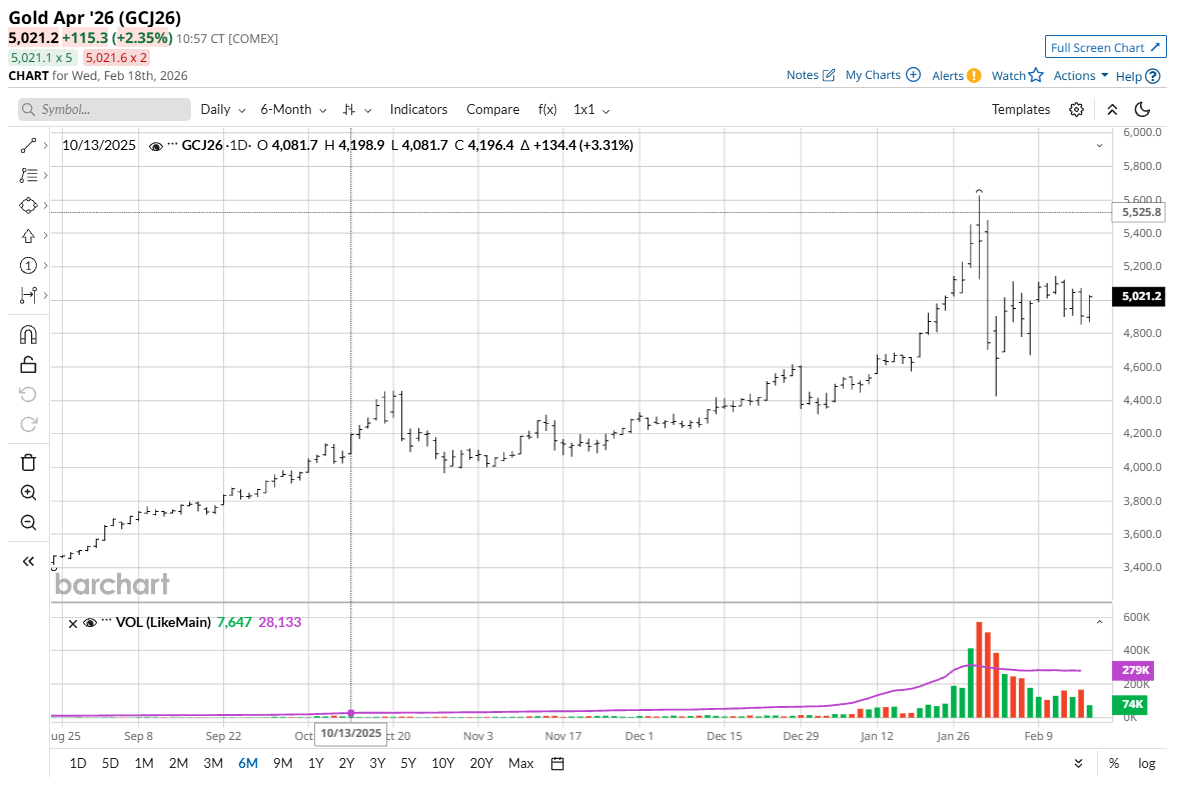

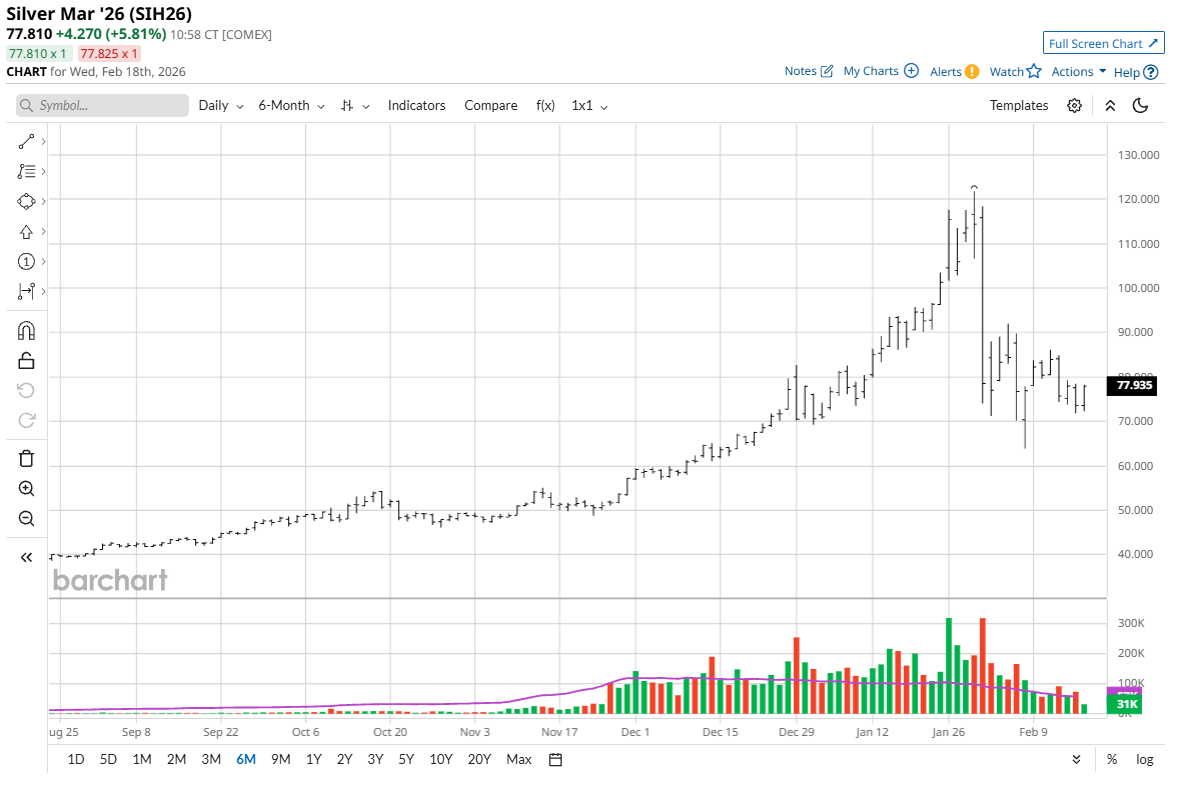

An examination of the daily bar charts for gold (GCJ26) and silver (SIH26) futures shows that daily price volatility has declined from levels seen in late January and early February.

In other words, the daily price bars are smaller than those seen in that earlier timeframe. However, make no mistake: The gold and silver markets are by no means calm. Just last week, silver futures had a $10 daily trading range and gold a $220 daily trading range. Last summer, those trading ranges were nearly unfathomable.

What Are the Key Drivers for Gold and Silver Prices Now?

I want to share with you what I believe will be the fundamental catalysts that could spark bigger price moves in the coming weeks or few months but first let’s see what the charts are presently suggesting for the two precious metals.

The extreme and even record-setting daily price volatility in the gold and silver markets three weeks ago — both on the upside and on the downside — favor the bearish camp. Higher price volatility at higher price levels is a warning signal of a major topping process in a market that has been on an extended bull run.

Gold and silver bulls have somewhat stabilized prices and stopped the bleeding, which favors the bullish camp. What is important, technically, at present, is that gold and silver prices hold above solid chart support levels at the February lows. For April Comex gold futures, the February low is $4,423.20. For March Comex silver futures, the February low is $63.90. There are likely a large number of pre-placed sell-stop orders in futures markets that reside just below those key near-term technical support levels.

So, here are the fundamentals working in the gold and silver markets at present, and which will likely continue working in the coming weeks and few months.

- Investor and commercial demand for silver, and investor and central bank demand for gold, will at least keep a floor under both metals’ prices — if not push them back up to challenge the record highs scored in January.

- The moves by major economies to stockpile (hoard) rare earth minerals will continue to support the gold and silver markets, and especially silver.

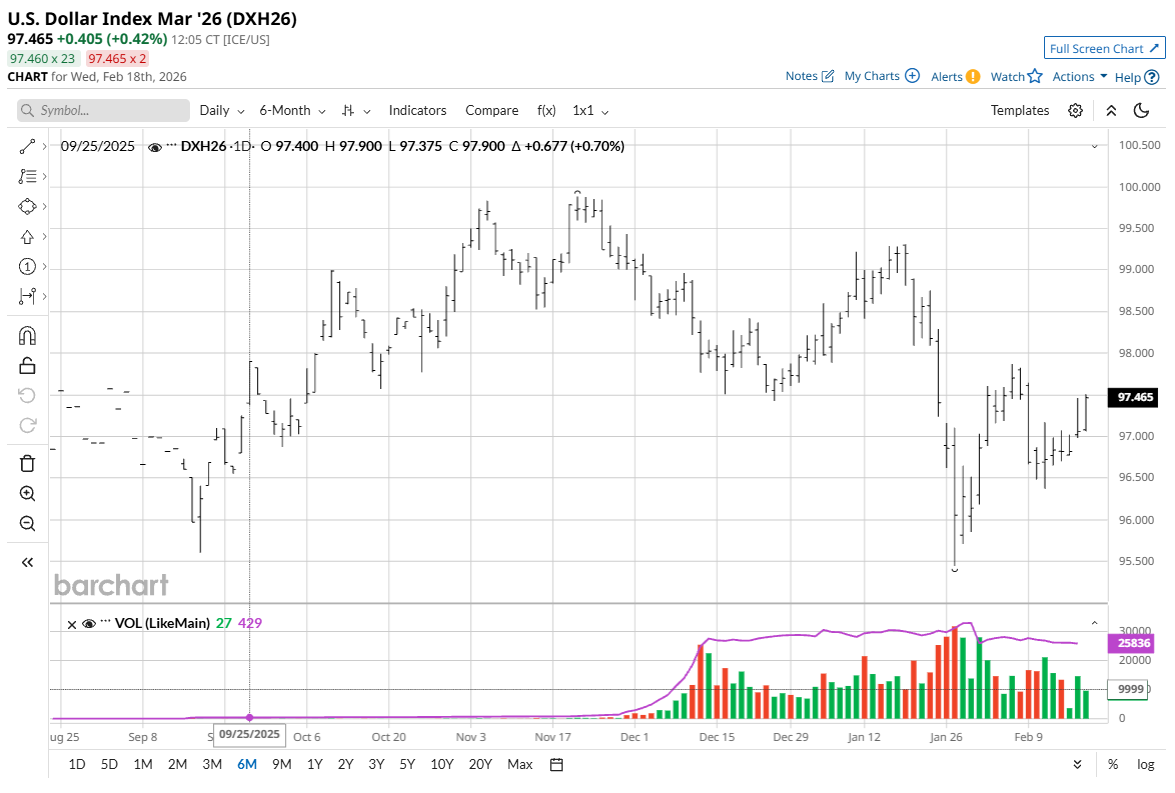

- The push by President Donald Trump for lower interest rates will likely see lower U.S. interest rates this year, despite recent U.S. economic data that has been mostly upbeat. That’s bullish for metals on two fronts. One, it puts downside pressure on the U.S. dollar ($DXY) in the foreign exchange market. Two, the Trump administration’s push for lower interest rates despite a U.S. economy that is not unhealthy raises the specter of problematic inflation down the road.

- Better economic growth in major global economies — likely led by the U.S. and China — will mean better consumer and commercial demand for precious metals.

- Geopolitics are never far from the front burner of the marketplace, and such is the case at present. The Russia-Ukraine war, U.S.-Iran tensions, recent political turmoil among European Union members, China-Taiwan tensions, North Korea’s nuclear ambitions — these are situations that could flare up quickly to drive better safe-haven demand for gold and silver.

My Bias

Silver appears to be leading the gold market in daily price direction, and such will likely continue to be the case for at least the near term.

It’s my bias that one of the above-mentioned geopolitical situations will flare up in the coming months, or sooner, to push gold and silver futures prices higher.

I believe investors will continue to accumulate physical gold and silver, and especially silver, keeping global supplies tight and prices elevated.

I think the gold and silver trade is now a mature and tired one, meaning most of the metals’ upside price moves have already occurred. Savvy traders and investors will be looking for the next bull-market boom in the raw commodity sector. My bias is the next boom in commodities will be in the grain futures markets.

Tell me what you think. I read every one of your emails. My email address is jim@jimwyckoff.com. I enjoy getting feedback from all of you, my valued Barchart readers.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)