/Tesla%20Charging%20Station%20Plugged%20In.jpg)

After outperforming the broader market in 2023, Tesla (TSLA) stock is off to a challenging start in 2024. The shares of this electric vehicle (EV) giant have declined by over 23% year-to-date, pressured by concerns over signs of softer demand for EVs. Furthermore, heightened competition in the EV market has compelled the company to consistently lower its average selling prices, negatively affecting its profit margins and share price.

Adding to the challenges, Tesla’s management has offered a cautious outlook for 2024. The company anticipates a significant decrease in volumes compared to 2023, falling well below its targeted compound annual growth rate (CAGR) of 50%. Although this expected slowdown in volume growth is driven by a strategic shift towards developing new products, such as its next-generation low-cost EV, it is perceived as a negative development.

Against this backdrop, let's analyze various factors to gain insights into what the future holds for Tesla stock in 2024.

The Bull Case for Tesla Stock

Tesla is the world’s leading manufacturer of fully electric vehicles. In addition, it provides solar energy generation solutions and energy storage devices. Tesla achieved a remarkable milestone by manufacturing 1,845,985 consumer vehicles and delivering 1,808,581 units in 2023. Notably, the Model Y emerged as its best-selling vehicle worldwide in 2023, with over 1.2 million units delivered. This stellar performance solidifies Tesla’s dominant position in the EV market, showcasing its resilience in the face of intensified competition.

Looking ahead, Tesla’s strategic initiatives to expand its manufacturing capabilities, along with the introduction of new vehicle models and next-generation platforms, position it well for growth. Furthermore, the company’s commitment to cost reduction, including the ability to source and manufacture components locally, provide a strategic advantage. This enables Tesla to offer competitive pricing, plus maintain and grow its market share.

It is important to note that Tesla strategically utilizes its industry-leading profit margins to aggressively lower prices and boost sales volumes. This approach poses considerable challenges for competitors, as they are compelled to reduce prices, even if it impacts their profitability. Tesla has consistently reduced its cost of goods sold (COGS) per vehicle, and in Q4 2023, its COGS per vehicle came in slightly above $36,000, compared to nearly $40,000 in the prior-year quarter.

Tesla remains committed to expanding its production and identifying additional cost efficiencies throughout 2024. By prioritizing the reduction of the COGS per vehicle, Tesla aims to fortify its profit margins, which will drive further volume growth in the upcoming quarters.

In addition to reducing the cost per vehicle, Tesla is enhancing the performance and functionality of its cars to bolster demand. This involves advancements in artificial intelligence (AI)-driven products like Full Self-Driving (FSD) and Autopilot, along with various software features. These strategic initiatives position Tesla advantageously to maintain and protect its market share.

Beyond EVs, Tesla experienced significant growth in its energy storage deployments, which reached 14.7 GWh in 2023 — more than double the previous year’s figures. Further, its Energy Generation and Storage division's profit nearly quadrupled in 2023. Finally, the Services & Other business swung from a loss of approximately $500 million in 2019 to a profit of about $500 million in 2023.

To sum it up, Tesla is well-positioned to capitalize on the ongoing shift towards clean energy and electrification of the automotive sector.

The Bear Case for Tesla Stock

Tesla’s long-term fundamentals remain strong, and its margins could start to show acceleration, benefiting from improving the mix between hardware margin and recurring software margin - including FSD, supercharging, and Megapacks.

However, short-term challenges, such as heightened competition and lower prices, may continue to squeeze Tesla's margins. Notably, increased competition in China, mainly from BYD (BYDDY), could exert pressure on the company's profitability.

Furthermore, as Tesla’s margin gap with competitors narrows, its premium valuation becomes harder to justify - potentially limiting upside potential in 2024.

What's the Bottom Line for Tesla Investors?

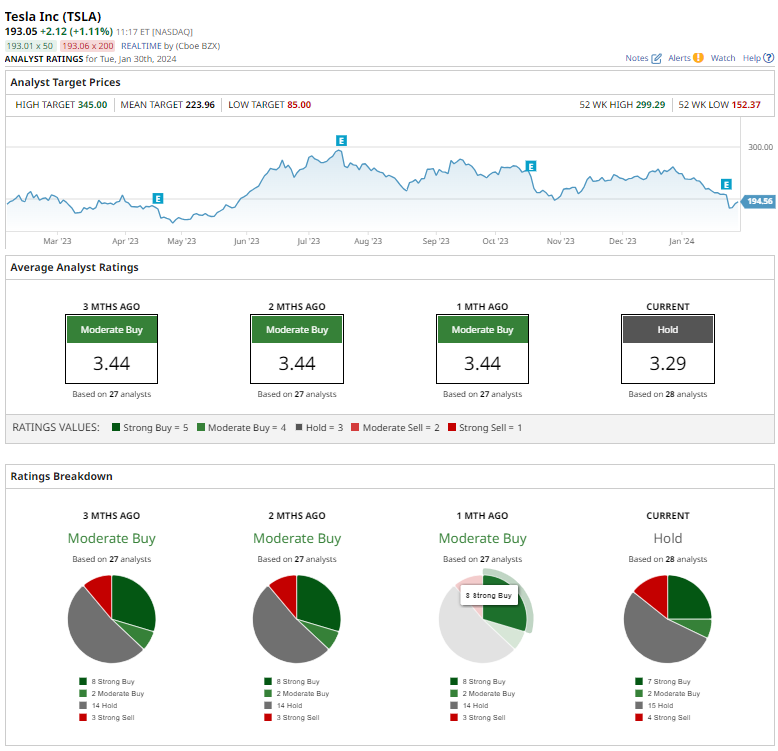

Given the near-term margin headwinds and expected decline in delivery volumes, analysts are not too bullish about Tesla stock in the near term. The consensus recommendation is now “Hold,” down from “Moderate Buy” a month ago.

Among the 28 analysts covering Tesla stock, seven have “Strong Buy” ratings, two recommend “Moderate Buy,” 15 have a “Hold,” and four suggest “Strong Sell.” Moreover, the average price target is $223.96, which implies relatively limited upside potential of about 16.8% from current levels.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)