/Facebook%20-5psJeebVp9o-unsplash.jpg)

This Thursday should be a busy day for investors, as three trillion-dollar giants – Meta Platforms (META), Apple (AAPL), and Amazon (AMZN) - will release their quarterly earnings after the bell. Last year's performance for Meta stock was remarkable, and with gains of 194%, 2023 marked its best-ever annual return. The gains came after a dismal 2022, when the shares lost around two-thirds of their value and suffered their worst-ever year amid a broader tech sell-off.

After Meta reported a YoY decline in its 2022 revenues – its first as a public company – CEO Mark Zuckerberg declared 2023 as the company's “year of efficiency.” Markets gave a thumbs-up to the company’s aggressive cost cuts, and the stock not only outperformed its FAANG peers by a wide margin, but was also the second-best performing S&P 500 Index ($SPX) stock of 2023 - behind only Nvidia (NVDA), which rode the artificial intelligence (AI) wave to become the first trillion-dollar chip designer last year.

In today's session, as investors brace for a flurry of tech earnings on Thursday, both Alphabet (GOOG) and Microsoft (MSFT) are trading lower after their respective quarterly reports, which failed to please markets despite the beat on headline metrics. Here’s what Wall Street expects from Meta’s Q4 earnings, and whether Zuckerberg might have a new ace in his sleeve, as the “year of efficiency” narrative might have run its course.

Meta Q4 Earnings Preview

Analysts expect Meta to post revenues of $39.17 billion in Q4 – 21.8% higher than the corresponding quarter last year. During their Q3 earnings call, Meta said that it expects to post revenues between $36.5 billion to $40 billion in Q4 - which, at the midpoint, was below the $38.9 billion that analysts expected. Also, the guidance range was wider than usual, which the company’s CFO Susan Li attributed to “more volatility” since the beginning of Q4, coinciding with the start of the Israel-Hamas war.

On average, analysts expect Meta’s earnings per share to rise 61.3% in Q4, as the company’s aggressive cost cuts continue to flow to its bottom line.

Apart from the headline numbers, Meta’s comments on the Q1 outlook will be critical, since the stock fell after the Q3 earnings release as its guidance spooked investors. Also, I would watch for the commentary on losses in the company’s Reality Labs segment, which is building the metaverse.

While Zuckerberg has touted the metaverse as critical to the company’s long-term growth, the business has been plagued by persistent losses that have eaten into the hefty profits that its core advertising business generates.

Analysts Are Bullish on Meta Heading into Q4 Report

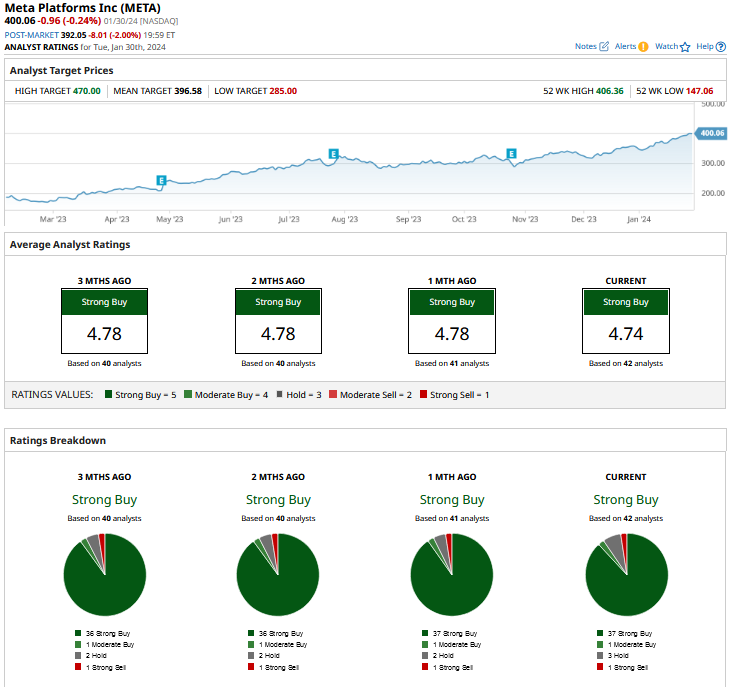

Wall Street analysts are bullish on Meta stock heading into the Q4 report, and KeyBanc analyst Justin Patterson raised his target price on the stock to $465 - just shy of the Street-high target price of $470. Evercore ISI and BofA are also bullish on Meta stock heading into the earnings report.

The overall analyst sentiment toward Meta stock is quite positive,, with a “Strong Buy” or “Buy” rating from over 90% of those in coverage. Currently, META is the second highest-rated FAANG stock behind Amazon.

Amid the recent rise in Meta shares – it recently rejoined the $1 trillion club – the stock trades marginally above its mean target price. We could see more analysts raise their target price on Meta following the Q4 report, as has been the case for the last few earnings calls.

What Could Drive the Next Leg of Meta's Rally?

Cost cuts helped fuel a rally in Meta stock last year. Along with the rise in earnings, the rally in Meta stock was also driven by an expansion of its valuation multiples, with the next 12-month price-to-earnings multiple gradually rising to 23.1x - which is slightly higher than the average multiple for the last five years.

While Meta is still the cheapest FAANG stock based on the metric, it has historically traded at a discount to its tech peers. I believe Meta might need more pathbreaking steps like the 2023 cost cuts to support the next leg of its rally. AI is one venture that could help drive growth for Meta. Indeed, the company does see AI as a key short-term driver, and while Zuckerberg did not specifically term 2024 as the “year of AI,” the overall tone of the Q3 earnings call seemed to suggest as much.

The metaverse could be another driver, but the business is still years from monetization - and in the meantime, continues to drag down the company’s overall profitability. I would watch Meta’s Q4 earnings call for comments on how the Zuckerberg-led company plans to keep bulls in good spirits after the remarkable progress in 2023 as part of the “year of efficiency.”

On the date of publication, Mohit Oberoi had a position in: META , GOOG , AAPL , AMZN , MSFT , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)