Shares of Taiwan Semiconductor Manufacturing (NYSE:TSM), also known as TSMC, rose 63% in the first six months of 2024, according to data provided by S&P Global Market Intelligence. TSMC is the world's biggest microchip manufacturer, and its list of customers includes several of the largest semiconductor companies. It's been producing impressive financial results as the semiconductor industry rebounds from a cyclical slowdown.

TSMC has published impressive financial results this year

TSMC got the year off to a strong start with a bullish quarterly report in January. The company's revenue and profits both shrank relative to the prior year, but the results were better than Wall Street's forecasts. The fourth quarter showed remarkable improvement over the third, suggesting that the semiconductor industry is entering a cyclical boom period.

Image source: Getty Images.

Electronics sales suffered in 2023 as consumers grappled with high interest rates, inflation, and a difficult job market. This led to a buildup of semiconductor inventories among smartphone and personal computer makers, which is bad news for chip manufacturers. Weak demand and high inventories translate to lower microchip sales volume and unit pricing, leading to volatile financial results for semiconductor stocks.

TSMC's financial performance tends to be highly sensitive to cyclical trends due to its role as a manufacturer for numerous large chipmakers. That was on display in the first half of 2024. The company's top line grew 16% in the first quarter. Sales then accelerated in the second quarter, with TSMC reporting a remarkable 60% annual increase for the month of April. It maintained that momentum with growth rates above 30% in May and June. Improvements to the bottom line were even more impressive. TSMC produced roughly $250 million of free cash flow in the first quarter, up from $80 million in the first quarter of 2023.

Semiconductor stocks enjoyed industrywide momentum

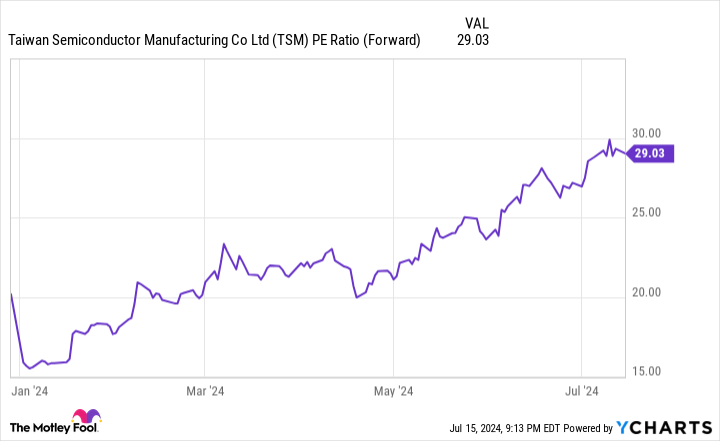

Optimism is playing a major role in TSMC's rally. The stock's forward P/E ratio has nearly doubled to 30. Investors are willing to pay a much higher premium to hold shares.

TSM PE Ratio (Forward) data by YCharts

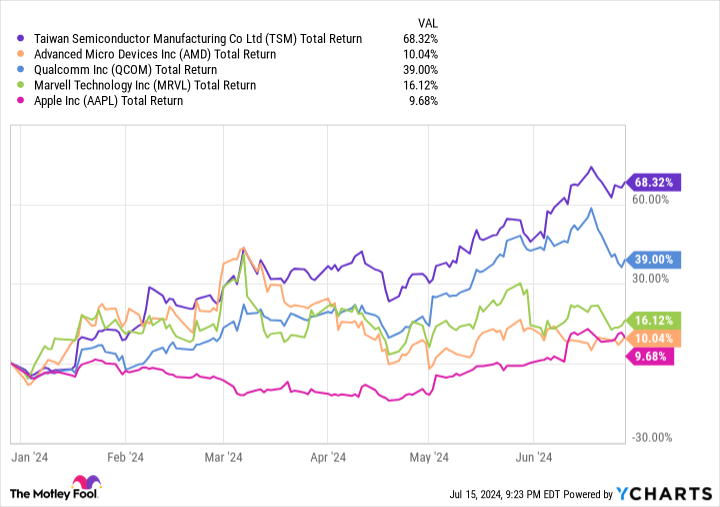

The iShares Semiconductor ETF climbed 28% during the first six months of 2024, so there's something bullish going on at the industry level. Nvidia and Broadcom have charged higher thanks to demand for high-performance hardware to run AI applications. Those companies are two of Taiwan Semi's biggest customers. Some of its other large customers also enjoyed a positive first half, including Apple, Qualcomm, Marvell Technology, and AMD. If most of your largest customers are having good years, there's a great chance that you're sharing in the spoils.

TSM Total Return Level data by YCharts

Investors are resetting their expectations for AI-driven microchip demand. It seems that the industry is in the early stages of booming demand related to these applications, and that's offsetting macroeconomic weakness impacting consumer activity. TSMC is in an excellent position to benefit from these market dynamics, and investors are pushing the valuation higher to avoid being left behind.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $774,281!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Ryan Downie has positions in Nvidia and Qualcomm. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, and iShares Trust-iShares Semiconductor ETF. The Motley Fool recommends Broadcom and Marvell Technology. The Motley Fool has a disclosure policy.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)