Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) is the world's biggest advertising company. It established itself as the industry leader largely due to the strength of Google Search, which has a monopoly-like market share for online search. That business, more than any other under Alphabet's umbrella, has helped give the company a valuation of around $2 trillion.

Digital advertising has proven to be a highly lucrative business for Alphabet, and it's driven superior operating margins at the company for much of its history. After all, Google's search page is among the most valuable digital real estate properties on the internet. It's the first place most users go when they want to get new information about a health concern, a trip they're planning, or a restaurant they're interested in, among other things.

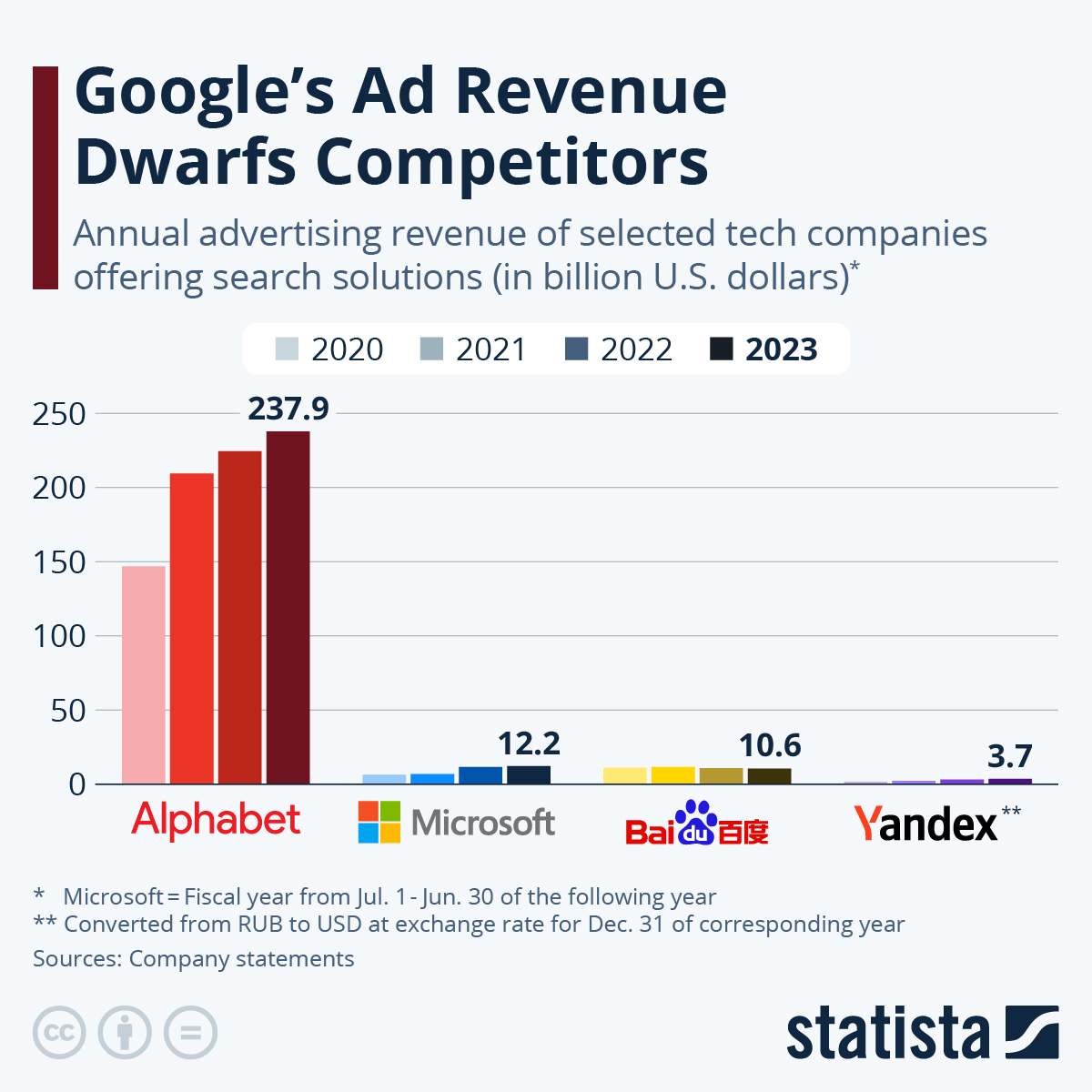

The chart below shows how Google compares to its closest rivals in search around the world.

Image source: Statista.

As you can see, not only is Alphabet light years ahead of Microsoft, Baidu, and Yandex, but there's more to Alphabet's ad business than just search. So where does Alphabet's ad revenue come from?

Let's take a closer look.

Google's ad revenue breakdown

Of the $237.9 billion Alphabet generated in ad revenue in 2023, $175.0 billion, or 73.6%, came from Google Search. The company's trademark search engine remains the primary driver of both revenue and profits at the tech giant.

After Search, it brought in $31.5 billion, or 13.3%, via YouTube, its leading video-sharing platform. Google Network, its third-party ads that are served on partner websites, brought in $31.3 billion, about the same percentage as YouTube.

Google's ad business is still delivering strong growth, up 11% year over year in the second quarter. And based on its dominance of the space and the consistent need of businesses to advertise on Google, it's likely to continue to grow.

Expect Alphabet to maintain its leadership in the digital advertising industry for years to come.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,803!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,654!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $404,086!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Baidu, Microsoft, and Nebius Group. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

/AI%20(artificial%20intelligence)/Image%20of%20server%20racks%20in%20modern%20server%20room%20data%20center%20by%20Sashkin%20via%20Shutterstock.jpg)

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)