- Reportedly, Ford Motors electric vehicles business continued to underperform during 2022.

- This isn't a huge surprise to those tracking one of Ford's largest sales demographics: Pickup trucks across rural US.

- A lack of infrastructure and growing demand for home-grown renewable fuels will continue to dampen prospects for EV growth outside of major US cities.

A CNBC story popped up in my inbox early Thursday morning, talking about how the Ford Motor’s (F) electric vehicle (EV) business lost $2.1 billion last year, though as the story states immediately after, this loss was “more than offset by $10 billion in operating profit between its internal combustion and fleet businesses”. This makes sense if we stop and consider one of Ford’s key sales demographics – US farm pickups.

For decades, Ford’s F series of pickups has ruled the rural market with the dominant model being the F-150. If you’ve been to a farm show across the US Plains or Midwest the past 50 years, you have likely parked in what looked to be an F-150 show lot. Every year, color, model, etc. could be seen, not to mention the local Ford dealership holding the prime real estate just inside the show’s main gate. I always thought it would be humorous to pay someone to make the announcement over the show speakers, “For the owner of the Ford F-150, your vehicle is being towed away”, then watch as nearly all the attendees make a run for the exit.

The fact Ford’s EV unit is struggling, particularly in pickups, is not surprising. As the recently concluded World Baseball Classic showed once again (Japan beat the US in the championship game, 3-2), the US doesn’t do much of what it is known for all that well anymore, but it can still grow corn. Another side note here: According to the March WASDE report, the US supposedly produced the largest crop in the world during 2022 but will fall to second place for the first time in exports. Brazil is projected to surpass the US by a count of 50.0 mmt to 47.0 mmt. If so, that could keep the US corn market (ZCPAUS.CM) on the bearish path laid out during the 2010–2014-time frame.

Before I get too far off track, though, let’s bring this discussion back around to Ford’s EV dreams. I visit with a number of folks across the US Plains and Midwest, and the idea of electric vehicles remains more a joke than a reality. To begin with, there is no infrastructure to bring charging stations to all the small towns where farm pickups dominate the market. Generally, these stations are found spaced out along the interstate highways that cut through rural US, much like the Pony Express stations of yesteryear. Secondly, there is a general consensus that EVs are inefficient for heavy duty use, both because of a lack of power and short battery life when the task gets more difficult than simply driving around a city trying to look like a cowboy (the phrase all hat, no cattle comes to mind).

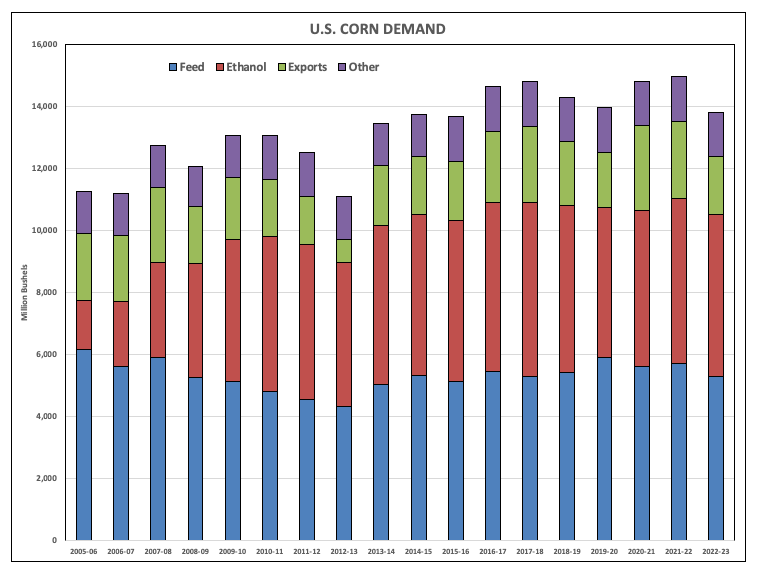

Renewable fuels also play a major role in the slow turn toward EVs across rural America, and rightfully so. For much of 2022 we heard of a number of soybean crushing plants beginning construction as demand for bean oil is expected to explode with the next wave of renewable diesel. Given this, if I were the head of Ford Motors, or any major automobile maker, I would be targeting that growing market sector. Additionally, USDA’s latest monthly supply and demand guesses pegged ethanol demand for US corn at 5.25 billion bushels. If realized this would be the fifth largest marketing year for ethanol demand on record. If I add my guess to the mix, I think ethanol demand for US corn will be stronger than 5.25 bb, if merchandisers can find the corn. Looking ahead to the 2023-2024 marketing year, the US is expected to increase its planted corn acres while weather is supposed to cooperate for the first time in about 4 years. The bottom line is the US should have more corn available for ethanol down the road.

Someday EVs, including those from Ford, will dominate the marketplace. It’s evolution. But not this year, or maybe this decade. Again, the US infrastructure is barely able to function as it is, let alone finding the time and money to reconfigure for a surge in demand for electricity. For now, the F-150 and other pickups like it will continue to be powered by diesel and gasoline engines, incorporating some homegrown fuel along the way.

More Grain News from Barchart

- Wheats Bouncing for Thursday

- Beans Backing Off Overnight Highs

- Corn At or Near Overnight Highs

- Sharp Drop from CBT Wheat

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)