Elon Musk just made his boldest corporate move yet — merging SpaceX with artificial intelligence (AI) firm xAI in a deal that values the combined entity at $1.25 trillion. The merger, announced on Feb. 2, shifts the balance of power within Musk's business empire and raises a critical question for investors: Is Tesla stock a buy, or has CEO Elon Musk moved on?

The Merger Reshapes Musk's Empire

SpaceX now represents the crown jewel of Musk's portfolio. The rocket maker's $1.25 trillion valuation puts it just 21% below Tesla's $1.58 trillion market capitalization. More importantly, Musk owns an estimated 43% of SpaceX compared to just 13% of Tesla. That means SpaceX now accounts for more than half of Musk's $852 billion net worth, per Forbes.

The deal follows xAI's earlier acquisition of X (formerly Twitter) in a stock transaction last year. Together, these moves create what fans and investors call the "Muskonomy" — an interconnected web of companies sharing resources, technology, and capital.

Why Musk Combined SpaceX and xAI

Musk said SpaceX acquired xAI to develop data centers in space, avoiding what he views as energy constraints on Earth. To that end, SpaceX has filed with the Federal Communications Commission (FCC) seeking permission to launch up to 1 million satellites for orbital computing infrastructure. But analysts at Moffett Nathanson warn that the capital requirements are "simply enormous."

The technical challenges are daunting. Engineers would need to solve problems with radiation shielding and cooling systems in space that don't yet exist, while also incurring the massive costs of launching and assembling heavy equipment.

Still, the strategic logic is clear: xAI could benefit from computing capacity provided by SpaceX's orbital data centers. Tesla's energy storage systems could also help power those data centers using solar energy in space.

Tesla's EV Business Is Struggling

Tesla just posted its first annual revenue decline on record. Full-year revenue fell 3% to $94.8 billion in 2025, with automotive revenue — still about 70% of the business — falling 10%. Vehicle deliveries plunged 16% in the fourth quarter and 9% for the full year.

Some of that move stemmed from Musk's polarizing political rhetoric and endorsements of far-right figures in Europe, which sparked a consumer backlash. Part of it also reflected Tesla's aging lineup and brutal competition from China's BYD (BYDDY) and European automakers.

Musk announced on the earnings call that Tesla is ending production of the Model S sedan and Model X SUV. Those lines in Fremont, California, will be converted to produce Optimus humanoid robots instead. "It's time to basically bring the Model S and X programs to an end with an honorable discharge," Musk said. "If you're interested in buying a Model S and X, now would be the time to order it."

The shift is symbolic. Analysts at Canaccord Genuity wrote that "the Tesla of yesterday is gone" and called it a "burn the ships" moment with no room for retreat.

The SpaceX Wildcard

SpaceX is preparing to go public this year and recently opened a secondary share sale valuing the company at $800 billion. That would make it the most valuable private company in the United States.

The rocket and satellite firm is targeting a June initial public offering (IPO) that could value it at roughly $1.5 trillion and raise up to $50 billion — potentially the largest IPO of all time. Bank of America (BAC), Goldman Sachs (GS), JPMorgan (JPM), and Morgan Stanley (MS) are expected to have senior roles. Even Robinhood (HOOD) is vying for a key position in the blockbuster offering.

SpaceX generated roughly $15 billion in revenue last year with $8 billion in profit. CFO Bret Johnsen told employees in December that a potential IPO would help fund "an insane flight rate" for its Starship rocket and a possible moon base. The company plans to use IPO proceeds to ramp up Starship flights, deploy AI data centers in space, build "Moonbase Alpha," and send both uncrewed and crewed missions to Mars.

Different parts of Musk's vision for SpaceX would potentially be served by various merger scenarios. xAI could benefit enormously from computing capacity provided by SpaceX's data centers in orbit — if the engineering actually works. Tesla's ability to manufacture energy storage systems could also enable SpaceX to use solar energy in space to power its data centers. Musk has also talked about using Starship rockets to carry Optimus robots to the moon and Mars.

SpaceX is in a much stronger position than Tesla. The rocket maker is the leading provider of orbital launch services under contracts valued at billions annually with NASA and the U.S. Department of Defense. SpaceX also owns and operates Starlink satellite internet, which has more than 9,000 satellites in orbit and roughly 9 million customers.

Should You Buy Tesla Stock?

Bulls argue that SpaceX's success strengthens the broader Musk ecosystem. Meanwhile, bears counter that Tesla is abandoning its core auto business at the wrong time. The honest answer is that buying TSLA stock now is a bet on Musk's vision, not the company's current fundamentals.

If you believe that data centers in space, humanoid robots, and driverless robotaxis represent the future — and that Musk can execute — then the current weakness in Tesla stock might be a buying opportunity. If you think Tesla should focus on making better cars and competing with BYD, the risk-reward doesn't look attractive.

For investors worried about Musk's attention, the prospect of a $1 trillion long-term payout might provide comfort. Musk's pay package, approved by shareholders in November, consists of 12 tranches of shares to be granted if Tesla hits certain milestones over the next decade.

The first tranche is paid out if Tesla reaches a market cap of $2 trillion. That's about $400 billion above its current valuation.

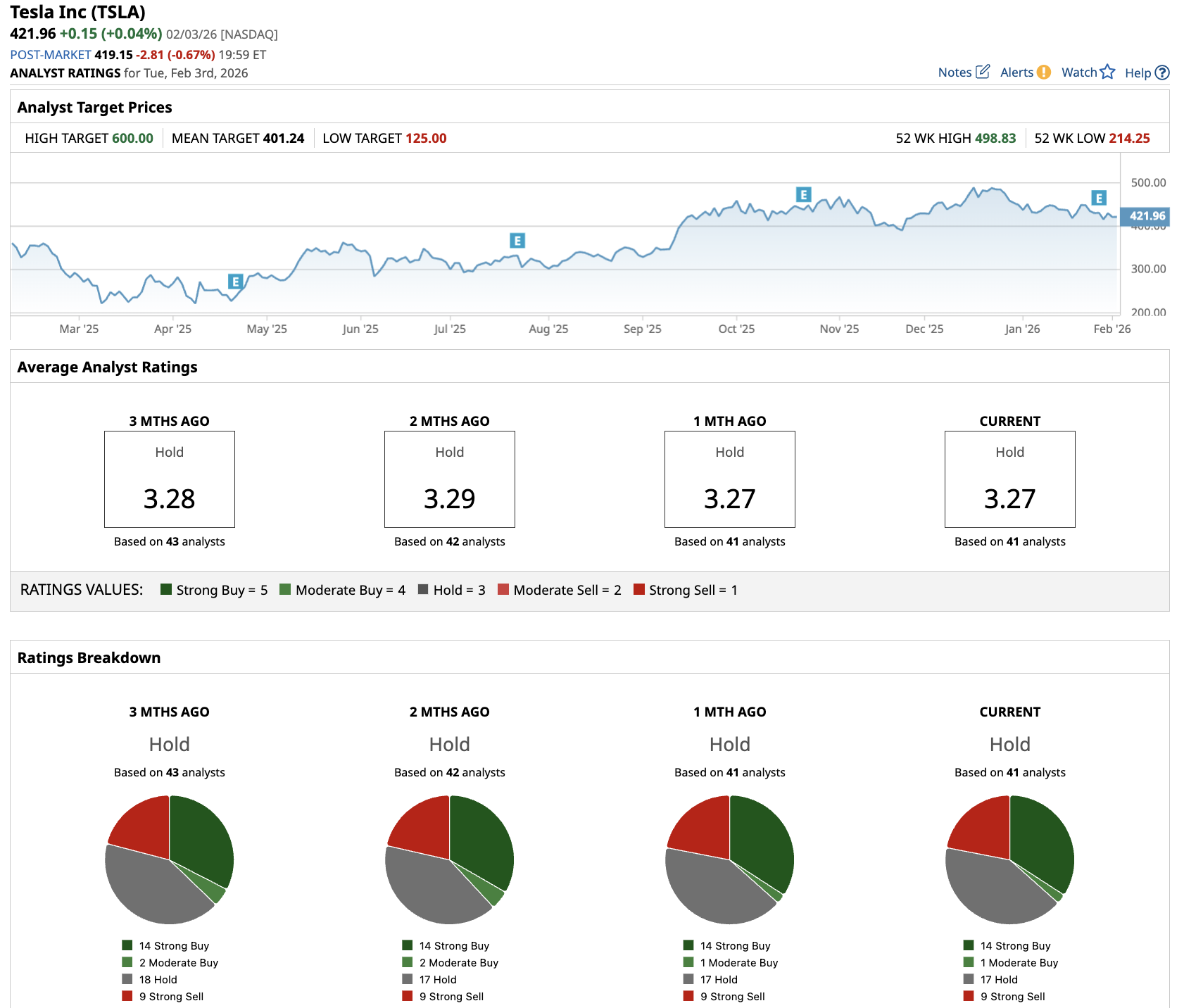

Out of the 41 analysts covering Tesla stock, 14 recommend a “Strong Buy,” one recommends a “Moderate Buy,” 17 recommend a “Hold” rating, and nine analysts recommend a “Strong Sell” rating. The average TSLA stock price target is $402.74, which is slightly above the current price of about $400 per share.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Amazon%20box%20delivery%20by%20Tumisu%20via%20Pixabay.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)