The euro began trading on December 31, 1998, at $1.1686 against the U.S. dollar. The exchange rate was as low as $0.8230 in October 2020 and as high as $1.6038 in July 2008. At the $1.06 level on March 3, the euro was below the midpoint of the current century.

In 2022, the euro fell below parity against the U.S. dollar for the first time since 2002. The war in Ukraine, on Europe’s doorstep, and an aggressive U.S. Federal Reserve battling rising inflation with tighter credit pushed the euro lower and the dollar higher in an almost perfect bullish storm for the U.S. currency and a bearish hurricane for the euro.

The euro has recovered against the U.S. dollar since the September 2022 low, but the factors that drove the euro lower remain intact in March 2023. The Invesco Currency Shares Euro Trust (FXE) tracks the foreign exchange relationship between the euro and the U.S. dollar.

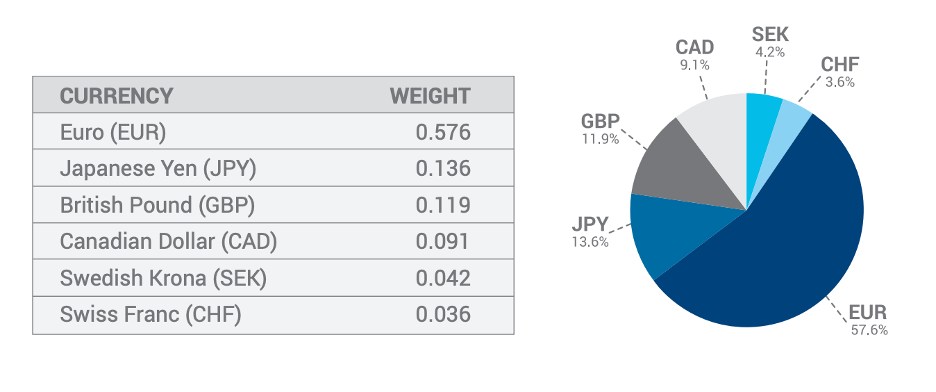

The euro is the primary currency in the U.S. dollar index

The dollar index measures the U.S. dollar’s value against a portfolio of other reserve currencies, including the euro, yen, pound, Canadian dollar, Swedish krona, and Swiss franc. Meanwhile, the euro has the most exposure in the index.

Source: ICE

As the chart highlights, 57.6% of the index depends on the U.S. dollar’s currency relationship with the euro. The euro is the second-leading reserve currency.

It has been a while since I wrote about the euro

In a late August 2022 article on Barchart, when the euro was heading below parity against the dollar, I wrote, “The trend is always your best friend in markets, and it remains lower in the euro currency. Selling on any recovery has been the best approach for the past fourteen years and will likely continue as technical and fundamental factors point to a lower path of least resistance for the European currency.”

The chart shows the euro moved below parity against the dollar and fell to a $0.95364 low in September 2022. The pattern of lower highs remains intact in March 2023, even though the euro has recovered against the dollar since the September 2022 twenty-year low.

The euro has been trading below the midpoint since the September 2022 low

In January 2021, the euro made its last lower high at $1.23490 against the U.S. dollar. The midpoint of the January 2021 high and the September 2022 low is $1.09427.

The short-term chart of the currency relationship shows the recovery pattern of higher lows and higher highs since the September 28, 2022, low. While the euro-dollar relationship briefly probed above the midpoint when it reached $1.10326 on February 2, it quickly returned below the $1.09427 midpoint and was under the $1.07 level on March 3, 2023.

The reasons why parity is a pivot point

Parity is the significant pivot point for the foreign exchange relationship as it is a critical psychological level. The break below took the euro to the lowest level since 2002.

As highlighted in the August 6 piece, two significant factors have weighed on the euro versus the dollar.

Interest rate hikes to battle the highest inflation in decades have caused U.S. rates to rise. One of the primary factors that drive the dollar’s value versus the euro is interest rate differentials, which widened in the dollar’s favor throughout 2022, pushing the euro lower and below parity against the dollar.

Meanwhile, the first significant war on European soil since WW II was the other factor that weighed on the euro in 2022. Russia’s invasion of Ukraine and NATO’s support for the Ukrainian defense caused sanctions to boomerang, impacting Europe’s supply chain. Russia is a leading energy exporter to Western Europe, and Russia and Ukraine are Europe’s breadbasket. The war weighed on the euro’s value.

With the euro trading over the $1.06 level against the dollar on March 3, the trend suggests that $1 remains the foreign exchange relationship’s pivot point.

Can the euro and the dollar be weak at the same time?

The U.S. economy faces a debt crisis as Congress and the administration must agree to increase the debt ceiling. The potential for a default likely caused the dollar to decline against the euro since the late September low. Meanwhile, the bifurcation of the world’s nuclear powers and Russia’s alliance with China threaten the dollar and the euro as reserve currencies. Increasing use of non-dollar and non-euro exchange instruments to pay for international cross-border transactions threatens the U.S. and European currencies worldwide role. Therefore, the euro and dollar can weaken simultaneously, regardless of the exchange rate between the two currencies. The over two-decade rise in gold prices in dollar and euro terms is a sign that both foreign exchange instruments are weakening.

The Invesco Currency Shares Euro Trust (FXE) ETF product tracks the euro versus the U.S. dollar currency relationship. At $97.79 per share on March 3, FXE had $288.809 million in assets under management. FXE trades an average of 95,239 shares daily and charges a 0.40% management fee. FXE’s fund summary states:

The latest rally in the foreign exchange relationship took the euro from $0.95364 on September 28 to $1.10326 on February 2, a 15.7% recovery.

Over the same period, FXE rose from $88.37 to $101.52 per share or 14.9%. The ETF’s drawback is it is only available during U.S. stock market hours, while the currency markets operate around the clock.

The FXE will not reflect highs or lows during the stock market’s off-hours.

The exchange rate’s critical resistance level sits at the January 2021 $1.23490 high. It will remain in a bearish trend until it breaks above the level ending the pattern of lower highs since 2008.

More Forex News from Barchart

- Stocks Move Higher as Bond Yields Fall on Interest Rate Optimism

- Dollar Climbs With T-Note Yields

- Stocks Climb Higher Despite Rising Bond Yields

- Why a Weaker US Dollar Could Benefit Microsoft, IBM, and Amazon

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)