/Old%20Dominion%20Freight%20Line%2C%20Inc_%20outside%20sign-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Thomasville, North Carolina-based Old Dominion Freight Line, Inc. (ODFL) is a major American transportation and logistics company specializing in less-than-truckload (LTL) freight services, which involve transporting smaller freight shipments from multiple customers on shared trucks. With a market cap of $40.7 billion, it operates an extensive network of 260+ service centers across the United States and, through alliances, provides regional, inter-regional and national LTL services throughout North America.

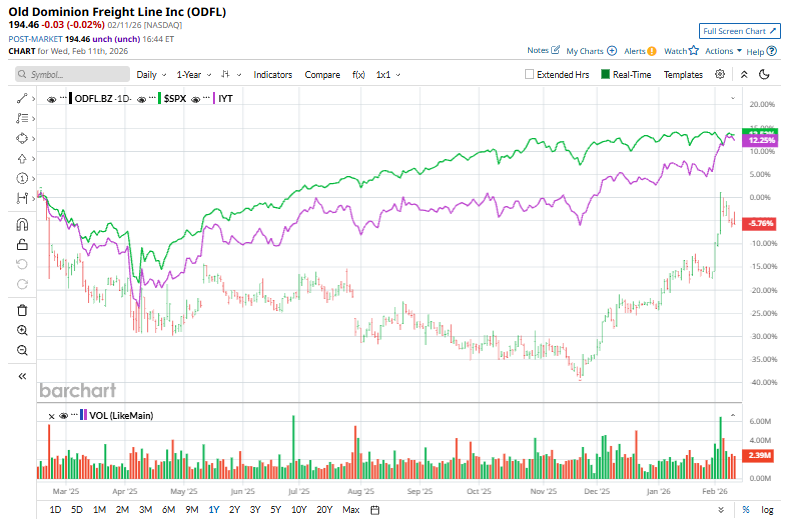

The company has significantly underperformed the broader market over the past year. ODFL stock prices have plunged 5.5% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% gains. But, the stock has gained momentum this year, rising 24%, surpassing the index’s 1.4% rally.

Narrowing the focus, ODFL has also underperformed the industry-focused iShares Transportation Average ETF’s (IYT) 13.4% uptick over the past 52 weeks but outpaced the ETF’s 9.3% rise on a YTD basis.

On Feb. 4, Old Dominion announced its FY2025 Q4 earnings, and its shares rose 9.9%. Revenue declined 5.7% year over year to $1.31 billion, though it modestly exceeded consensus estimates. Earnings per share came in at $1.09, topping the Street’s $1.06 forecast. The revenue decline was primarily driven by a 10.7% decrease in LTL tons per day, partially offset by improved pricing, as revenue per hundredweight increased.

For fiscal 2026, ending in December, analysts expect ODFL to deliver an adjusted EPS of $5.09, up 5.2% year over year. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

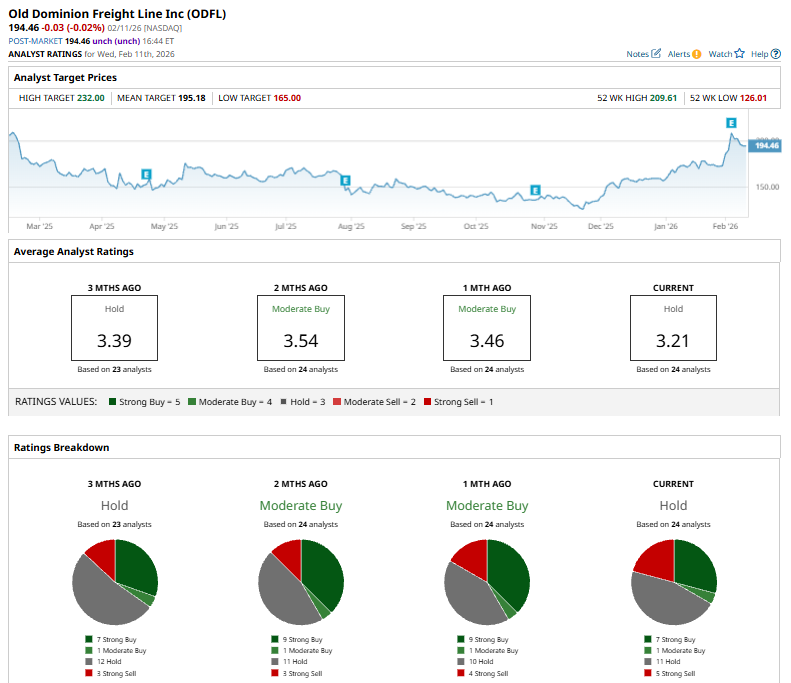

Among the 24 analysts covering the ODFL stock, the consensus rating is a “Hold.” That’s based on seven “Strong Buys,” one “Moderate Buy,” 11 “Holds,” and five “Strong Sells.”

This consensus is bearish than a month ago when the stock had an overall rating of “Moderate Buy.”

On Feb. 11, Susquehanna analyst Bascome Majors maintained a “Neutral” rating on Old Dominion Freight Line and raised the price target to $205 from $185, reflecting a 10.8% increase and signaling measured optimism about the stock’s outlook.

ODFL’s mean price target of $195.18 represents a marginal premium to current price levels. Meanwhile, the street-high target of $232 suggests a notable 19.3% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)