Chips are at the foundation of every digital technology. Whether it's a smartphone, electric vehicle, or laptop, they are filled with chips, making this technology one of the most important products in the supply chain. As a result of their necessity, the companies behind them have significant pricing power, making them fantastic investments.

Two chip stocks that look like great buys now and are critical to the chip supply chain are Taiwan Semiconductor (NYSE:TSM) and ASML (NASDAQ:ASML). With each stock trading an attractive valuation and plenty of tailwinds on the horizon, these two could be portfolio-changing investments.

China is a risk for both companies

Taiwan Semiconductor and ASML are not competitors. Instead, ASML supplies its EUV (extreme ultraviolet) and DUV (deep ultraviolet) lithography machines to Taiwan Semiconductor so they can etch microscopic patterns onto the chip.

The latest and greatest in chip design is a 3nm (nanometer) chip, which means the distance between transistors is at a minimum of 3nm wide. For reference, a human hair is between 80,000 and 100,000 nanometers wide.

While only a handful of companies can manufacture 3nm chips (Taiwan Semiconductor being one of them), only one creates the machines that make this technology possible: ASML. This makes these two companies fantastic investments based on their technological capabilities.

However, there's one overarching threat to both companies: China.

While the China invasion worries over Taiwan have died down, it is still a real possibility. Any action against Taiwan would sink Taiwan Semiconductor's stock (along with almost every other stock that uses Taiwan Semiconductor chips, like Apple and Nvidia). So avoiding TSMC because of this worry isn't wise, as iPhones and GPUs that power much of our computing infrastructure would have a part shortage and tank the market in general.

ASML also has to deal with China bans, as the Dutch government doesn't want the company to export its top-end EUV machines to China. So, ASML sends China its DUV machines, which are less powerful and can only produce chips 7nm in size. There is always a possibility that ASML may be prohibited from exporting any of its products to China, which would be an issue, as 46% of ASML's Q3 and 24% of Q2's new machine sales came from China.

This makes China a large part of the investment risk for both companies, but with how destabilized the world's economy would become if an attack happened, I don't think it's a valid reason not to invest. However, it's something to keep an eye on.

Despite these risks, both stocks look like strong buys right now.

Trading at recent valuation lows

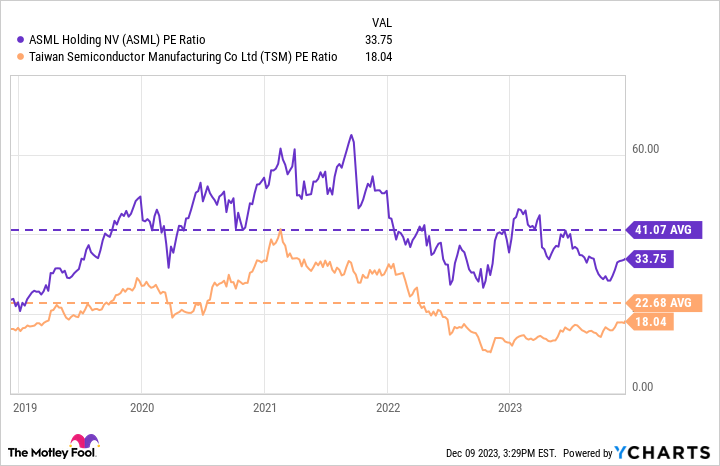

If you look at each company's price-to-earnings (P/E) ratio at face value, it may appear Taiwan Semiconductor is far cheaper than ASML, which is true. However, Taiwan Semiconductor is a cyclical business, as demand for its chips rises and falls based on consumer appetite. Planning and ordering machines from ASML takes some time, so it isn't as affected by consumer trends. For example, ASML's revenue backlog (for machines already ordered) sits at 35 billion euros, compared to Q3 system sales of 5.3 billion euros.

As a result, ASML has a higher valuation, which it has rightfully earned.

ASML PE Ratio data by YCharts

Both companies are trading well below their five-year historical average P/E ratio, which tells me each stock is undervalued in its own right.

With each company slated to capitalize on a chip boom that artificial intelligence (AI) computing creates, I think each stock is a buy right now. But if you forced me to pick one, I'd likely side with Taiwan Semiconductor because of its lower starting valuation.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Taiwan Semiconductor Manufacturing wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 7, 2023

Keithen Drury has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends ASML, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)