Few leadership changes move markets instantly, but The Kroger Company’s (KR) latest decision did exactly that. On Feb. 9, its stock went up 3.9% as the company announced the appointment of former Walmart (WMT) executive Greg Foran as chief executive, ending a year-long search after Rodney McMullen’s ouster last March.

Foran brings a proven turnaround pedigree. He served as CEO of Air New Zealand Limited (ANZLY) for nearly five years until October 2025 and previously led Walmart’s U.S. operations from 2014 to 2019. There, he rebuilt store performance and delivered 20 consecutive quarters of comparable sales growth.

Currently, Kroger is navigating pressured consumer spending and intensifying competition, including from Walmart itself. In that context, Foran’s operational rigor and credibility could restore momentum and sharpen the company's execution.

Now, with a battle-tested retailer at the helm, let us see whether Kroger can pair steadier execution with its long-standing dividend track record, and whether those income-backed shares truly earn a place in investors’ carts.

About Kroger Stock

Kroger is a Cincinnati, Ohio-based food and drug retailer managing more than 2,700 supermarkets, 2,200 pharmacies, and 1,700 fuel centers across 35 states and Washington, D.C. With a nearly $44.4 billion market cap, it blends physical retail with digital platforms, manufacturing select foods while enabling omnichannel pickup and delivery.

KR stock has gained 4.2% over the past 52 weeks and jumped 5.56% during the last three months. Leadership developments further energized sentiment, driving an 6% jump in just the past five trading sessions.

From a valuation standpoint, KR stock is trading at 14.61 times forward adjusted earnings and 0.30 times sales. Both metrics sit below industry averages, signaling a discounted profile.

Kroger’s dividend record reinforces its defensive appeal. The company has raised its dividends for 19 consecutive years and pays $1.40 per share annually, translating into a 2% yield. Its latest $0.35 per share dividend is scheduled for March 1, payable to shareholders of record on Feb. 13.

A Closer Look at Kroger’s Q3 Earnings

Kroger reported Q3 fiscal 2025 revenue of $33.86 billion on Dec. 4, missing Street expectations of $34.29 billion. Despite the shortfall, revenue marginally grew year-over-year (YOY), supported by steady grocery execution and continued momentum across eCommerce and pharmacy.

Core demand trends remained encouraging. Identical sales, excluding fuel, rose 2.6% from the prior year and strengthened to 4.9% on a two-year stack. Pharmacy and eCommerce drove growth, with eCommerce sales climbing 17%, led by delivery. Adjusted EPS reached $1.05, beating Street’s expectations of $1.04 and up 7.1% from the prior year’s quarter.

Management is now prioritizing profitability over scale in digital operations. Kroger closed three fulfillment centers and expanded store-based delivery, a strategy expected to generate approximately $400 million in incremental eCommerce operating profit in 2026. At the same time, the company is accelerating physical expansion, planning to break ground on 14 new stores in the fourth quarter.

Reflecting year-to-date (YTD) performance and improved visibility, Kroger’s management has tightened its full-year outlook. They have narrowed the company’s identical sales, excluding fuel, growth range to 2.8%–3% and raised the lower end of adjusted EPS guidance to $4.75–$4.80.

On the other hand, analysts project Q4 fiscal 2025 EPS growth of 5.3% YOY to $1.20. For the full fiscal year 2025, EPS is expected to rise 7.2% to $4.79, followed by another 10.2% increase from the previous year to $5.28 in fiscal year 2026.

What Do Analysts Expect for Kroger Stock?

Telsey Advisory Group, led by analyst Joseph Feldman, has reiterated an “Outperform” rating on KR stock and maintained an $80 price target, signaling steady conviction in Kroger’s fundamentals.

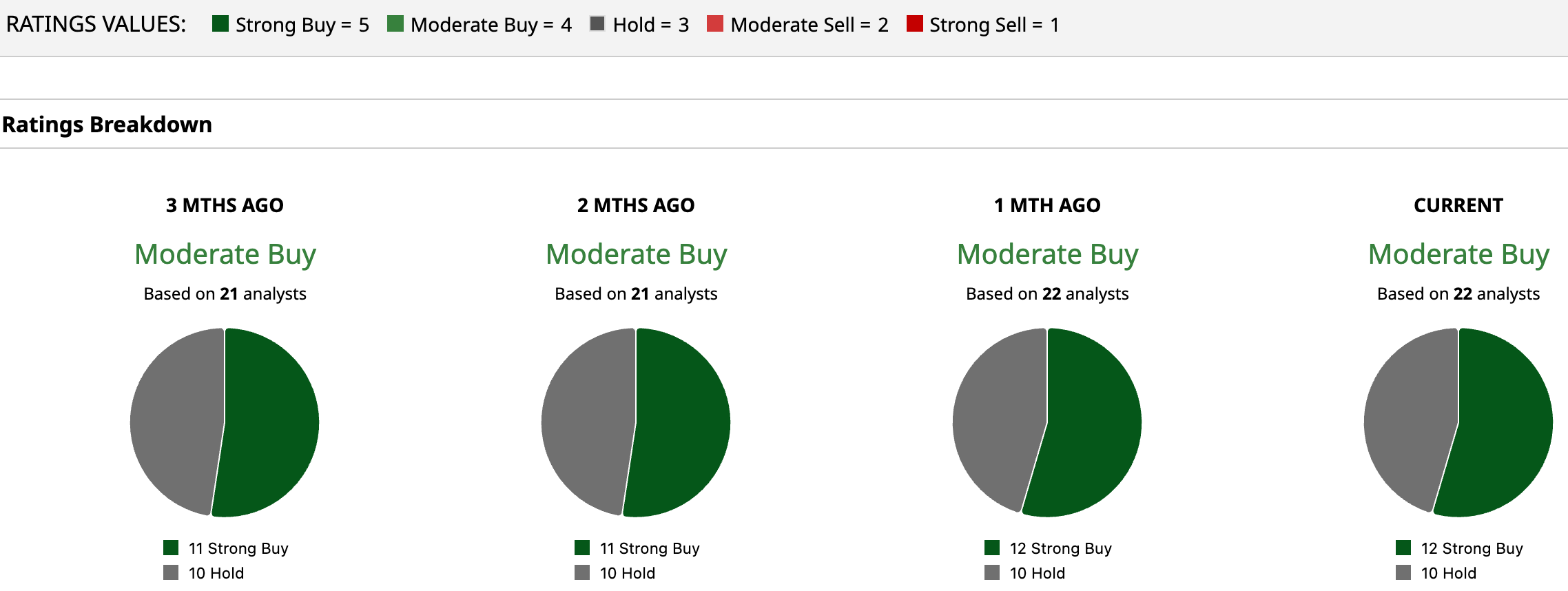

The optimism extends across Wall Street, with KR stock holding a “Moderate Buy” consensus rating. Among the 22 analysts covering the stock, 12 have issued a “Strong Buy” rating, while 10 recommend a “Hold.”

From a price performance perspective, analysts continue to see clear upside potential in Kroger’s shares. The average price target of $74.81 signals a 10% appreciation. Meanwhile, the Street-high target of $85 points to a gain of 25% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.