Back in the 18th-century, Baron Rothschild was famously quoted as saying: “The time to buy is when there's blood in the streets, even if the blood is your own.” The good news for me, none of my blood is in the street from the current financial fiasco, and I’m looking at some very tempting buying opportunities.

For the first time since 2008, we had a significant bank run which resulted in the closure of Silicon Valley Bank (SIVB) and Signature Bank (SBNY) last week. The previous 2 were Washington Mutual and Wachovia which were closed on back-to-back days in September 2008. Over the weekend panic was setting in with many financial experts forecasting a massive bank run on Monday which could bring the financial system to its knees. Sunday evening however, US regulators said that customer deposits would be made whole, including those which were above the typical $250,000 FDIC threshold. It is estimated that 90% of Silicon Valley Bank deposits were above $250k, which would have been a big hit to startups and tech companies in the Silicon Valley. So, if regulators are guaranteeing that the money is there, why the panic? The truth is that there is still the potential for banks to struggle going forward, and more scrutiny will be put on financial institutions about their holdings and investments. That said, some of the financial firms are down 70% or more in just the past few days. Surely there were some banks that were not focused on tech startups or cryptocurrency companies that got caught up in the hysteria!

I spent the weekend running through Barchart.com scans, and brought up all the components of the S&P 500 Financials Sector (XLF). My goal was to focus on the largest retail financial firms that were not major players in VC, tech startups & crypto. I also want to stay with stocks that are covered by what remains of Dodd-Frank, which would be companies with over $250 billion in assets. Anything under this lacks stringent oversight by regulators and may engage in more speculative activities. I’m bullish on the banking sector as typically they make more money in a rising rate environment by taking advantage of higher lending rates. Out of the 67 components in XLF, the largest holding was Berkshire Hathaway (BRK.B) at roughly 15% of the entire ETF. While it’s safe to say that Warren Buffet and Charlie Munger are not tech Venture Capitalists, the 5% recent slide did not look like blood in the streets to me.

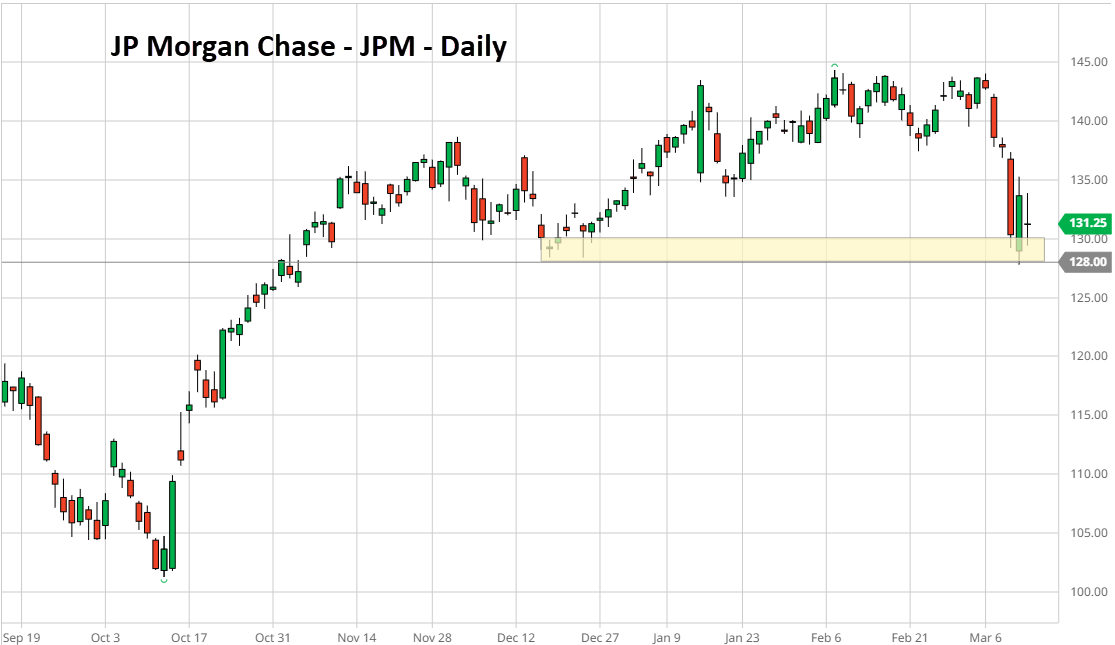

The second largest holding in XLF is JP Morgan Chase & Company (JPM). JP Morgan is one of the oldest and largest financial firms on wall street, with a steady track record of positive revenue and earnings. While it was only down 11% off of its most recent high, it fell right into the lower end of a demand zone that goes back to December 2022. I sold the 132 puts expiring March 17th and collected $1.5 in premium earning 1.1% ROR for 7 days. If it gets below 132, I’m happy to be long the stock.

Next on the list was Bank of America (BAC), with nearly 6% of the index weight. In the past 23 trading sessions, BAC has fallen nearly 25% from its February 7th high. Again, this is a major retail bank who got caught up in the chaos. From the information I’ve gathered, their risk exposure is far less do to its broad range of financial products and offerings. There are multiple areas I’d be happy being a buyer of Bank of America. On this trade, I sold the $28 puts expiring on March 7th, collected $.50 worth of premium earning a 1.8% ROR for 7 days

While the first 2 were clearly the bellwethers in the index, I wanted a third position which was in real pain, that didn’t deserve to be there. For me, that is Charles Schwab (SCHW), the largest US brokerage. The past 10 days have crushed the share price, which is down nearly 45% in the last 10 trading sessions. Unlike SIVB who only had 10% of accounts covered by the FDIC limits, Schwab has 80% protected by the FDIC. The biggest risk element for me is what Schwab calls its “conservative investment portfolio” which is comprised of 80% U.S. Treasuries. This may be an issue if there is a run on Schwab accounts, similar to what happened with Silicon Valley Bank and their Treasury portfolio. All in all, its was worth the risk to me and I sold the $50 puts expiring on March 7th, and collected $3.49 worth of premium, which equals equal a ROR of 6.98% for 5 days.

At the end of the day, there is blood in the street, and this may present some great trading or investment opportunities. The above trades entail elevated risk due to the extreme volatility of current markets. For this reason they represent a small amount of my total portfolio allocation. There may be much more pain in the financial sector going forward. Everyone must determine what their individual risk tolerance is and plan accordingly.

More Stock Market News from Barchart

- Investors Flock to Apple and Microsoft During Bank Stock Rout

- Stocks Jump as Bank Stocks Rebound and U.S. Consumer Prices Ease

- Markets Today: Stock Indexes Climb as Bank Stocks Rebound

- Adobe Earnings: Iron Condor Could See 37% Return On Risk

On the date of publication, Merlin Rothfeld had a position in: BAC, JPM, SCHW. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.