Robinhood (HOOD) has gone from headline favorite to live stress test in just a few weeks, with the stock now down about 33% year-to-date (YTD) after its latest earnings release knocked confidence and reset expectations. That move comes even as the business keeps adding products and scale, which makes this slide challenging to ignore for anyone watching high‑growth names in the trading and fintech space.

Crypto has been at the center of the story. A steep slide in Bitcoin (BTCUSD), back below $70,000 earlier this year, after trading near record highs above $120,000 in late 2025, wiped away hundreds of billions in market value and pulled risk‑sensitive stocks down with it. Robinhood felt that hit directly as crypto trading cooled, and the market quickly marked down how much this revenue stream can be relied on when digital assets stumble.

The real question is whether this 2026 drawdown is setting up a genuine buying window or flagging that the easy money has already been made. Let’s dive in.

Robinhood’s Numbers Behind the Dip

Robinhood Markets is an online brokerage based in Menlo Park that offers commission‑free trading, banking tools, retirement accounts, and credit cards to retail investors, with an equity value of nearly $77 billion.

Its share price is $76.58 as of early Feb. 13, down 33% YTD yet still up 20% over the past 52 weeks.

That pricing sits on top of a rich valuation profile, with the stock at a PEG ratio of 1.34x and a price‑to‑sales multiple of 16.02x versus sector medians closer to 1.0x on PEG and roughly 2.94x on sales, which signals that the market is still assigning Robinhood a steep growth premium even after the recent slide.

Their latest earnings report explains why that premium is being tested. This fourth‑quarter 2025 report, released in early February 2026, showed earnings per share of $0.66, beating the $0.63 consensus and confirming that the company is now solidly profitable on a GAAP basis. It also revealed quarterly revenue of about $1.28 billion, which rose at a healthy mid‑20s percentage pace year‑over‑year (YoY).

Their total platform assets climbed 68% from a year earlier to $324 billion, with retirement assets more than doubling to $26.5 billion as more customers adopt its long‑term investing and tax‑advantaged products. That combination of expanding assets and new services also showed up in the margin book, which jumped 113% YoY to a record $16.8 billion, helped by record equities and options volumes.

What’s Shaping Robinhood’s Next Chapter

Robinhood is pushing deeper into prediction markets by acquiring 90% of MIAX’s MIAXdx derivatives exchange, leaving MIAX with a 10% stake. This deal gives Robinhood direct control over listing and clearing event contracts, futures, and options instead of relying on outside venues.

It already handles an estimated 30%-35% of U.S. retail prediction contract volume, and management says prediction markets are its fastest‑growing segment, with volumes roughly doubling each quarter. That expansion is meant to lock in more trading activity, add new fee streams, and tie users more closely to the platform.

The leadership bench is shifting at the same time investors are reassessing the stock. The company's long-time CFO, Jason Warnick, is stepping down in 2026 but will remain as an advisor through Sept. 1 to support the transition. Shiv Verma, previously senior vice president of finance and strategy, became CFO on Feb. 6, keeping someone familiar with the firm’s growth and capital plans in charge of the numbers.

Big institutional money is also taking a clear view on whether this selloff is an exit point or an entry point. Bridgewater Associates, the world’s largest hedge fund, bought 807,514 shares of Robinhood in the third quarter. That move effectively wagers that the mix of prediction markets, options, crypto, and expanding client assets can support higher earnings over time.

Analyst Targets Set the Next Test

Investors watching this post‑earnings pullback already know the next big checkpoint for HOOD is its upcoming report scheduled for April 29, 2026. For the March 2026 quarter, the average EPS estimate stands at $0.60 versus $0.37 a year ago, implying 62.16% YoY growth and signaling that analysts still expect robust profit expansion, not a pause.

Expectations for the full December 2026 fiscal year tell a similar story, with consensus calling for $2.48 in EPS compared with $2.05 last year, a projected 20.98% increase that assumes the business can keep scaling even after the latest revenue miss.

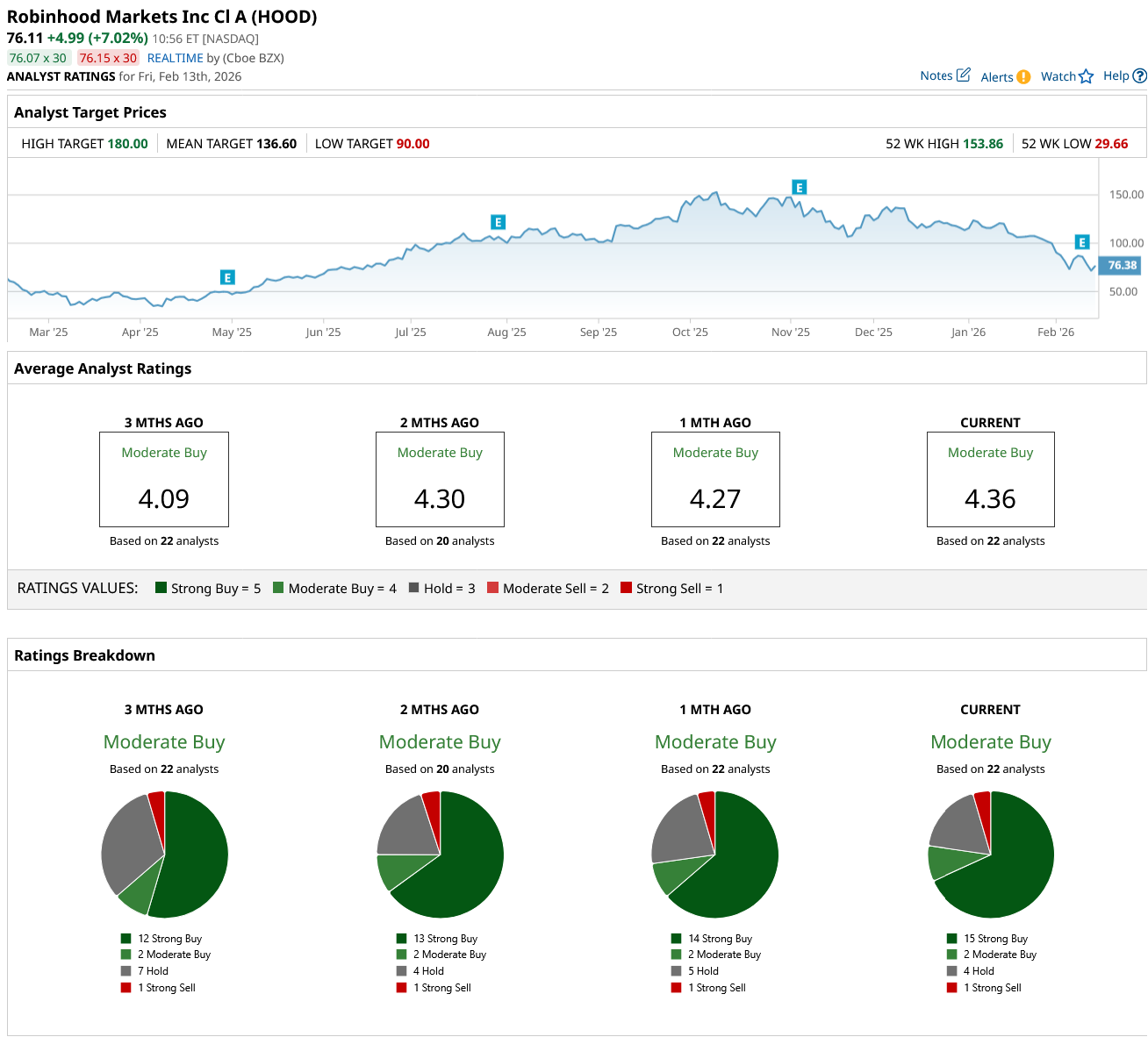

One indication that the Street is leaning toward “reset, not breakdown” comes from Wolfe Research, which recently upgraded HOOD to “Outperform” from “Peer Perform” and set a $125 price target. That call effectively frames the earnings‑driven weakness and 2026 YTD slide as a chance to step into the name.

Consensus overall still tilts constructive as the stock carries a “Moderate Buy” consensus rating drawn from 22 analysts. The average price target of $136.60 stands far above the current level, pointing to roughly 79% potential upside from its current price.

Conclusion

Robinhood’s selloff looks more like a recalibration than a death sentence for the story. With earnings still growing, assets compounding, and prediction markets adding a new leg, the setup favors patient dip buyers over panic sellers. Shares can easily stay choppy in the near term as the market digests the revenue miss and rich valuation. Over a 12- to 18-month window, the risk-reward still skews toward a grind higher rather than a decisive breakdown.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)