/Amazon%20box%20delivery%20by%20Tumisu%20via%20Pixabay.jpg)

Amazon (AMZN) has been reshaping its corporate ranks this year, cutting tens of thousands of white-collar roles as CEO Andy Jassy pushes to trim layers and speed decision-making. Investors have watched the moves warily as the company balances efficiency drives with heavy investment in AI and data centers.

Now, a Washington WARN filing signals another round of about 2,200 permanent corporate job cuts across various state locations, with separations set to begin April 28, according to a recent filing with the Washington Employment Security Department.

For AMZN stock, the takeaway is mixed. Cost savings could boost margins over time, but repeated rounds of cuts may raise questions about execution risk and growth trade-offs. Investors will keep a close eye on upcoming earnings and any quarterly guidance revisions for fresh direction.

Amazon Is Reshaping Its Business for 2026

Aside from layoffs, Amazon has made notable moves in the past two months. In late January, it announced a pivot in its physical retail strategy, that Amazon Fresh and Go stores will be shuttered or converted into Whole Foods locations. The company will also expand same-day grocery delivery nationwide, betting on its 150 million-plus Prime customer base for more orders. This shift aims to cut losses on smaller-format stores and “prioritize investment in growth areas,” as Amazon stated.

Other moves, like expanding cloud infrastructure, Trainium chips, new AWS data centers, investing in AI services, and Alexa upgrades, underscore Amazon’s long-term priorities. These initiatives have yet to significantly move the stock, but they reinforce Amazon’s narrative of reallocating resources to its strongest growth engines.

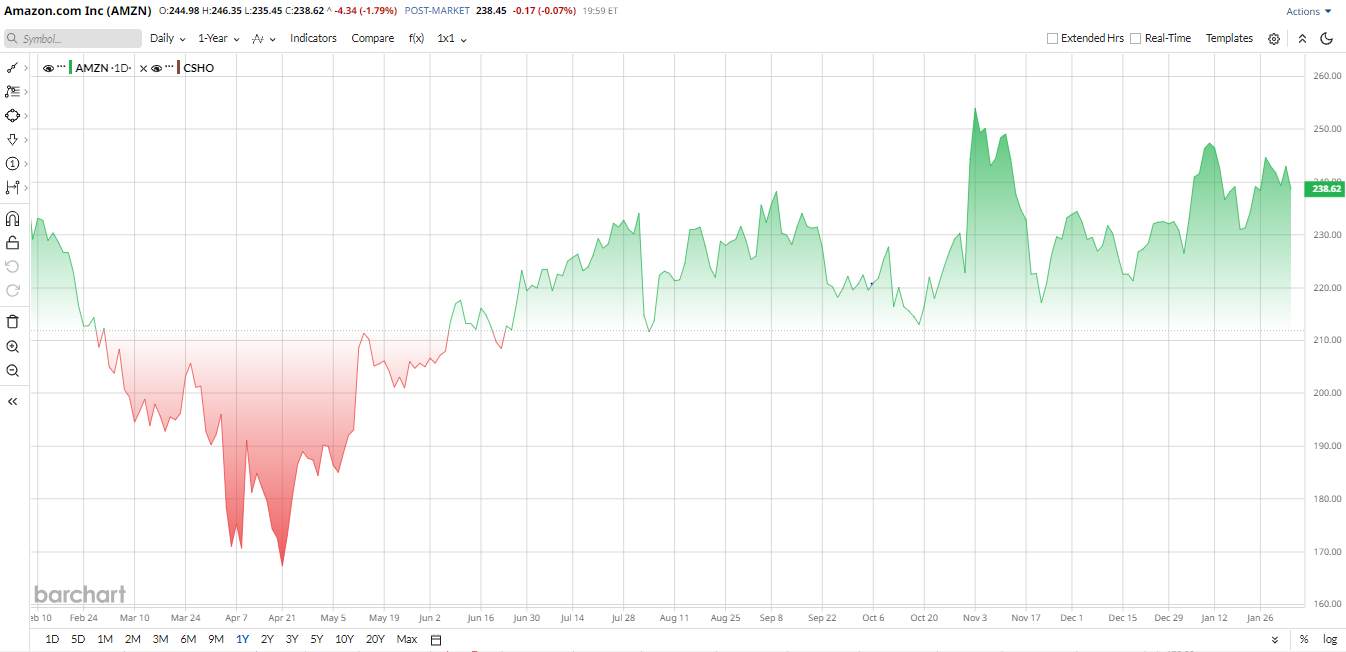

In 2025, Amazon underperformed big-cap peers despite strong business fundamentals, and after hitting an all-time high in November 2025, Amazon’s shares retreated and ended the year essentially flat, a disappointing outcome when the S&P 500 ($SPX) was up roughly 17%. However, in 2026, it began with modest gains for AMZN relative to its technical support levels.

From a valuation point of view, Amazon looks rich but not extreme within its sector. Its trailing P/E is roughly 33×, above the 32× peer group median. Likewise, Amazon’s enterprise value-to-sales is around 3.9×, slightly higher than many Internet retail and cloud peers. In simple words, the stock trades at the upper end of its range versus sector norms, reflecting its growth profile and profitability.

Amazon Layoffs News & Impact

Shareholders have been swallowing the aggressive cost reductions at Amazon. Recently, another piece of news came from the January WARN filing in Washington, which confirms that approximately 2,198 employees, including tech and corporate roles, will be laid off in Seattle and Bellevue by mid-2026. These jobs are engineering, product management, and other technological roles, which correlate with the idea of an organizational reset proposed by Amazon, instead of closing down this or that branch. The reductions are in addition to the 16,000 job cuts announced the week before, and Amazon is positioning the layoffs as the needed streamlining.

Jassy has told shareholders that earlier layoffs were not prompted by financial distress but rather by a culture shift and simplification. The company is still extremely profitable. Q3 net income increased by 40% to $21 billion, so the actions are focused more on reducing unnecessary bureaucracy.

The market has taken this news with a generally passive stock reaction. Upon the announcement of the 16K job cut, AMZN shares declined by roughly 1%, indicating that investors perceived the downsizing as a cost-control measure. Any new severance charges between $500 million and $700 million for 2,200 jobs will hit current profits, but analysts project that the cost will be offset by annual savings.

Amazon Upcoming Earnings Preview

Amazon is scheduled to report Q4 2025 results after the close on Feb. 5. Consensus is for roughly $211.3 billion in revenue and $1.98 EPS. That implies about 12 to 13% sales growth year-over-year (YoY) and modest margin expansion.

Street forecasts assume AWS growth around 20%, perhaps the strongest in over two years, and continued strength in advertising, which should offset any softness in e-commerce.

On the cost side, investors will watch spending trends closely. Amazon has signaled rising investment: CFO Brian Olsavsky pegged full-year 2025 capex near $125B with higher spend expected in 2026.

The Q4 call is likely to focus on how quickly AWS can convert its large backlog into revenue and whether margins can expand as planned. Analysts expect operating margins to tick higher as high-margin segments, e.g., AWS, outpace retail growth.

Free cash flow is also under scrutiny. Q3 free cash flow fell sharply due to AI infrastructure spending, so any guidance on how Amazon will fund future growth, debt vs. cash flow, could influence the stock.

What Do Analysts Think About AMZN Stock?

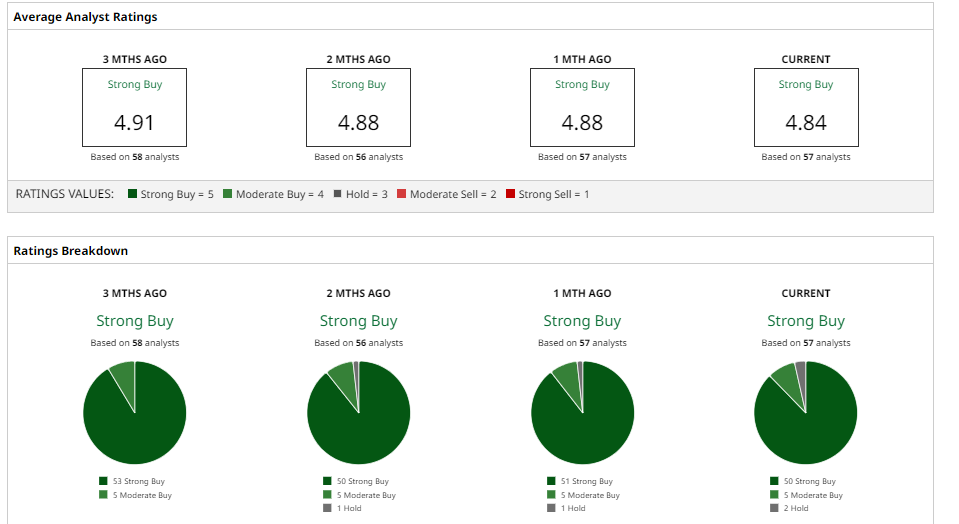

Wall Street is mostly positive about Amazon. Several firms have raised price targets following the recent pullback. Morgan Stanley is leading with a target of $315 with an "Overweight" rating based on accelerating 20% growth of AWS.

Similarly, Jefferies raised its target to $300, citing momentum in the cloud, and noted that AMZN is currently trading at a relatively appealing 12x projected 2026 EV/EBITDA.

Moreover, Goldman Sachs re-emphasized a “Buy” and a target of $275, stating that the growth and profit potential of AWS is being underestimated. Goldman forecasts AWS to resume >20% growth in income and mid-30s operating margins.

Overall, analysts believe that future returns will be brought by the investment made by Amazon in artificial intelligence and productivity. Barchart data show the Street consensus target is approximately 25% higher than the current price, at about $297.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)