Shares of Robinhood Markets (HOOD) are tanking on Wednesday after the company missed on Q4 revenue estimates. At the time of writing, HOOD stock is down about 12% today.

In addition to the earnings report, the slide also comes on the back of the recent crypto crash and the announcement late last year that the company’s former CFO, Jason Warnick, was stepping down in 2026. Although Warnick is staying on as an advisor to the company through Sept. 1, investors have been anticipating uncertainty for Robinhood.

Given this backdrop, investors may be wondering if they should buy HOOD stock on the dip, sell their shares, or simply hold for more information. Let's take a look.

About Robinhood Stock

Based in Menlo Park, California, Robinhood is a prominent financial services company offering a user-friendly electronic trading platform for stocks, exchange-traded funds (ETFs), options, futures, cryptocurrencies, and prediction markets. The company has established a reputation for itself by offering commission-free trading, primarily targeting younger traders.

Since its inception in 2013, Robinhood has expanded its services internationally to the U.K. and the European Union, introducing features such as wealth management, cryptocurrency wallets, and banking services.

The company continues to innovate with new products, such as prediction markets and futures trading, reinforcing its commitment to democratizing access to financial markets and evolving into a comprehensive fintech platform. The company has a market capitalization of about $76 billion.

While HOOD stock is still up 40% over the past 52-week period, it has been a rough start to 2026. Year-to-date, HOOD stock is down about 34%.

Robinhood’s Q4 Results Disappoint Investors

On Feb. 10, Robinhood reported fourth-quarter and full-year results for fiscal 2025. The company’s total revenue for 2025 hit a record $4.5 billion, including record Q4 revenue of $1.28 billion. This represented a 27% increase year-over-year.

However, analysts had been expecting Q4 revenue of $1.35 billion. Notably, crypto revenue came in at $221 million, well below Wall Street's estimates of $248 million and down 38% year-over-year. This, on the heels Bitcoin's (BTCUSD) dramatic fall, has understandably caused some investors to feel nervous.

Diluted earnings per share (EPS) for Q4 came in $0.66, representing a 35% year-over-year decline.

Robinhood also acknowledged the CFO transition in the latest earnings report, confirming that Warnick is currently operating in an advisor capacity through Sept. 1. Shiv Verma, formerly Robinhood's senior VP of finance and strategy, has taken over the CFO role as of Feb. 6.

What Do Analysts Think About Robinhood Stock?

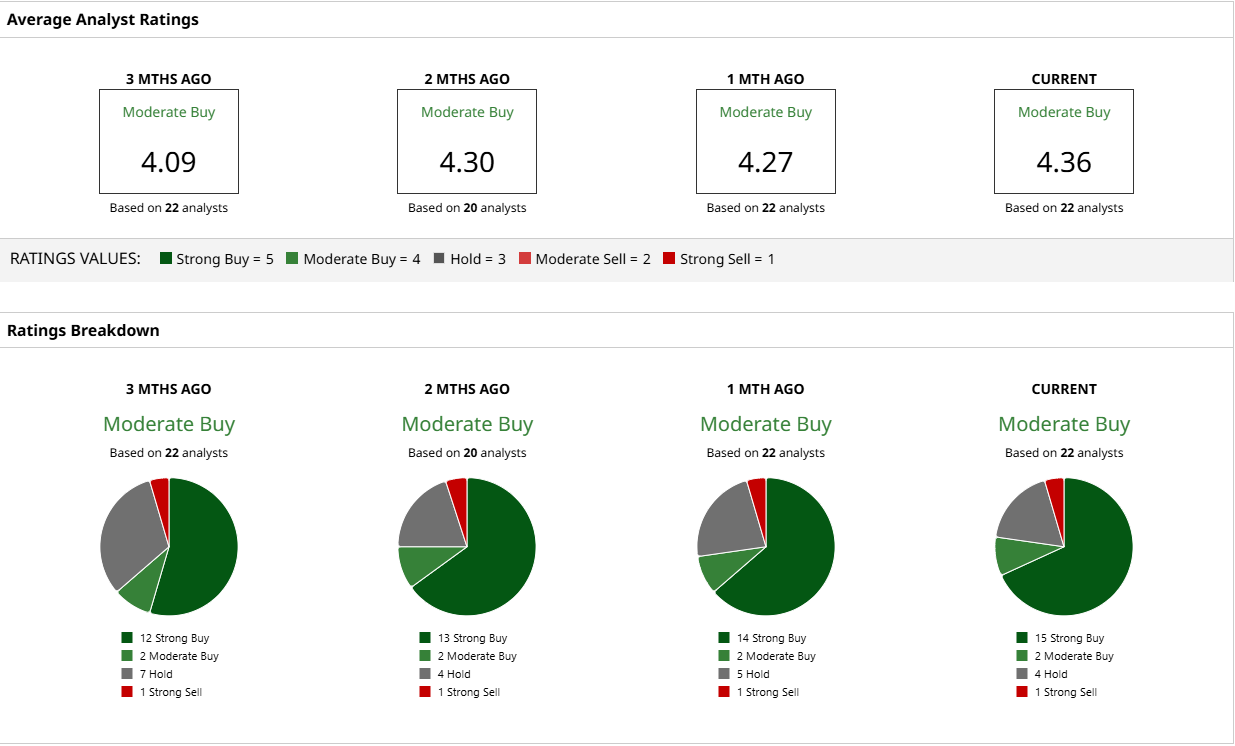

Despite the somewhat disappointing earnings report, Robinhood remains a popular name on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 22 analysts rating the stock, a majority of 15 analysts have rated it a “Strong Buy.” Two analysts suggest a “Moderate Buy,” and four analysts are playing it safe with a “Hold” rating. Only one analyst has a “Strong Sell” rating. The mean price target of $146.70 represents nearly 94% upside from current levels.

Key Takeaways

Despite the recent selloff, Robinhood’s fundamentals suggest that the markets might be overreacting to this recent earnings report. The company’s operations are expanding, and Wall Street analysts remain bullish on the stock. Therefore, it might be worth considering buying the dip in Robinhood stock now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)