/Meta%20Platforms%20by%20Primakov%20via%20Shutterstock.jpg)

Billionaire investor Bill Ackman recently turned heads on Wall Street by disclosing a significant new stake in Meta Platforms (META), signaling his belief that the tech giant’s stock is undervalued despite ongoing volatility. Through his hedge fund Pershing Square Capital Management, Ackman allocated a major new stake in Meta Platforms, now representing about 10% of the fund's capital as of the end of 2025.

In its annual investor presentation, Pershing said that Meta’s current share price significantly undervalues its long-term artificial intelligence (AI) driven growth potential, arguing that investor concerns over heavy AI spending are overstated. META shares have declined amid fears about substantial AI-related capital expenditures for 2026, but Pershing noted that the stock’s valuation is lower than peers like Alphabet (GOOGL), Apple (AAPL) , and Nvidia (NVDA) .

While META stock has faced pressure amid concerns over high AI-related spending and short-term execution risk, Ackman’s bold move fuels the debate over whether Meta Platforms' current valuation offers a compelling entry point.

About Meta Stock

Meta Platforms is a technology conglomerate headquartered in Menlo Park, California, and best known for owning and operating some of the world’s most influential social media and communication platforms, including Facebook, Instagram, WhatsApp, Messenger and Threads. Originally founded as Facebook in 2004, the company rebranded to Meta in 2021 to reflect its strategic pivot toward immersive technologies such as virtual reality, augmented reality, and the metaverse.

In addition to its flagship apps, Meta develops hardware and AI-driven products through divisions like Reality Labs, spanning VR headsets and smart glasses. Meta’s market capitalization stands at $1.64 trillion, ranking it among the largest technology companies globally.

Meta’s share price has shown a modest recovery this year after a period of volatility. Year-to-date (YTD), META stock is down about 2%, slightly underperforming the broader market, reflecting a stabilizing trend after investors digested mixed earnings and heavy AI spending projections.

Over a longer 12-month horizon, the stock has declined 11%, lagging the S&P 500 Index’s ($SPX) 12% gains over the same period. That decline comes amid fears about the company's projected $115 billion to $135 billion in AI-related capital expenditures for 2026. META stock is currently trading 18% below its 52-week high of $796.25, which was reached back in August 2025.

However, looking back over longer horizons, META has delivered significant multi-year gains, delivering 276% returns over the past three years as the company has expanded its dominance in digital advertising and invested in next-generation technologies.

META stock currently trades at a premium compared to the sector median but below its own historical average at 22.5 times forward earnings.

Stable Topline Growth

Meta Platforms’ fourth-quarter and full-year 2025 results, released on Jan. 28, reflected continued topline strength alongside intensifying investment in AI and infrastructure.

For Q4 2025, Meta reported revenue of $59.9 billion, up 24 % year-over-year (YOY), driven by robust advertising demand across its Family of Apps. Net income for the quarter rose 9% from the prior-year quarter to $22.8 billion, while EPS increased 11% to $8.88 compared with $8.02 in Q4 2024, exceeding analyst expectations. Total operating margins for the quarter were about 41%, compressed versus Q4 2024 as costs climbed with higher infrastructure and investments.

On a full-year basis, Meta’s 2025 revenue reached $201 billion, up 22% YOY from $164.5 billion, underscoring sustained demand. However, full-year net income was $60.5 billion, modestly below the prior year’s $62.4 billion, while EPS came in at $23.49, a decline of about 2% from $23.86 in 2024, reflecting the impact of significantly higher expenses tied to scaling AI infrastructure and other strategic initiatives.

In tandem with these results, management provided 2026 guidance that emphasized continued growth and heavy investment in AI capabilities. For Q1 2026, Meta guided for revenue of $53.5 billion to $56.5 billion.

For the full year, the company anticipates total expenses between $162 billion and $169 billion. Capital expenditures are expected to come in at $115 billion to $135 billion, a substantial increase, aimed at building out data centers, custom hardware and AI-related infrastructure.

Despite the elevated expense base, Meta reiterated its expectation that operating income in 2026 will exceed 2025 levels, underscoring management’s confidence in long-term profitability even as it invests heavily in future growth engines.

Analysts predict EPS to be around $29.67 for fiscal 2026, down slightly YOY, before surging by 14% annually to $33.79 in fiscal 2027.

What Do Analysts Expect for Meta Stock?

Recently, Citizens reaffirmed its “Market Outperform” rating on Meta Platforms with a $900 price target, pointing to accelerating engagement trends on Instagram as a key growth driver.

Freedom Capital Markets also raised its price target on Meta Platforms to $825 from $800 while reiterating a “Buy” rating following the company’s strong Q4 results. The firm noted that Meta exceeded consensus estimates across key metrics, supported by robust holiday-season ad demand and AI-driven improvements in advertising efficiency.

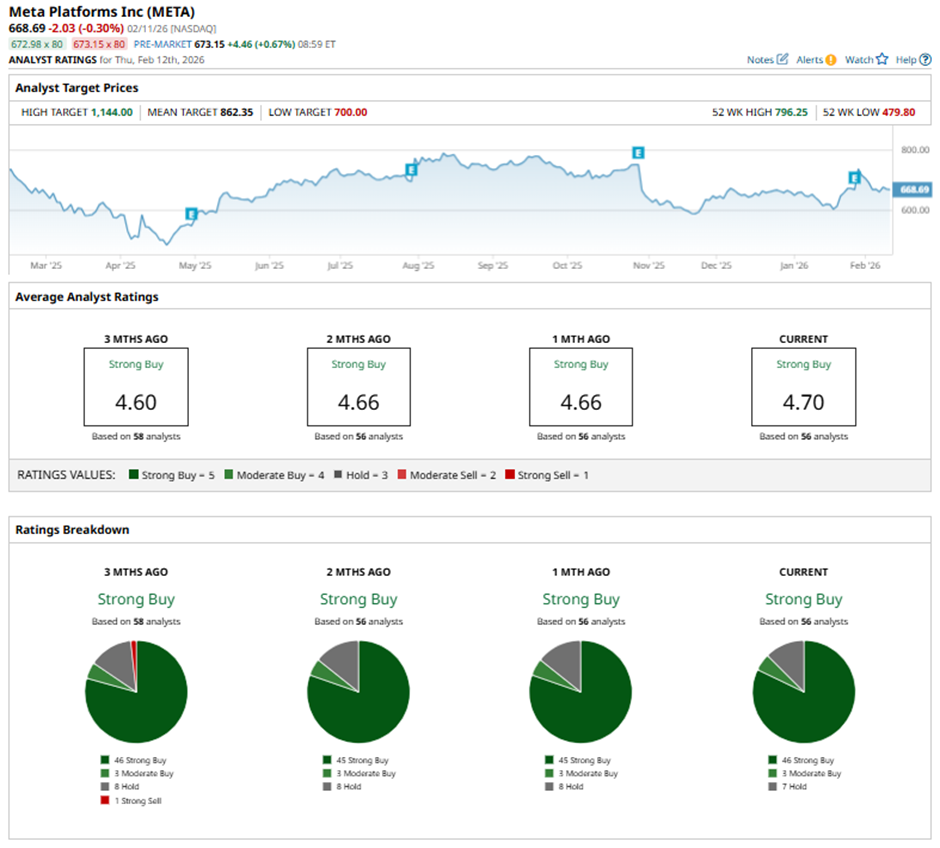

Wall Street is majorly bullish on META stock. Overall, META has a consensus “Strong Buy” rating. Of the 56 analysts covering the stock, 46 advise a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining seven analysts offer a “Hold” rating.

The average analyst price target for META is $862.35, indicating potential upside of 33%. The Street-high target price of $1,144 suggests that the stock could rally as much as 76% from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)