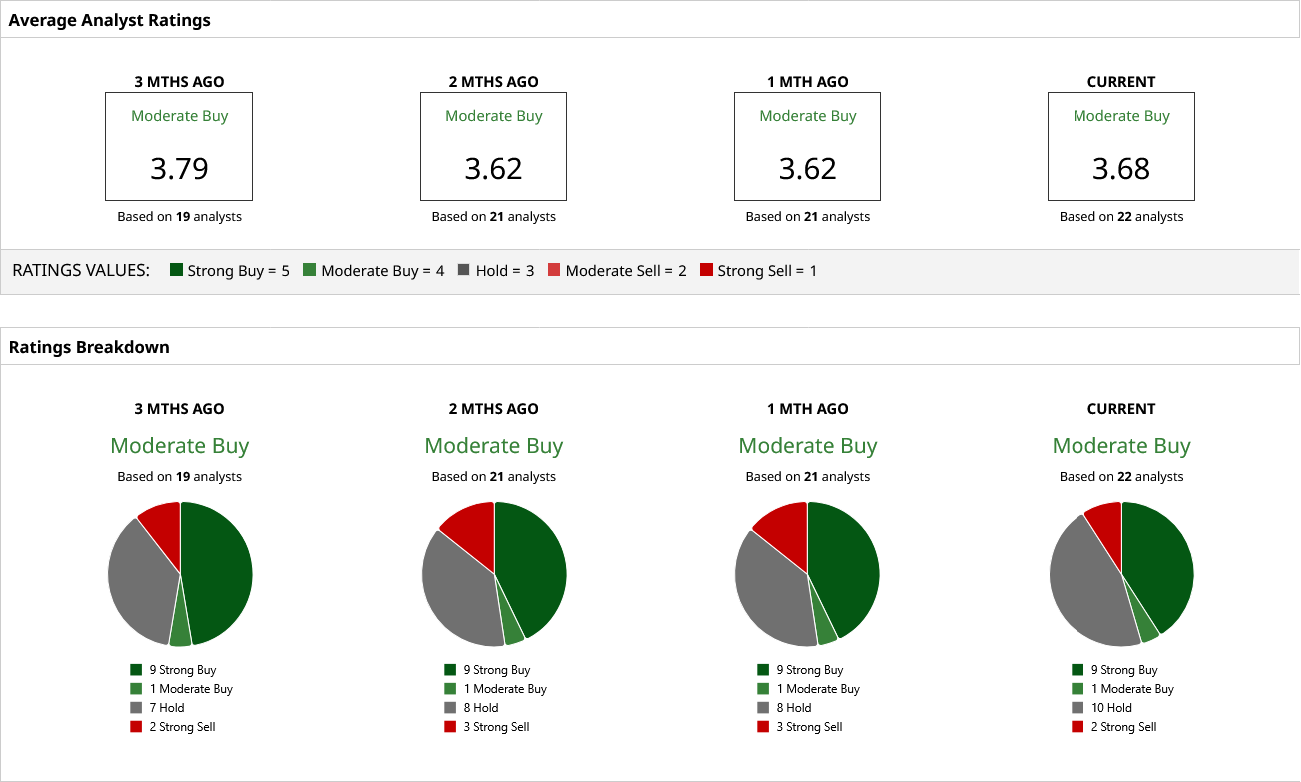

With expansion plans and a robust earnings growth outlook, CRCL stock has a “Moderate Buy” rating based on the consensus estimate of 22 analysts. Further, a mean price target of $126.94 implies an upside potential of 106%.

New SoftBank Stock #2: AbCellera Biologics (ABCL)

Headquartered in Vancouver, AbCellera Biologics is involved in the discovery and development of antibody-based medicines in the areas of endocrinology, women's health, immunology, and oncology. Currently, the company has 20 discovery programs in the pipeline. Of this, two molecules are in the IND-Enabling activities and another two in phase one and phase two clinical trials, respectively.

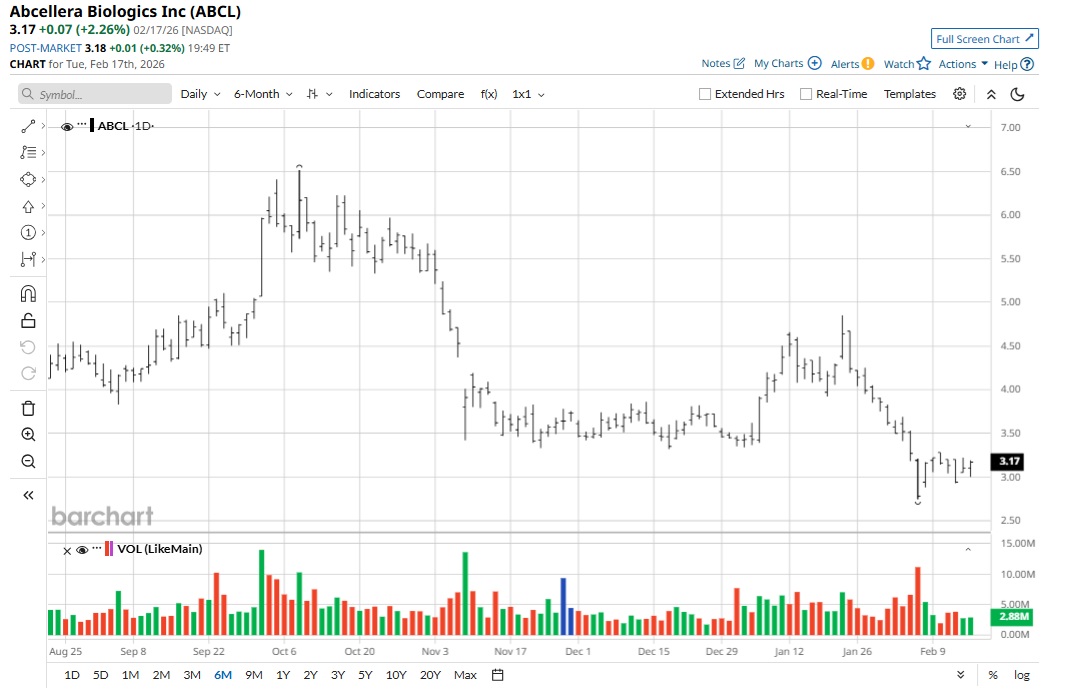

With the company still being at an early-growth stage, ABCL stock has been largely sideways with a marginal correction of 8% in the last 52 weeks. For medium- to long-term investors, current levels are attractive for exposure.

In terms of valuations, ABCL stock trades at a price-to-sales ratio of 26.7 and a price-to-book value of 0.91. With AbCellera Biologics expecting multiple catalysts in 2027, current valuations seem attractive.

For Q3 2025, AbCellera Biologics reported a net loss of $57.1 million. However, this is unlikely to be a concern, as the company is still in the clinical stage. With a liquidity buffer of $680 million, AbCellera Biologics is well positioned to aggressively invest in R&D and clinical trials. With more than 20 discovery programs, the biotech company expects one to two discovery programs per year. For now, as Phase 1 and 2 trials progress, positive price action seems likely.

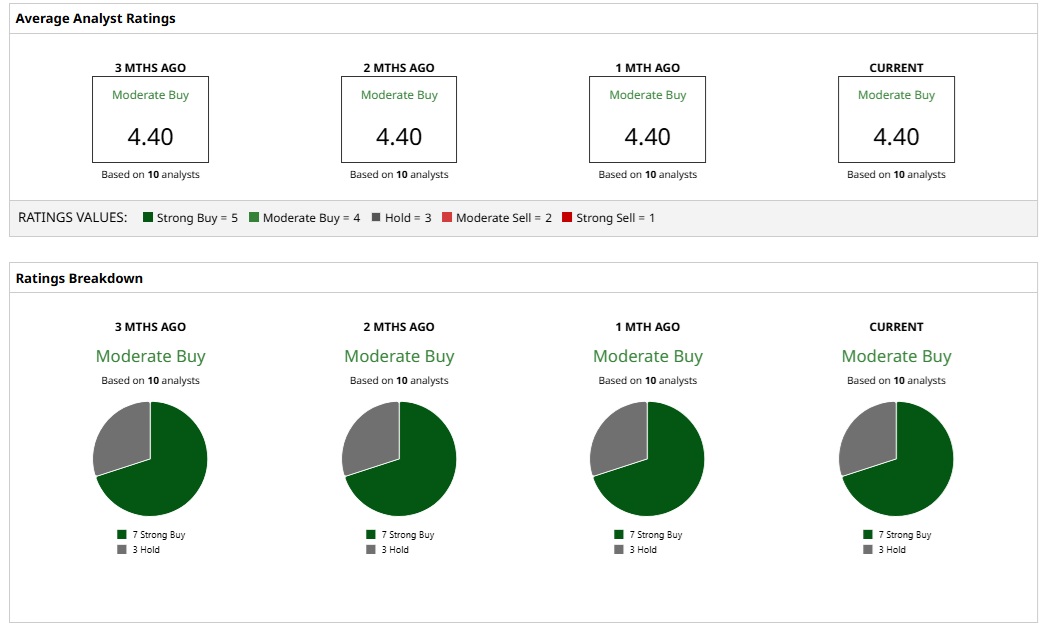

With an attractive clinical pipeline, ABCL stock has a “Moderate Buy” rating based on the consensus estimate of 10 analysts. Further, a mean price target of $9 implies an upside potential of 184%.

New SoftBank Stock #3: TwentyOne Capital (XXI)

Headquartered in Austin, TwentyOne Capital is engaged in Bitcoin (BTCUSD) related business. This includes accumulating the cryptocurrency and actively managing its holdings. Besides this, the company intends to develop educational materials and branded content for increased institutional and retail investor Bitcoin literacy.

After listing in December 2025 at $11.42, XXI stock has been in a downtrend and is currently lower by 43.8%. This correction has been in sync with a sharp correction in Bitcoin for the year.

With the company still at an early-growth stage, there is little in terms of valuation metrics. From March 7, 2025 (inception) through Sept. 30, 2025, TwentyOne Capital didn’t have any operating history, and it has yet to generate revenue. At the same time, operating-level losses are likely to be sustained, and fundraising for executing the business plan is on the cards.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)