Greenlight Capital’s David Einhorn is betting big on gold, expecting the Federal Reserve to cut interest rates more than what’s anticipated, as Kevin Warsh, President Donald Trump’s pick to succeed Jerome Powell as Fed chair, might persuade the committee to cut rates if inflation is lower than the 4%-5% level.

The non-ferrous metal, in addition to being a proven inflation hedge, has become a popular asset amid geopolitical tensions and an unstable trade policy. Einhorn, who became popular after his bet against Lehman Brothers during the 2008 crisis, stated that gold has become a “reserve asset” for central banks worldwide because they seek something more stable than the U.S. dollar. He also believes there may be issues affecting the major currencies “sometime over the next number of years.”

Given this backdrop, it might be wise to consider investing in gold-mining stock McEwen (MUX) which has shown triple-digit growth over the past year.

About McEwen Stock

McEwen is a diversified mining company focused on gold, silver, and copper production across the Americas. Headquartered in Toronto, Canada, it manages key assets like the San José mine in Argentina, the Gold Bar mine in Nevada, the Fox Complex in Ontario, Canada, and the Los Azules copper project in Argentina.

The company emphasizes profitable operations and growth through its exploration properties. It also prioritizes advancing low-cost projects and boosting output at existing sites. It has a market capitalization of $1.5 billion.

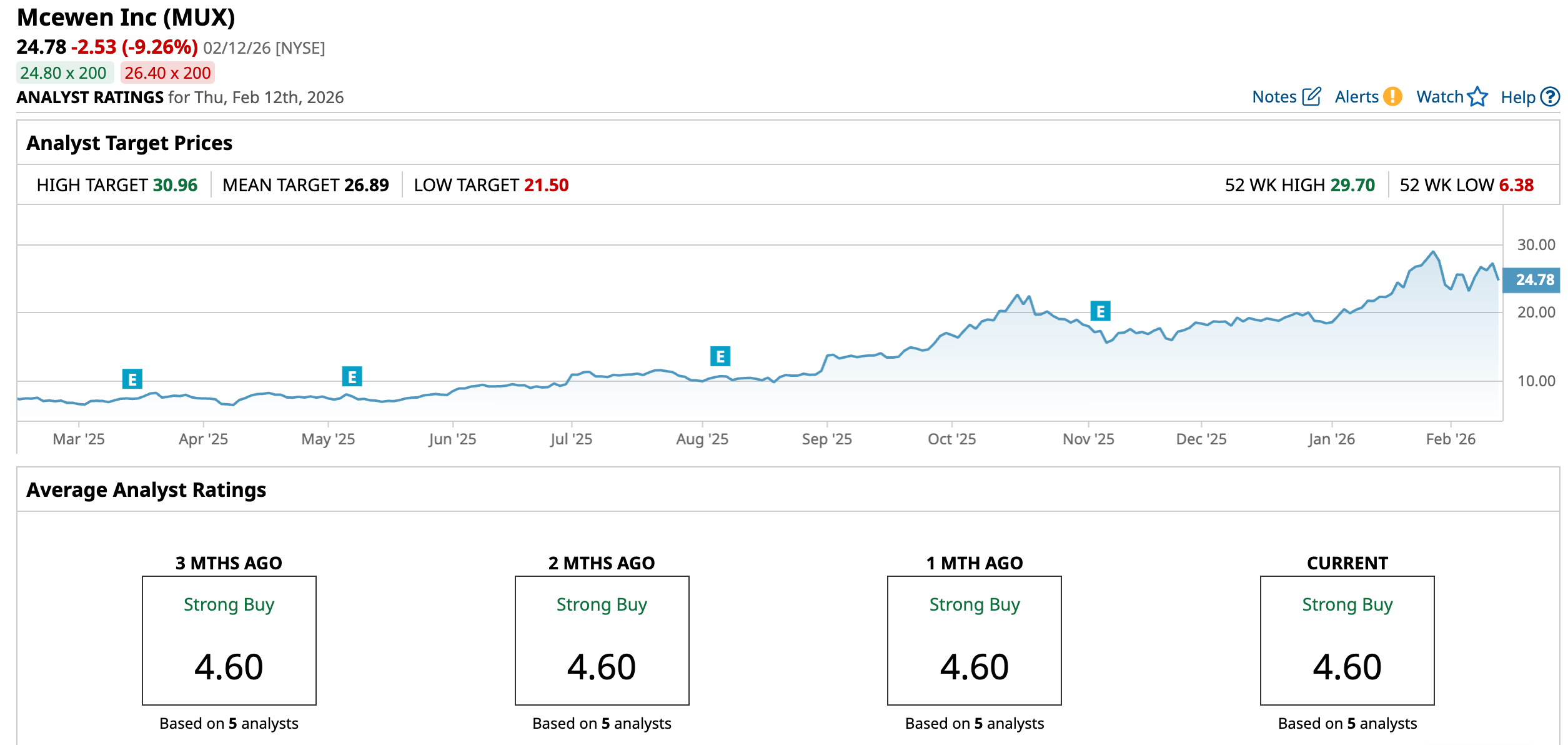

The stock has risen sharply over the past year, driven primarily by surging gold and copper prices amid global economic uncertainty. Over the past 52 weeks, McEwen’s stock has gained 220.98%, while it has risen 33.87% year-to-date (YTD). Just for comparison, the broader S&P 500 Index ($SPX) has gained 12.9% and -0.19% over the same periods. Building on strong momentum, the shares had reached a 52-week high of $29.70 on Jan. 29, but are down 16.6% from that level.

McEwen is trading at a stretched valuation. Its price-to-sales ratio of 8.79x is significantly higher than the industry average of 1.77x.

McEwen’s Recent Operational Strides

McEwen has the ambitious target of reaching 250,000-300,000 gold equivalent ounces (GEOs) of annual gold production by 2030, effectively doubling its current production level. For that goal, the company is currently working on the Fox project, which comprises the Stock mine and the Grey Fox complex. This can be considered McEwen’s flagship project, as it’s expected to account for approximately 50% of the total production goal.

Prior to the prefeasibility study in the second quarter this year, McEwen reported that the 2025 Mineral Resource Estimate at Grey Fox now stands at 1,892,000 GEOs of indicated resources. Additionally, the Stock mine in the complex is expected to begin production by mid-2026, which should result in lower-cost gold production (compared to the Froome mine) due to a lower royalty burden, shorter ore haulage to the mill, and cost benefits from processing softer material.

There’s also the Gold Bar Mine Complex, comprising the Gold Bar Mine, Windfall, and Lookout Mountain, which is expected to pull 30% weight of the annual production target. In January, the company announced the acquisition of Golden Lake Exploration Inc., which owns the Jewel Ridge and Jewel Ridge West projects, adjacent to McEwen’s Windfall and Lookout Mountain locations. Therefore, this acquisition bolsters the company’s operations in Nevada.

However, McEwen has encountered some operational challenges that have affected its third-quarter 2025 production and raised costs. 8,191 GEOs were produced from the Pick deposit, which was lower than expected. As a result, the company revised its annual production guidance for fiscal 2025 from 40,000-45,000 GEOs to 32,000-35,000 GEOs.

The company’s Q3 revenue from gold and silver sales declined 3.3% year-over-year (YOY) to $50.53 million. However, McEwen reduced its bottom line loss per share from $0.04 to $0.01.

Wall Street analysts are robustly optimistic about McEwen’s future earnings. They expect the company’s EPS to climb by 266.7% YOY to $0.25 for Q4 of fiscal 2025. For fiscal 2026, it is expected to reverse its prior-year losses, with an EPS of $0.93.

What Do Analysts Think About McEwen’s Stock?

Last month, Roth Capital analyst Joe Reagor maintained a bullish “Buy” rating and raised the price target from $23 to $30, reflecting positive sentiment around the stock. In October, Canaccord Genuity analyst Jeremy Hoy initiated coverage of McEwen with a “Buy” rating and a price target of $25, indicating a positive outlook.

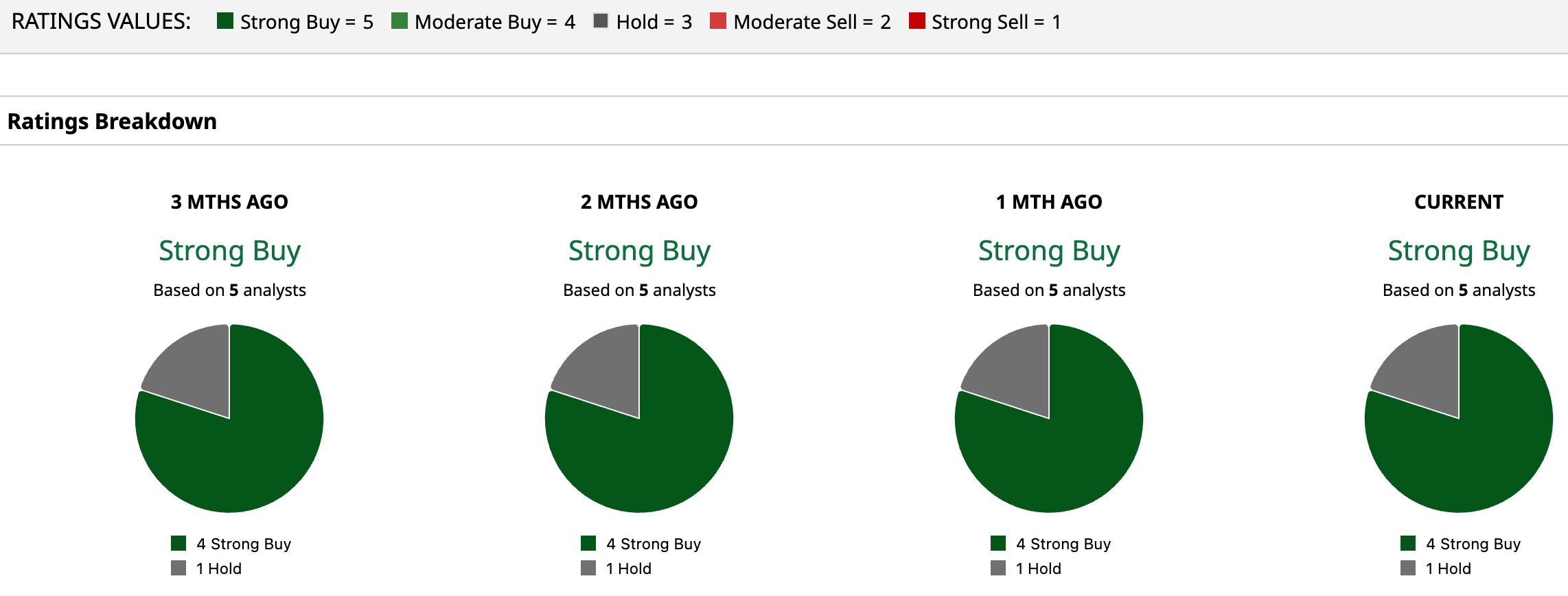

McEwen is gaining praise on Wall Street as a gold stock, with analysts awarding it a consensus “Strong Buy” rating overall. Of the five analysts rating the stock, a majority of four analysts have rated it a “Strong Buy,” while only one analyst is taking a middle-of-the-road approach with a “Hold” rating. The consensus price target of $26.89 represents 8.5% downside from current levels. However, the Street-high price target of $30.96 indicates almost 25% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)