/AI%20(artificial%20intelligence)/AI%20technology%20concept%20by%20NMStudio789%20via%20Shutterstock.jpg)

Michael Burry, the renowned investor who famously predicted the 2008 housing crisis in The Big Short, has once again taken a contrarian stance. In his recent Substack post, "Palantir’s New Clothes," the founder of the now defunct Scion Asset Management argues that Palantir Technologies (PLTR) is wildly overvalued, likening its AI platform hype to an emperor with no clothes.

He cites ballooning accounts receivable, heavy dilution, unreliable third-party AI models, and a business model that resembles low-margin consulting more than scalable software. Burry pegs the stock's fair value at just $46—implying a roughly 65% drop from current levels around $131. While some of his concerns about valuation risks and execution in a crowded AI space are valid, he's also very wrong.

About Palantir Technologies Stock

Palantir Technologies, headquartered in Denver, Colorado, builds powerful data integration and analytics platforms that help organizations—primarily governments, militaries, and large enterprises—make sense of vast, complex datasets in real time. Its core offerings include Gotham for defense and intelligence, Foundry for commercial operations, and the newer Artificial Intelligence Platform (AIP), which layers secure AI orchestration on top of enterprise data. These tools power everything from counterterrorism to factory-floor optimization, blending human insight with machine-scale analysis.

In 2026, PLTR stock has tumbled 26% year-to-date (YTD), a sharp reversal from its 135% surge in 2025. By contrast, the S&P 500 ($SPX) has been essentially flat, down a negligible 0.14% over the same period. At a market cap of $313 billion, the stock trades at a trailing P/E of 219x—far above the software industry's typical 30-50x—reflecting its history of unprofitability until recent quarters. The forward P/E sits at 123x, still premium but more digestible given expected earnings growth. Price-to-sales is a lofty 69x, versus historical averages for high-growth SaaS firms in the 10-20x range during expansion phases.

These metrics argue in favor of Burry's thesis that Palantir is "expensive" on traditional gauges, yet they underscore AI stocks' transition: once a cash-burning startup, it's now generating software-like margins as revenue scales. The stock actually isn't undervalued by any stretch, but calling it overvalued ignores the earnings inflection underway—it's trading at a price that prices in continued hypergrowth rather than the past.

Here's What's Wrong With Burry's Analysis

Burry's critique, while thorough, feels stuck in Palantir's rearview mirror. His deep dive into historical accounting quirks—like accounts receivable exploding faster than revenue in the "build" years or persistent shareholder dilution—highlights real issues from 2020 to 2023, when the company was pouring money into R&D and custom integrations. But that era is over. Palantir has flipped the script with explosive commercial momentum, particularly in the U.S., where revenue jumped 137% year-over-year (YoY) in the fourth quarter, powering overall growth of 70% to $1.41 billion.

The real game-changer is AIP, which has supercharged adoption. Instead of lengthy, bespoke deployments that dragged on for months, Palantir now runs intensive five-day "bootcamps" that get clients live on the platform almost immediately. This has slashed sales cycles, boosted deal sizes, and driven a customer count surge of 34% to 954 in 2025.

Revenue is compounding at 50-60% rates, with 2026 guidance calling for $7.19 billion (up 61%). Even more telling is the operating leverage: incremental dollars are falling to the bottom line at 55% margins, as fixed platform costs spread across a rapidly expanding base. Adjusted operating income is projected to more than triple in the coming years, hitting billions as U.S. commercial revenue alone exceeds $3 billion in 2026.

Burry dismisses this as hype around "unreliable" LLMs, but AIP isn't just another chatbot—it's the secure orchestration layer that makes AI production-ready for regulated enterprises. It integrates disparate data sources, enforces governance, and delivers trustworthy outputs where raw models falter. This moat is widening, turning Palantir from a services-heavy firm into a true software powerhouse.

The past red flags are relics of a company that was still proving its model. Today's metrics show a business hitting escape velocity, with profits scaling faster than almost any peer. Burry's $46 target undervalues this transformation by orders of magnitude.

What Do Analysts Expect For PLTR Stock

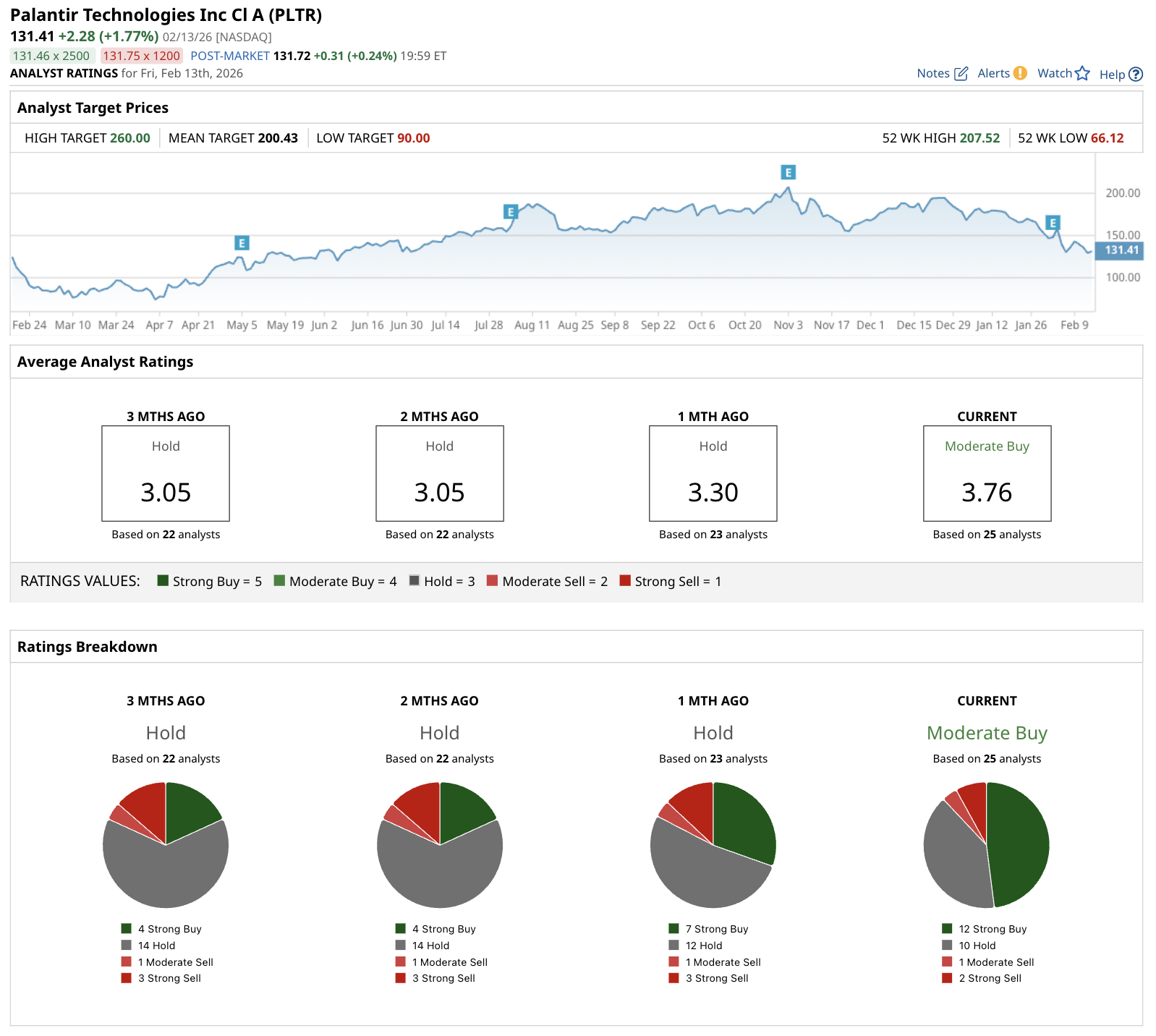

Wall Street remains broadly optimistic on Palantir despite the recent pullback. According to Barchart data, 25 analysts cover the stock, rating it a "Moderate Buy" with an average score of 3.76 (on a 1-5 scale, where 5 is “Strong Buy”). The breakdown shows a shift toward positivity: 12 "Strong Buy" ratings, 10 "Holds," one "Moderate Sell," and two "Strong Sells." This marks a notable upgrade from three months ago, when the consensus was a weaker "Hold" with only four "Strong Buys"—the improved sentiment reflects Palantir's strong Q4 results and 2026 guidance that beat expectations.

The mean price target stands at $200.43, implying a potential upside of 53%, with highs reaching $260 and lows at $90. Analysts see the commercial acceleration and AIP-driven efficiency as sustainable, projecting continued 50%+ top-line growth and margin expansion through 2028. While not unanimous—some worry about competition from big tech—the consensus tilts bullish, viewing Palantir as a leader in enterprise AI rather than a bubble stock.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)