/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies (PLTR) just delivered what CEO Alex Karp called a “truly iconic” performance in its Q4. The stock briefly popped after the company crushed Wall Street estimates and issued 2026 guidance that feels more like science fiction than reality.

But as a risk manager, you have to look past the post-earnings glow. While the rally was impressive, the stock is fighting a multi-year history of volatility and a valuation that puts it in a category of one — for better or worse.

And then, PLTR gave it all back and more. Followed up by rallying 5% on Friday morning. What else is new?

I’ve come to regard PLTR as a symbol of the modern stock market. The way it is discussed, the boldness and arrogance of the CEO, and the thrills and spills that are part and parcel of being a PLTR shareholder.

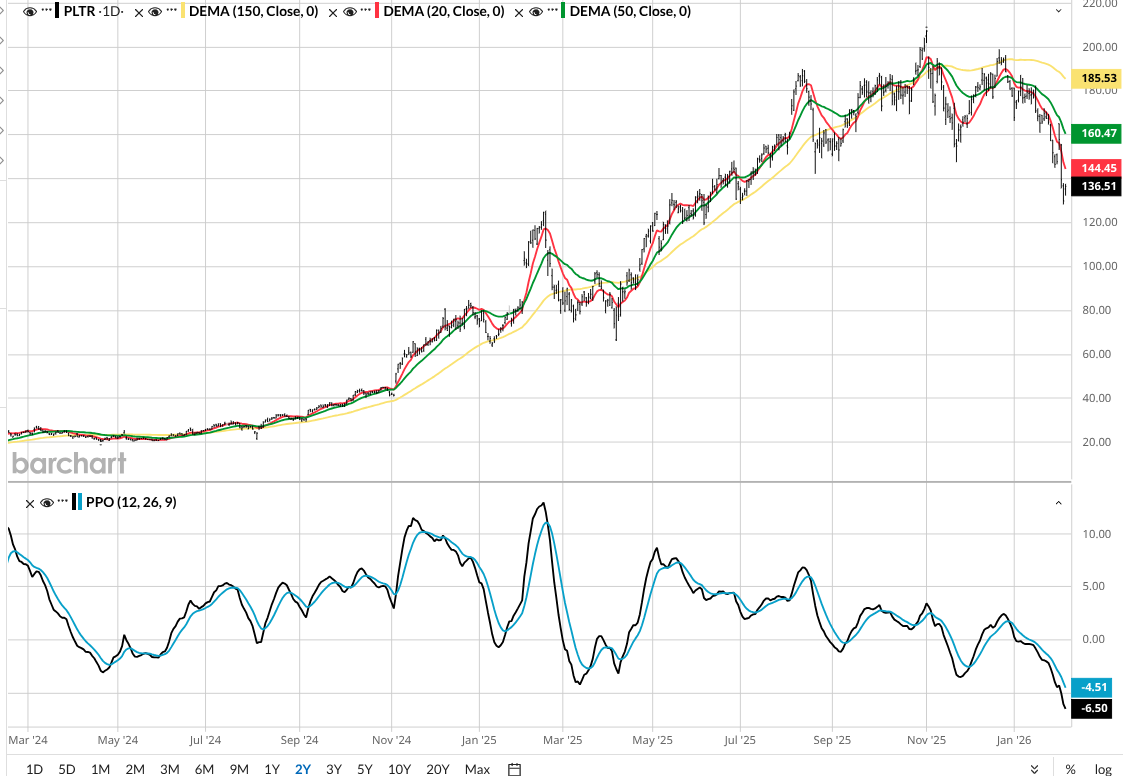

The longer-term chart picture, as in a daily view, shows just how much this stock is “juiced” in both directions. Since last July 4, the stock has essentially roundtripped from $136 to $200 and back to $136. And while the Percentage Price Oscillator (PPO) is as low as it has been over the past 12 months, the 20-day moving average (in red, top of chart) is still in deep decline. Translation: it will take more than a few days’ rally to turn this ship around.

What’s the Bull Case for PLTR Stock?

In software, the “Rule of 40” (revenue growth + profit margin) is the gold standard. In Q4, Palantir hit a staggering 127%. This was driven by a 70% year-over-year revenue surge and a massive 93% growth in its U.S. business. When a multibillion-dollar company accelerates its growth rate while increasing its profit margins to 57%, the market is going to reward it with a massive pop. At least for a little while. Then, the expectations move up with the stock price.

For years, the bear case was that PLTR was just a government consultant with no scalable product. But with U.S. commercial revenue flying higher by more than 130% year-over year in the last report, there’s hard proof that companies aren’t just testing Palantir’s AI. They are committing to it.

The Case for Caution

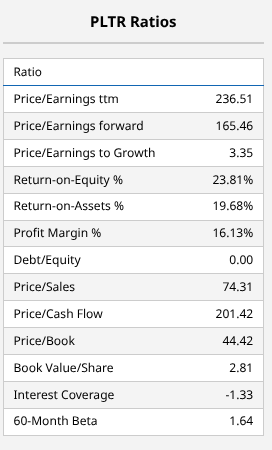

Despite the stellar numbers, Palantir remains the most expensive stock in the S&P 500 Index ($SPX) by several metrics. It currently trades at a price-to-earnings ratio that doesn’t even look like it’s a real number. But it is. Same with its trailing revenue multiple.

Risk Analysis and Roar Score for PLTR Stock

My proprietary Risk Opportunity and Reward (ROAR) score on PLTR shows that over the past 12 months, Palantir has very rarely been a low-risk investment. That’s because the stock’s up moves are typically so sudden, and my risk management discipline is such that I don’t chase stocks higher. That doesn’t mean you can’t hold hot stocks in small positions, which is implied by the dominance of the yellow in that chart below. But swinging for the fences? Not here.

ROAR went to a higher-risk score (red in the chart above) on Jan. 7, at around $182 a share, and stayed as such during the stock’s 30% dive to this week’s intraday low of $128. Risk-focused investors could have completely dodged this 30% move.

PLTR is one of those classic cases. It is a great company. But is it a great stock here? I have my doubts. If you are a big risk taker, you’ll move up in your chair every time a great growth stock like this collapses as it has. But all I’m saying is, tread lightly. This market is still very vulnerable, especially for richly-valued stocks.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)