Coffee futures broke hard Tuesday, with selling tied to both sides of the market - commercial and noncommercial.

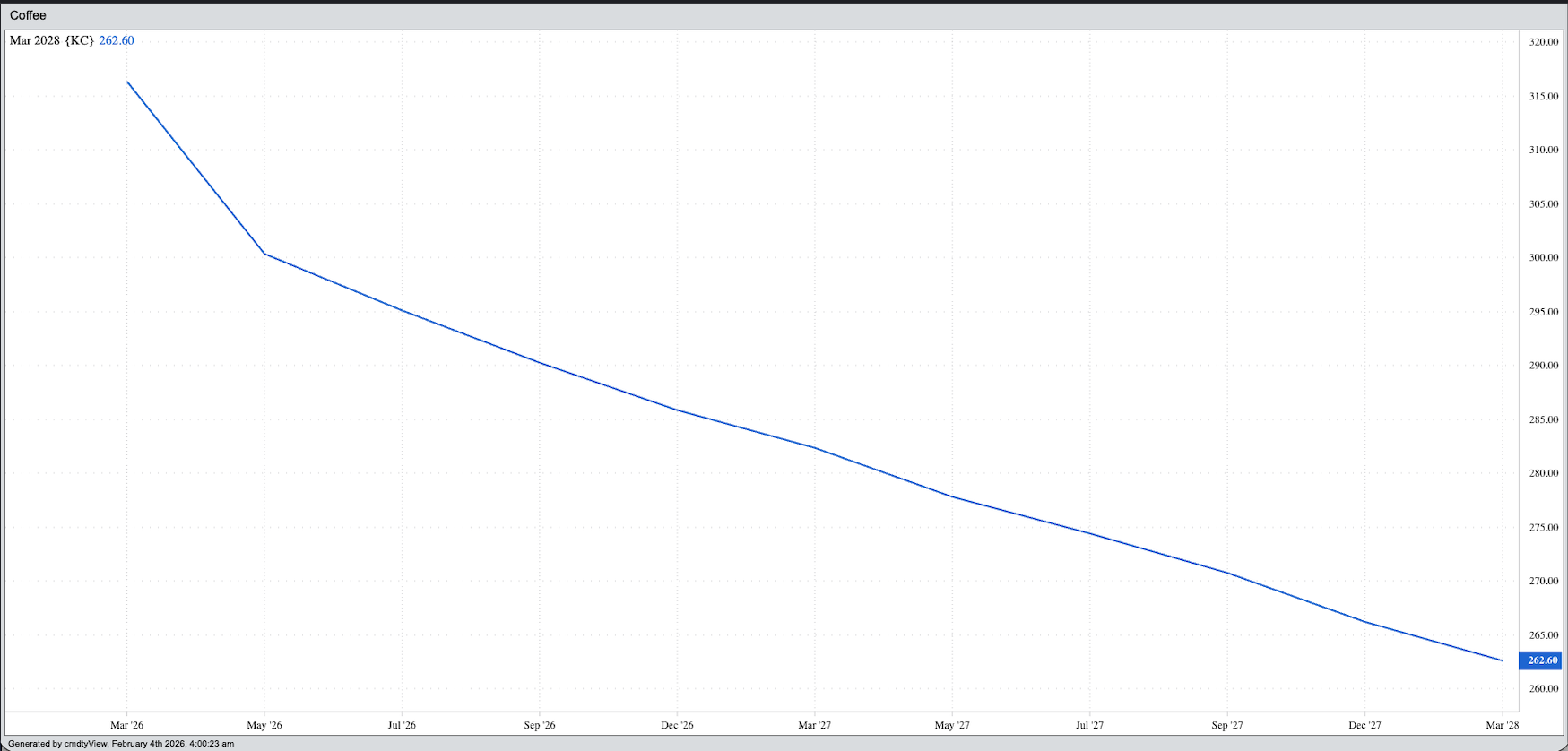

Despite the break in futures spreads, the market's forward curve remains in backwardation (inverted) telling us longer-term supply and demand remains bullish.

Investors could view the selloff as a buying opportunity despite a turn to more favorable weather in Brazil.

Tuesday afternoon, a friend from central Nebraska called with a market question, but rather than corn, soybeans, cattle, and so on, he asked about coffee. Tuesday's close saw the market sharply in the red (per pound):

- March (KCH26) was down 16.15 cents (4.9%)

- May (KCK26) was down 14.15 cents (4.5%)

- July (KCN26) was down 12.85 cents (4.2%)

- We can see commercial interests were selling alongside noncommercial traders, as indicated by nearby contracts listing ground to deferred issues

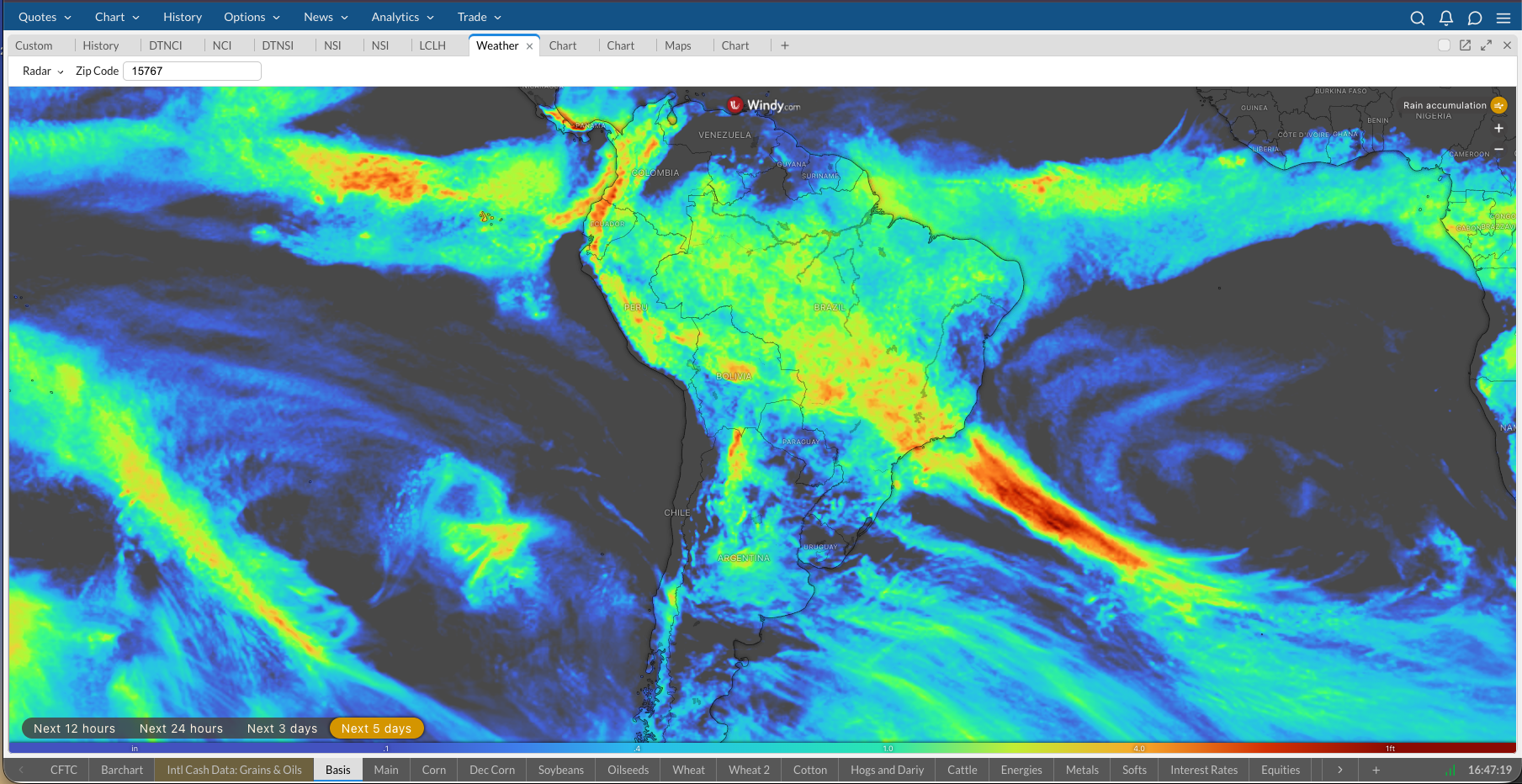

Keeping in mind coffee is a weather derivative, my Blink reaction was a change in weather patterns drove the market lower.

- Brazil is world's largest producer and exporter of coffee

- A look at the weather forecast for Brazil called for continued rains across much of the country

- Increasing Brazil's production potential

Despite Tuesday's sharp selloff in futures and commercial selling in futures spreads, the market's forward curve continues to show a strong inverse, backwardation in New York terms.

- This tells us coffee's supply and demand remains bullish, long-term

- With global demand for coffee still strong (particularly in my office)

- Given this, Watson could view the selloff as a buying opportunity

The latest Commitments of Traders report showed noncommercial traders held a net-long futures position of 32,734 contracts, an increase of 2,971 contracts as of Tuesday, January 27.

- This included an increase in long futures of 1,109 contracts

- And a decrease in short futures by 1,862 contracts

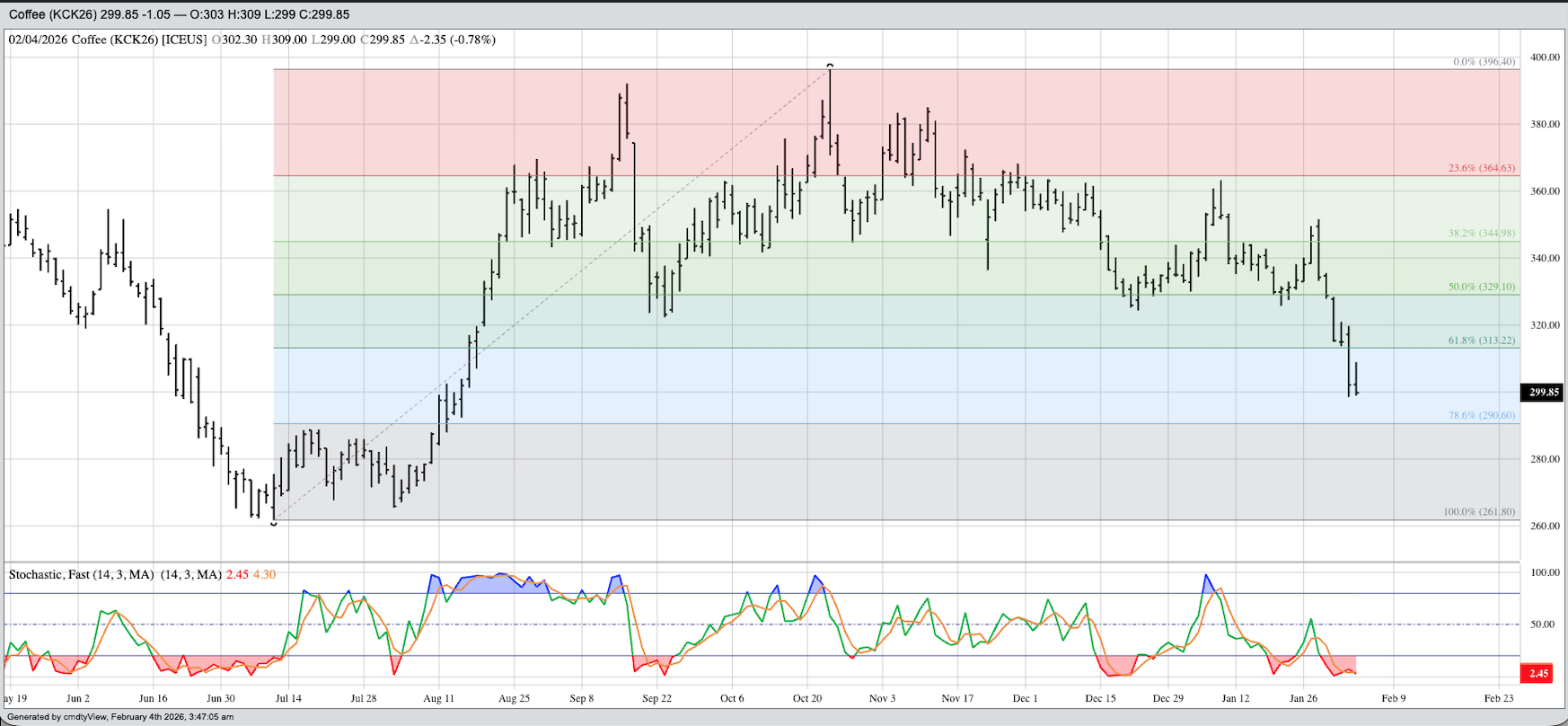

Overnight through early Wednesday morning finds the May issue holding Tuesday's low of 299.00 (cents per pound).

- Additionally, daily stochastics did complete a bullish crossover below the oversold level of 20% at Tuesday's close, indicating the minor (short-term) trend should turn up soon.

- From a technical point of view, I have no idea what type of reversal pattern to look for

- As for a possible price target, there is an old pocket of trade with a high just below 290.00 from last July that could act as support.

- Therefore, risk could be viewed as about 15.0 cents with the reward close to 30.0 cents, for a ratio of 1:2. This could also be viewed as attractive to Watson over the coming days.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)