For investors keeping a close eye on Carvana (CVNA), Feb. 18 has emerged as one of the most important dates on the 2026 market calendar. After a rollercoaster ride marked by volatile trading in 2025, Carvana is scheduled to release its fourth-quarter and full-year 2025 financial results after the market closes on Feb. 18.

This earnings announcement has the potential to redefine the narrative for the online used-car retailer. Following its dramatic turnaround from near bankruptcy, a recent addition to the S&P 500 Index ($SPX) and heightened scrutiny, made investors intensely focused on whether the company can continue to deliver both top-line growth and financial transparency.

Thus, the upcoming report could be a catalyst for a renewed rally or a sharp correction, depending on how Carvana’s results measure up against consensus and how management addresses lingering concerns.

About Carvana Stock

Carvana is a prominent e-commerce platform focused on the online buying, selling, financing, and home delivery of used vehicles. Based in Tempe, Arizona, the company has built one of the nation’s most vertically integrated automotive retail models.

Since its initial public offering (IPO) in 2017, Carvana has undergone a dramatic turnaround, surviving near-bankruptcy to emerge with strong profitability margins, streamlined operations, and rapid sales growth. Today, the company commands a market capitalization of $74.8 billion, firmly establishing it as a large-cap stock.

Carvana has delivered a dramatic resurgence in its share price in 2025 as investor confidence returned and fundamentals improved.

The company’s growth in retail unit sales and revenue signals a dramatic turnaround from previous years of volatility and losses. These operational improvements, coupled with Carvana’s inclusion in the S&P 500 in December 2025, mechanically increased demand for the stock as index funds and ETFs adjusted their holdings and also elevated the company’s visibility. The stock hit a 52-week high of $486.89 on Jan. 23, amid the positive sentiments.

However, the stock has since retreated by 29.3%, while its total 52-week returns stand at about 27%.

Carvana’s stock has come under pressure this month amid renewed investor anxiety ahead of its upcoming earnings report. A high-profile report from Gotham City Research alleging accounting irregularities and undisclosed related-party transactions reignited doubts about the sustainability of Carvana’s turnaround, triggering heavy selling and a significant drop in share price. The stock has declined nearly 14% over the past five days, while it is down 18% on a year-to-date (YTD) basis.

The stock is trading at 50x forward earnings, well above the sector average.

Blockbuster Topline Performance

Carvana released its third-quarter 2025 earnings report on Oct. 29, providing one of the most compelling updates in the company’s turnaround story. In the quarter, the online used-car retailer reported record retail units sold of 155,941, representing a 44% year-over-year increase, while total revenue surged 55% year-over-year to $5.7 billion, marking the highest quarterly sales figure in the company’s history.

Profitability also strengthened meaningfully in the quarter. Net income rose to $263 million, up 78% year-over-year, with net income margin expanding to 4.7% and operating income climbing 64%. Adjusted EBITDA reached $637 million, a company record and a 48% year-over-year increase. Earnings per share (EPS) came in at $1.03, a significant increase from $0.64 in Q3 2024, but still below estimates.

Carvana further expects retail units sold in Q4 2025 to exceed 150,000, and it reiterated that full-year adjusted EBITDA should reach or exceed the high end of its previously communicated range between $2.0 billion and $2.2 billion.

For the fourth quarter, analysts tracking Carvana project EPS to grow 96.4% from the prior-year quarter to $1.10. Moreover, the company’s EPS is expected to climb 389.2% YOY to $4.99 in fiscal 2025 and grow another 45.7% to $7.27 in fiscal 2026.

What Do Analysts Expect for Carvana Stock?

Last month, JPMorgan analyst Rajat Gupta maintained an “Overweight” rating on Carvana and raised the price target to $510 from $490, reflecting continued confidence in the company’s market position and growth potential despite recent volatility in the stock.

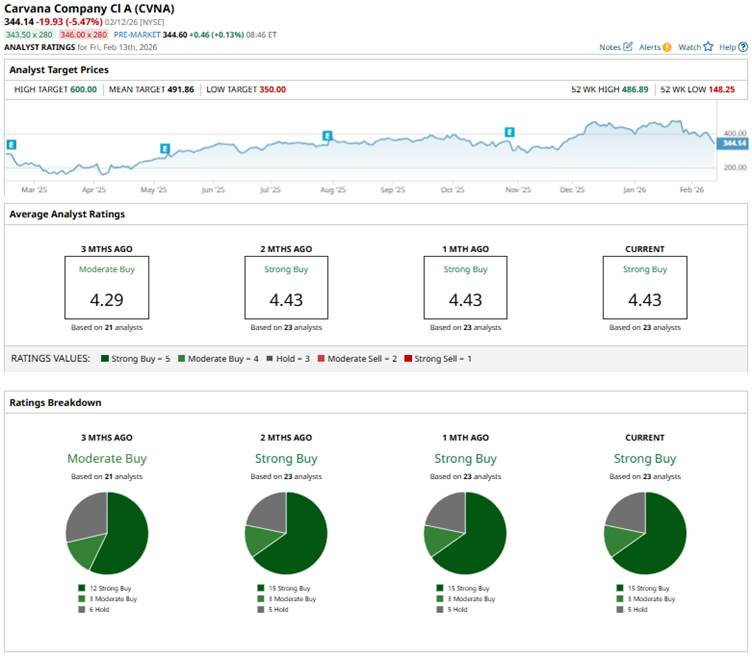

CVNA has a consensus rating of a “Strong Buy” overall. Of the 23 analysts covering the stock, 15 advise a “Strong Buy,” three suggest a “Moderate Buy,” and five analysts give it a “Hold” rating.

While CVNA’s average price target of $491.86 suggests an upside of 42.9%, the Street-high target of $600 signals that the stock could rise as much as 74.3% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)