/Hartford%20Financial%20Services%20Group%20Inc_%20magnified%20logo-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Valued at $39.6 billion by market cap, The Hartford Insurance Group, Inc. (HIG) is a Connecticut-based insurance and financial services holding company, with roots dating back to 1810. The firm operates through subsidiaries that provide a broad suite of property-and-casualty (P&C) insurance, employee benefits, and asset-management products to individuals and businesses, primarily in the United States.

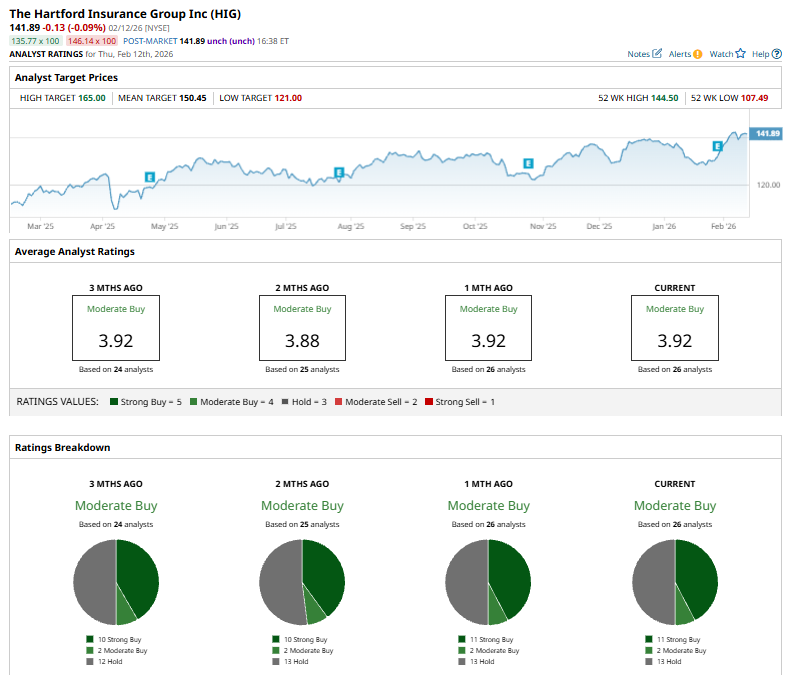

Shares of this insurance giant have outperformed the broader market over the past year. HIG has gained 27.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.9%. In 2026, HIG stock is up 3%, surpassing SPX’s marginal fall on a YTD basis.

Zooming in further, HIG has also surpassed the Invesco KBW Property & Casualty Insurance ETF (KBWP). The exchange-traded fund has gained about 8.5% over the past year and a 3.4% drop on a YTD basis.

On Jan. 29, HIG shares rose 1.3% after the company reported its Q4 2025 earnings, which showed robust profitability and underwriting performance. Its core earnings rose 38% year over year to $4.06 per share. Business Insurance loss ratios improved significantly due to lower catastrophe losses and favorable prior-year reserve development, while Personal Insurance saw notable underlying loss-ratio improvement from better auto and homeowners performance. Net investment income increased to $832 million on higher invested assets and stronger alternative-investment returns.

For the current fiscal year, ending in December, analysts expect HIG’s EPS to dip 1.4% to $13.23 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

Among the 26 analysts covering HIG stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, two “Moderate Buys,” and 13 “Holds.”

The configuration is bullish than two months ago when the stock had ten “Strong Buy” recommendations.

On Feb. 5, Keefe, Bruyette & Woods analyst Meyer Shields reiterated an “Outperform” rating on Hartford and modestly raised the price target to $163 from $160, reflecting continued confidence in the insurer’s outlook and upside potential.

The mean price target of $150.45 represents a 6% premium to HIG’s current price levels. The Street-high price target of $165 suggests an upside potential of 16.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)