Biotech stocks are not for the faint of heart, as companies in the clinical stage push risk to the extreme. With key clinical data still to come, huge financial burn, and valuation almost entirely dependent on trial outcomes, these companies only offer massive upside if everything goes as planned. Here are two of the riskiest biotech stocks investors are betting on.

Biotech Stock #1: Opus Genetics

Opus Genetics (IRD) has emerged as one of the boldest and riskiest bets investors are making right now. Valued at $1.4 billion, Opus Genetics is a clinical-stage biopharmaceutical company focused on developing gene therapies to restore vision and prevent blindness in people with inherited retinal diseases (IRDs).

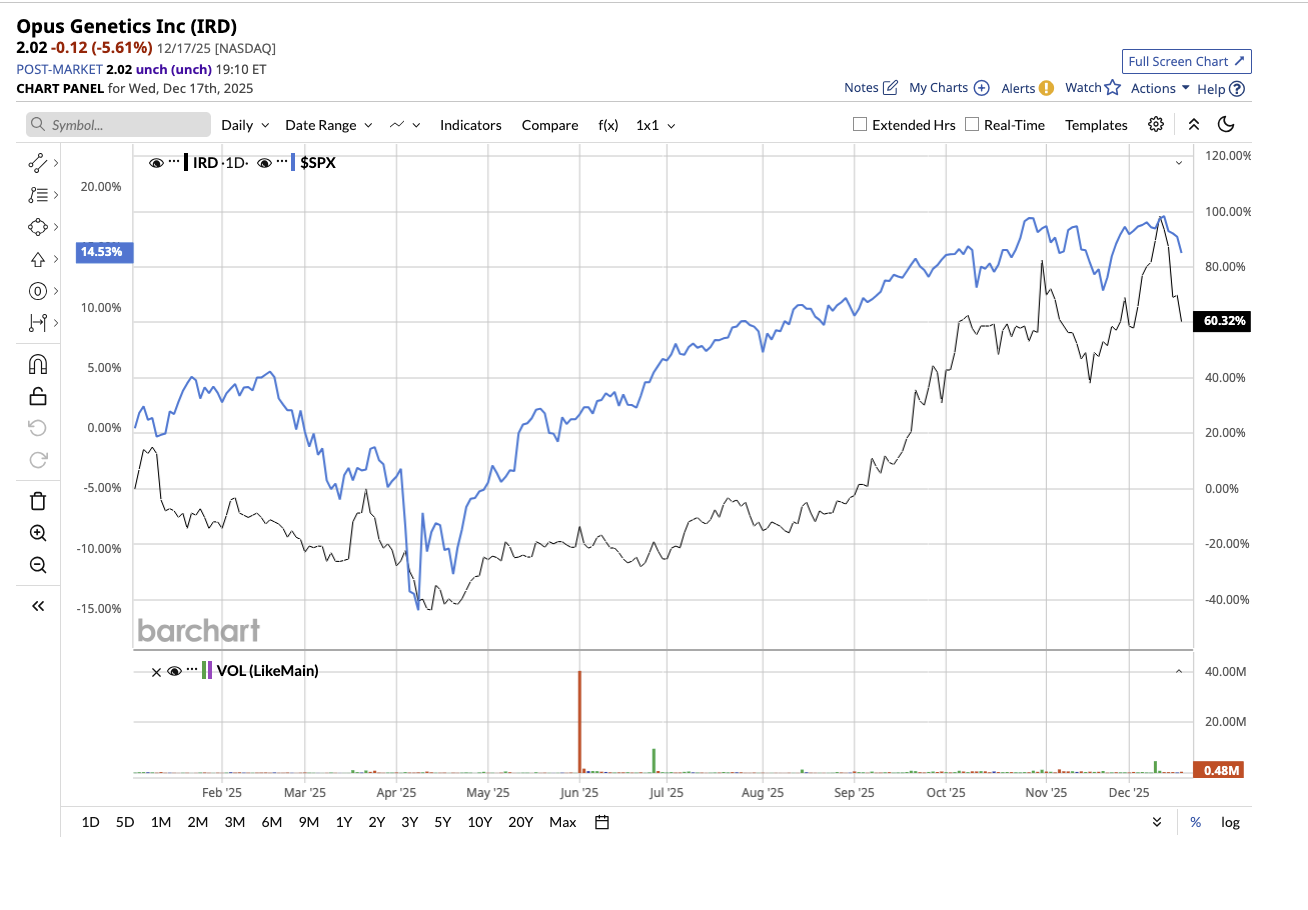

Opus stock has surged 60.3% year-to-date, outperforming the broader market, and Wall Street expects the stock has much more room to run. While the potential upside is significant, it hinges on clinical success, regulatory outcomes, and ongoing funding.

The company is developing one-time, long-lasting medicines that address the underlying genetic causes of serious eye disorders rather than simply treating symptoms. Its risk profile is driven by its pipeline, which includes OPGx-LCA5, a gene therapy that targets Leber Congenital Amaurosis (LCA5). The company revealed excellent early clinical data from a Phase 1/2 trial, which showed significant increases in cone-mediated vision in pediatric participants over three months and durability of response in adult participants out to 18 months. While these findings are intriguing, they are based on a limited number of individuals, emphasizing the ongoing uncertainty about long-term efficacy and broader application.

Additionally, Opus Genetics recently completed a successful FDA Regenerative Medicine Advanced Therapy (RMAT) meeting for OPGx-LCA5, opening the door to a potentially accelerated regulatory pathway. While this is a positive development, it also raises expectations. Opus Genetics reported a net loss of $17.5 million in the third quarter. The company ended the quarter with $30.8 million in cash and subsequently raised about $23 million through an equity offering, bringing total liquidity to over $50 million. Management intends to use this cash to fund operations into the second half of 2027. This signifies that investors believe the company will reach important clinical milestones before another funding round is required. Any delays may increase dilution risk or force strategic changes.

Opus Genetics is a classic high-risk, high-reward stock. The company is advancing potentially transformative gene therapies, supported by early positive data and regulatory engagement. At the same time, its future depends heavily on the success of its trials, regulatory execution, and continued access to capital.

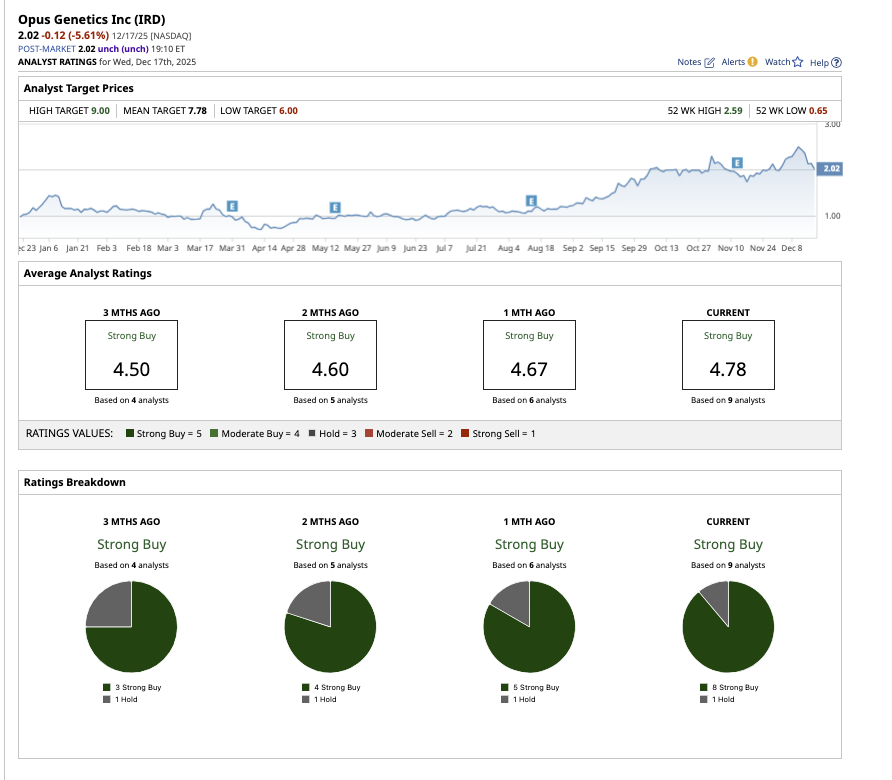

Overall, Wall Street rates Opus stock a “Strong Buy.” Out of the nine analysts covering the stock, eight have a “Strong Buy” recommendation and one rate it a “Hold.” The average analyst target price of $7.78 for Opus implies a 285% increase over current levels. Furthermore, analysts have set a high price target of $9, implying that the stock could rise as much as 345% over the next year.

Biotech Stock #2: EyePoint

Valued at $1.4 billion, EyePoint Pharmaceuticals (EYPT) is a clinical-stage biopharmaceutical company focused on developing long-lasting treatments for serious retinal diseases.

EyePoint stands out as another risky stock on which investors are banking heavily, resulting in a 107.5% year-to-date gain. Nearly all expectations are riding on the success of its lead program, DURAVYU

DURAVYU is an experimental sustained-release therapy for wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME). The medicine is currently in Phase 3 development, putting the company at a crucial point where clinical execution and upcoming trial data will heavily influence its worth. The Phase 3 LUGANO and LUCIA trials for wet AMD have reached full enrollment, with top-line data from LUGANO due in mid-2026 and LUCIA data to follow. EyePoint has also launched a pivotal Phase 3 program in DME, which includes two similar non-inferiority trials, COMO and CAPRI.

EyePoint reported a net loss of $59.7 million in the third quarter, driven primarily by rising Phase 3 clinical trial costs. The company closed an oversubscribed $172.5 million stock offering, extending its liquidity runway into Q4 2027. While this boosts the balance sheet in the short term, the positive late-stage data is critical in determining if additional capital is required. The company has a single lead asset in late-stage development, ambitious plans across two major retinal indications, and a long wait for pivotal data. This makes Eyepoint a high-risk, high-reward investment.

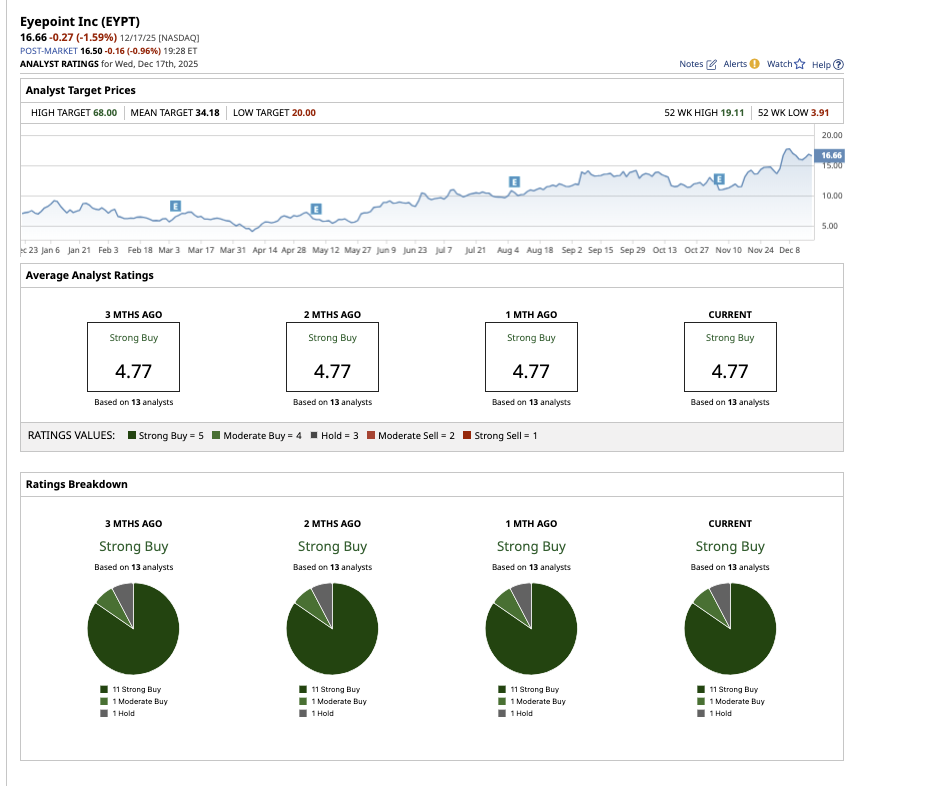

Overall, Wall Street rate Eyepoint stock a “Strong Buy.” Out of the 13 analysts covering the stock, 11 have a “Strong Buy” recommendation, one says it is a “Moderate Buy,” and one rates it a “Hold.” The average analyst target price of $34.18 for Eyepoint implies a 105.1% increase over current levels. Furthermore, analysts have set a high price target of $68, implying that the stock could rise as much as 308% over the next year.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)