/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies (PLTR) delivered what CEO Alex Karp called "indisputably the best results that I'm aware of in tech in the last decade" during a CNBC interview, but one comment buried in the presentation might matter more than the headline numbers.

"If you look at our numbers very closely, what you will see is inexplicable growth in revenue, but not inexplicable growth in customers," Karp told analysts. "It's inexplicable growth in revenue because customers that are serious are putting a lot of their most important problems in our hands."

That statement cuts to the heart of Palantir's evolving business model and what makes the AI software maker fundamentally different from its competitors.

Palantir's Revenue Grew 70% in Q4

Palantir reported fourth-quarter revenue of $1.41 billion, crushing Wall Street's estimate of $1.33 billion and representing 70% year-over-year (YoY) growth. The company reported adjusted earnings of $0.25 per share, beating the $0.23-per-share consensus.

- U.S. government revenue climbed 66% YoY to $570 million, while U.S. commercial revenue more than doubled to $507 million.

- The company's U.S. business now accounts for 77% of total revenue, growing 93% YoY.

But the real story lies in what Karp highlighted: customer count grew just 34% YoY to 954, while revenue from the top 20 customers jumped 45% to $94 million per customer on a trailing 12-month basis. Karp's comment reveals Palantir's strategy of going deeper rather than wider with its customer base.

"It's not just that you get more problems," Karp explained during the call. "It's that you solve them in a way that is determinative from the business and then they pay you a lot more."

The company closed 61 deals worth over $10 million in the fourth quarter, according to executives on the call. Total contract value bookings hit a record $4.3 billion, up 138% YoY.

Palantir executives shared examples of customers expanding rapidly after seeing results. One utility company grew its annual contract value from $7 million in Q1 2025 to $31 million by year-end. A healthcare company attended two boot camps last summer, then signed a $96 million deal before December.

"We are moving customers from AI adopters to AI-native enterprises," Chief Revenue Officer Ryan Taylor said, citing a construction company executive who noted that 97% of employees now use Palantir's Foundry platform daily.

Why Wall Street Is Betting on Palantir's “Rule of 40”

Palantir's combined revenue growth rate and adjusted operating margin hit 127% in the fourth quarter, which the company calls its "Rule of 40" score. For context, a Rule of 40 score above 40% is considered excellent for software companies.

- The company generated $2.3 billion in adjusted free cash flow for the full year, representing a 51% margin and 82% growth YoY.

- Full-year 2025 revenue reached $4.48 billion, up 56% from 2024.

- For 2026, Palantir guided to revenue of $7.18-$7.20 billion, representing 61% growth at the midpoint.

- That's up significantly from the company's guidance at the start of 2025, which was around 30%.

William Blair analyst Louie DiPalma noted that Palantir's operating margin should rise from 50% to 65% over the next five years as government and defense contracts increase, according to a note released ahead of earnings.

Palantir Stock Faces Valuation Questions Despite Strong Results

Shares jumped nearly 7% following the earnings report, though the stock remains down about 17% year-to-date (YTD) and is taking a beating today along with its other tech peers.

The company has faced skepticism over its valuation. Short seller Michael Burry revealed a bet against Palantir in November, prompting Karp to call the move "bats--- crazy" in a CNBC interview.

But Karp's remark about revenue growth without corresponding customer growth suggests Palantir isn't concerned about land-grabbing market-share tactics. Instead, the company is betting that once organizations adopt its AI platform, they'll integrate it so deeply into operations that spending accelerates naturally.

For investors, Karp's vision of "inexplicable revenue growth" represents a bet that enterprise AI adoption won't follow traditional software economics, where growth slows as you saturate your addressable market.

If Palantir's existing customers keep expanding their usage at current rates, the math behind that Rule of 40 might not look so inexplicable after all.

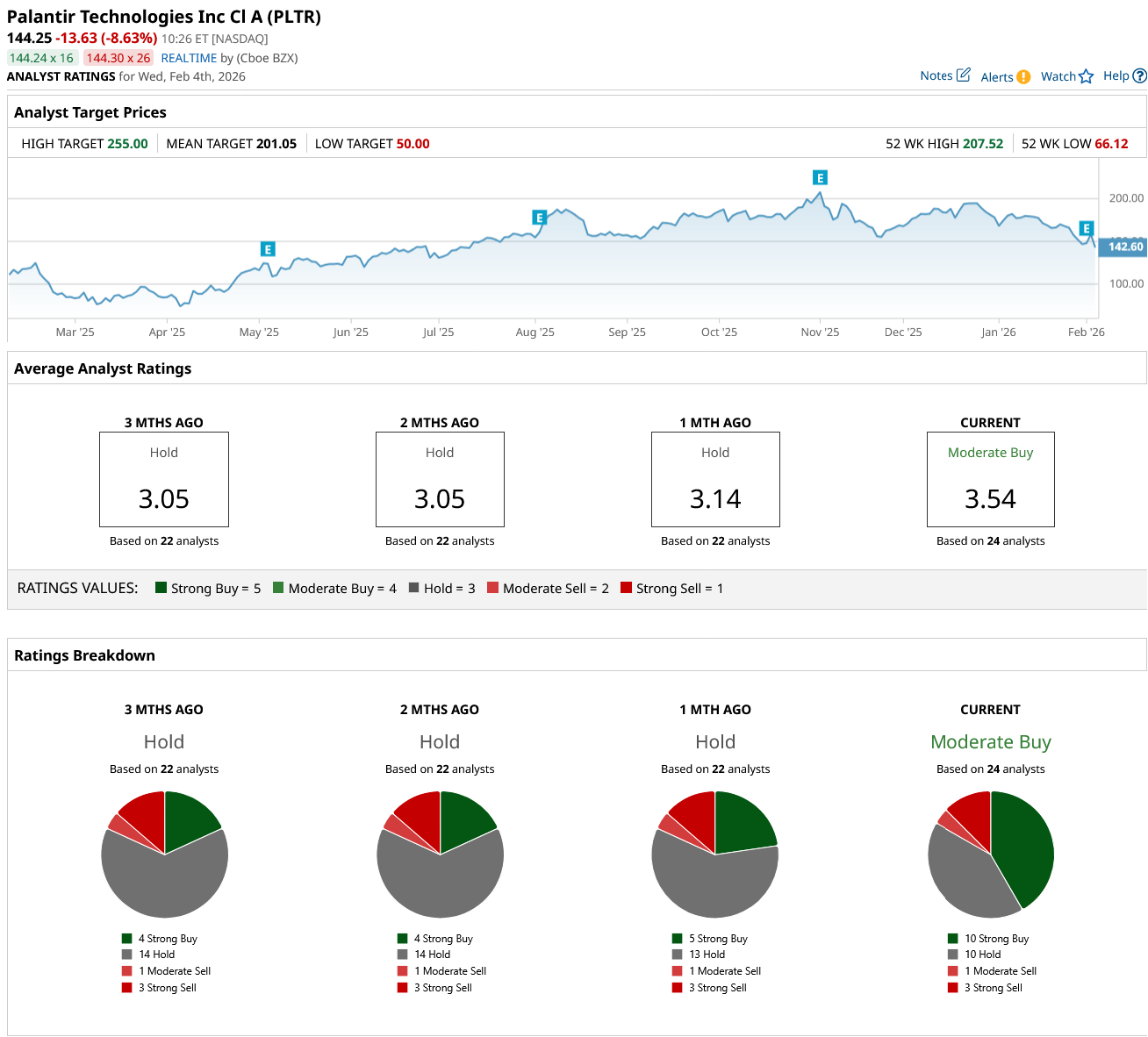

What Is the PLTR Stock Price Target?

Valued at a market cap of $376 billion, Palantir stock has surged 2000% over the past three years. However, the tech stock also trades at a lofty forward earnings multiple of 120x.

Analysts forecast adjusted earnings for Palantir to improve from $0.75 per share in 2025 to $3.55 per share in 2030. If the earrings multiple “normalizes” to 65x, PLTR stock should trade around $231 in late 2029, indicating an upside potential of 47% from current levels.

Out of the 24 analysts covering PLTR stock, 10 recommend “Strong Buy,” 10 recommend “Hold,” one recommends “Moderate Sell,” and three recommend “Strong Sell.” The average PLTR stock price target is $201, above the current price of $144.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)