/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Global e-commerce and cloud computing powerhouse Amazon.com (AMZN) is facing renewed scrutiny from Wall Street amid intensifying competition and heavy capital spending. After reporting mixed results that included strong revenue growth paired with an ambitious $200 billion capital expenditure plan for 2026, investor confidence has wavered as the company pivots aggressively into artificial intelligence (AI) and cloud infrastructure.

In a notable shift, DA Davidson’s Gil Luria downgraded Amazon’s stock from “Buy” to “Neutral” and cut price target to $175, arguing that Amazon is “losing the lead” in cloud computing and is “scrambling to catch up through escalating investment,” particularly against rivals like Alphabet (GOOG) (GOOGL) and Microsoft (MSFT).

About Amazon Stock

Headquartered in Seattle, Washington, Amazon.com operates across a dazzling range of businesses, cloud services via AWS, digital streaming, subscription services, advertising, physical retail, and consumer electronics. Its diversified growth model has placed it among the world’s most valuable public companies, with a market cap of $2.2 trillion, and it has a secure position in the Magnificent Seven.

However, AMZN has underperformed broader benchmarks, with total returns in negative territory. Amazon’s shares have declined by roughly 10.2% over the past 52 weeks, contrasting sharply with 14.43% gains in the S&P 500 Index ($SPX). This underperformance reflects a shift in investor sentiment as markets have increasingly penalized heavy capital deployment and margin pressures despite continued revenue growth.

The year-to-date (YTD) picture in 2026 has followed a similar trend, with Amazon’s stock again recording a notable decline, down 9.47%. This negative movement has been driven in large part by a significant market sell-off linked to the company’s 2026 capital expenditure guidance, which far exceeded expectations. Investors reacted strongly when Amazon announced plans to spend around $200 billion on AI, cloud, robotics, and data-center infrastructure, a figure that eclipsed consensus forecasts and raised concerns about near-term free-cash‐flow erosion and profitability headwinds.

The underperformance can also be attributed to heightened investor concerns over its competitive position in the AI race and a perceived slowdown in the growth rate of its highly focused AWS division relative to rivals.

AMZN currently trades at a premium compared to the sector median, but below its own historical average at 28.17 times forward earnings.

Q4 Earnings Missed Expectations

Amazon reported its fourth-quarter and full-year 2025 results on Feb. 5. In Q4 2025, net sales climbed to $213.4 billion, representing a 14% year-over-year (YOY) increase. AWS segment generated $35.6 billion in revenue, up 24% YOY, marking its fastest growth rate in over a year and underscoring continued strength in cloud demand, particularly around AI and enterprise workloads.

Advertising revenue also contributed to upside, rising about 22% YOY to $21.3 billion. Its earnings per share came in at $1.95, compared to the prior-year quarter value of $1.86, but slightly missed Street forecasts, and the stock saw a sharp sell-off as investors digested the company’s outlook and spending plans. The stock slumped 4.4% on Feb. 5 and 5.6% on Feb. 6.

For the full year 2025, Amazon delivered double-digit net sales growth of around 12%, with total net sales reaching $716.9 billion. However, free cash flow contracted sharply, falling to roughly $11.2 billion, down significantly from prior periods, largely due to aggressive capital expenditures and strategic investments.

Management’s guidance for 2026 signaled both continuity and escalation of these trends. Amazon forecast capital expenditures of roughly $200 billion for the year a substantial increase over prior estimates, aimed at expanding AI data centers, custom silicon production, robotics, and emerging businesses such as low-Earth-orbit satellite infrastructure.

While this aggressive spending underpins the company’s long-term strategic thrust into AI and cloud leadership, it contributed to downward pressure on near-term profitability and cash-flow metrics, which analysts and the market viewed with caution.

For the first quarter of 2026, Amazon projected revenue in the range of approximately $173.5 billion to $178.5 billion, implying YOY growth between 11% and 15%.

Analysts remain upbeat, projecting EPS of $7.72 for fiscal 2026, up 7.67% YOY, and anticipating a further 20.1% annual increase to $9.27 in fiscal 2027.

What Do Analysts Expect for Amazon Stock?

Recently, DA Davidson downgraded Amazon to “Neutral” from “Buy” and cut its price target to $175, warning that the company is losing its leadership in cloud computing and facing a growing strategic disadvantage in an AI-driven retail world.

Analyst Gil Luria said AWS is lagging rivals, with Google Cloud growing 48% and Microsoft Azure 39%, compared with AWS’s 24% growth, and noted Amazon lacks both a frontier AI lab and a key OpenAI-style partnership.

The firm cautioned that falling behind is forcing Amazon into heavier spending, highlighting over $200 billion in capital expenditures to stay competitive. Luria also raised concerns about Amazon Retail’s readiness for a chat-driven internet, warning that limited AI integrations could leave a structural disadvantage.

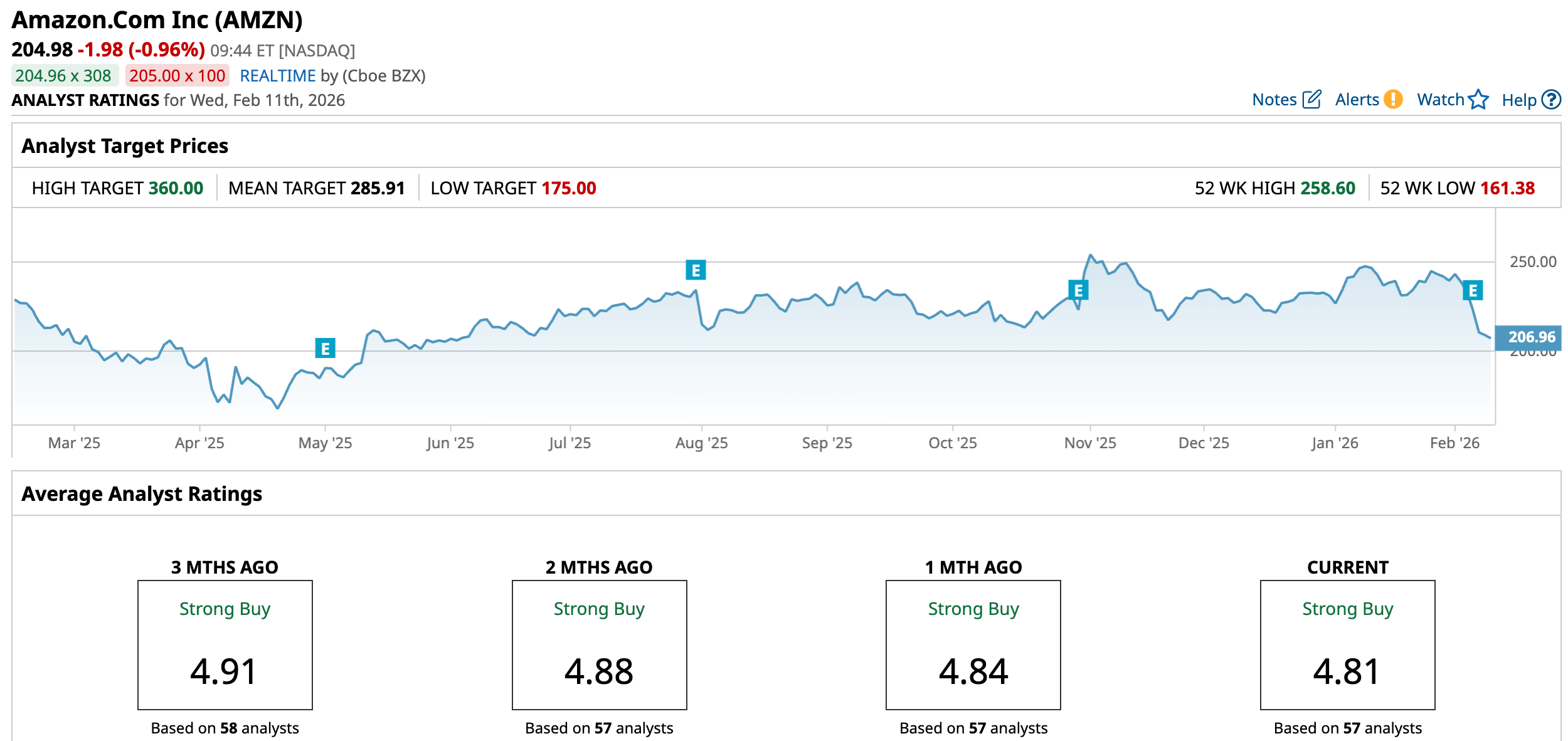

Nevertheless, overall, AMZN has a consensus “Strong Buy” rating. Of the 57 analysts covering the stock, 49 advise a “Strong Buy,” five suggest a “Moderate Buy,” and three analysts recommend a “Hold” rating.

The average analyst price target for AMZN is $285.91, indicating a potential upside of 39.5%. The Street-high target price of $360 suggests that the stock could rally as much as 75.6%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)