Western Alliance Bancorporation (WAL) is up 43% today to $37.41 with a new filing that Citadel Advisors and related companies purchased 5.4% of the stock in the market. The stock had been trading below its tangible book value per share (TBVPS). As of Dec. 31, 2022, that was at $40.25, according to page 31 of its latest 10-K filing.

This means that this company run by a well-known value investor (Kenneth Griffen) has likely bought the stock at well below its TBVPS. (Tangible book value per share deducts all the bank's intangible assets and just includes liquidatable assets.) Since yesterday WAL stock down significantly. As I wrote yesterday, the company issued a press release saying that it had raised $25 billion to cover any deposit withdrawals.

Bargain Purchase With Margin of Safety

At the time WAL stock was down 54% to $26.59 during the early part of the day after the release came out. By the end of the day, the stock was down to $26.12 per share. That means that if Citadel was able to buy the WAL stock at say $26.50 on average they bought the stock at 65.8% of its TBVPS, or ⅓rd below its liquidation value.

However, it's also likely that the value of some of its assets has also deteriorated. So, even taking a 20% haircut, assuming TBVPS has temporarily, at least, fallen to $32.20, the investor still has bought the stock at 82.2% of its adjusted TBVPS, i.e., 18% below its adjusted tangible book value per share.

This is what value investing is all about since the purchase was done with a sufficient margin of safety. In addition, the investor now stands to make a huge dividend yield. For example, the bank has been paying 36 cents per share quarterly, or $1.44 per share annually. That gives Citadel a potential yield of 5.43%.

In fact, even at today's price of $37.41, WAL stock still has a yield of 3.85% (i.e., $1.44/$37.41). Moreover, this is likely to be close to or slightly over the bank's adjusted lower TBVPS, which we will find out at the end of the Q1 period and its results are announced.

Most of the bank's assets, $65 billion in total, were in loans, $52 billion, as of Dec. 31. The bank had total deposits of $53.6 billion as of year-end, but, as pointed out above, the bank has already raised $25 billion to cover any potential run on the bank.

Speculative Investors May Short Out-of-the-Money Puts

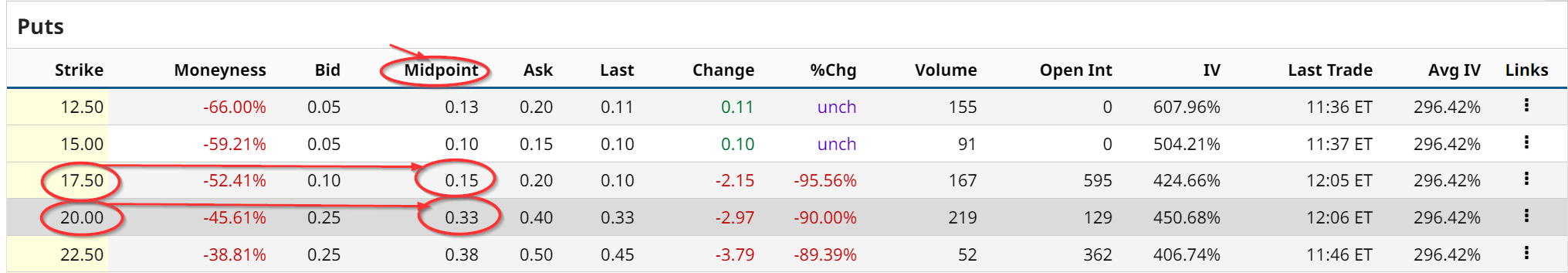

Those investors with a speculative bent may be looking at shorting deep out-of-the-money (OTM) puts, with an eye to creating extra income or a good entry point. For example, the March 17 $22.50 puts trade for 33 cents in the midpoint and the $20 puts are at 15 cents. That means the investor could short the $22.50 puts and immediately buy long the $20.00 puts and collect a net 18 cents per put option contract. Granted there is still a risk the stock could fall over 50% between $22.50 and $20.00, but this is significantly below today's price. That spread risk would have to happen in the next three and a half days.

Moreover, the investor could also sell OTM calls to cover some of this spread risk. For example, the $40 calls trade for $2.95. That more than covers the $2.50 spread risk. So, the total received would be $3.28 (i.e., $2.95 shorted call, plus $0.33 short put at $22.50), but the purchased put was $0.15, so the net received is $3.13. That still gives a $0.63 profit given the $2.50 put spread risk between $22.50 and $20.00.

Keep in mind this requires capital to be put up on the short put side and likely capital to be put up on the covered call side unless the investor has the margin authority to short naked calls. And in addition, this is a very risky trade especially if the bank goes under. At that point, it's not clear whether the trades will be honored or allowed to expire in the profit. Moreover, the stock could rise over $40.00 which will call away the underlying covered shares, and if not covered, will require the investor to purchase the shares to deliver, which could be an unlimited risk situation. So buyer beware here.

More Stock Market News from Barchart

- The 3 Financial Stocks I’m Buying Now

- Investors Flock to Apple and Microsoft During Bank Stock Rout

- Stocks Jump as Bank Stocks Rebound and U.S. Consumer Prices Ease

- Markets Today: Stock Indexes Climb as Bank Stocks Rebound

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)