/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

Semiconductor powerhouse Micron Technology (MU) has turned memory into momentum. Shares of the artificial intelligence (AI)-focused memory and storage maker have surged by three digits over the past year as a global shortage is colliding with explosive demand. AI systems rely on memory to keep vast datasets close to GPUs, enabling large models to run faster without costly slowdowns.

Micron CEO Sanjay Mehrotra stated that AI-driven demand is accelerating and irreversible, forcing the industry to scale rapidly. To meet it, Micron is investing $200 billion to expand U.S. capacity, including two fabs in Idaho and a 600,000-square-foot facility in Clay, New York.

These investments are already reflected in operating trends. At the start of 2025, Micron forecasted 10% server-memory growth. By year-end, growth landed in the high teens. PC memory and storage also outperformed expectations, signaling that AI spillover demand is broadening beyond data centers into everyday computing.

This scramble to supply tech titans has intensified shortages. Prices for memory components are now projected to rise an estimated 55% in the first quarter, as previously reported by CNBC. The pricing trajectory creates a favorable setup for suppliers and strengthens the bull case for Micron shares at current levels.

About Micron Stock

Headquartered in Boise, Idaho, Micron is the only U.S.-based manufacturer of Dynamic Random-Access Memory (DRAM), NAND flash memory, and NOR flash memory. It designs and fabricates high-performance memory solutions under the Micron and Crucial brands, serving AI, data centers, mobile devices, automotive systems, and industrial applications globally.

With a market cap brushing $410.8 billion, MU stock has climbed 251.1% over the past 52 weeks. It gained 239.2% in six months and added another 44.4% in the last month alone, reflecting higher memory pricing amid constrained industry supply.

MU stock is currently trading at 11.17 times forward adjusted earnings, a valuation that sits comfortably below both the industry average and Micron’s own five-year norm. The gap signals a clear discount, pointing to an opportune window for investors to step in before improving fundamentals and sustained AI demand narrow the valuation spread.

Shareholders are also receiving income, albeit modestly. Micron pays an annual dividend of $0.46 per share, yielding 0.13%. The most recent dividend of $0.12 per share was paid on Jan. 14 to shareholders of record as of Dec. 29, 2025.

Micron Surpasses Q1 Earnings

On Dec. 17, Micron reported fiscal Q1 2026 results that pushed shares up 10.2% the following session. Revenue rose 56.7% year-over-year (YOY) to a record $13.6 billion, setting a quarterly record for the third consecutive quarter. The figure surpassed the Street forecasts of $12.7 billion.

Profitability followed suit as non-GAAP net income increased 169.1% from the year-ago value to $5.5 billion, while non-GAAP EPS climbed 167% to $4.78, surpassing consensus expectations of $3.91.

Cash generation reinforced financial strength. Cash and equivalents edged up to $9.7 billion at the end of the quarter, up from $9.6 billion as of Aug. 28, 2025. Meanwhile, adjusted free cash flow rose significantly from the prior year’s quarter to $3.9 billion.

Management paired results with confident guidance. For the current quarter, Micron expects revenue of $18.70 billion, plus or minus $400 million. It also forecasts non-GAAP EPS of $8.42, plus or minus $0.20, signaling continued acceleration driven by DRAM, NAND, and HBM demand.

Analysts project the momentum to compound. Consensus estimates call for Q2 FY2026 EPS of $8.18, up 480.1%. Full-year 2026 earnings are projected to jump 319.1% to $32.19, followed by another 31.8% increase to $42.44 in fiscal year 2027.

What Do Analysts Expect for Micron Stock?

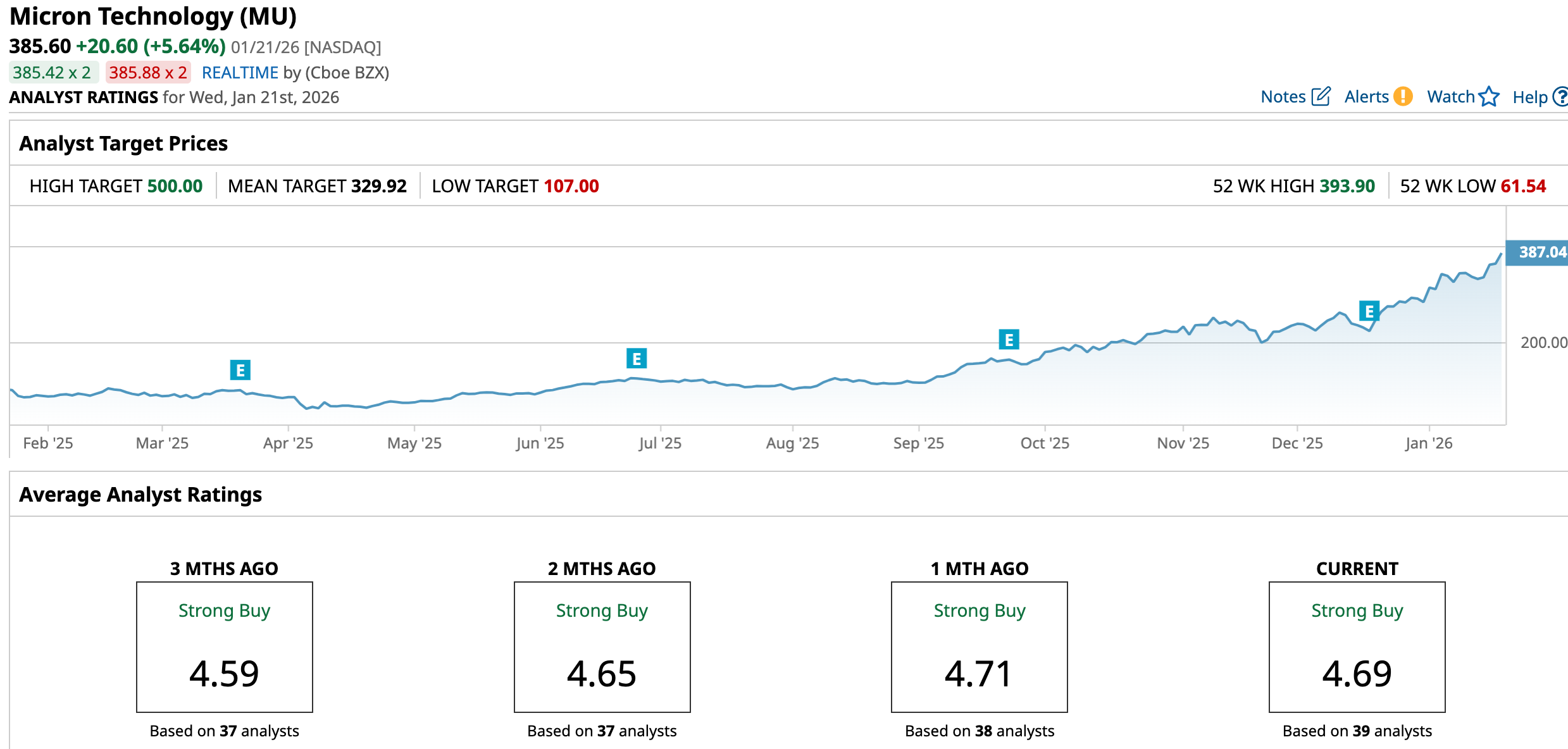

Analyst conviction around Micron continues to intensify, led by Piper Sandler’s Harsh Kumar, who placed a bold vote of confidence on MU with a $400 price target. The move represents a sharp 45% jump from his prior $275 view, signaling rising conviction in Micron’s AI-driven earnings power.

Kumar is not alone in reassessing MU's upside. Wells Fargo & Company raised its price target to $410, reinforcing the view that earnings momentum remains underappreciated. Barclays followed suit, lifting its 12-month price target to $450 from $275, reflecting expectations of sustained pricing strength and structural memory tightness.

Taken together, Wall Street’s stance is overwhelmingly optimistic. MU stock carries a “Strong Buy” consensus rating, with 30 of 39 analysts recommending “Strong Buy,” six advising “Moderate Buy,” and just three maintaining a “Hold” rating, underscoring broad alignment around the company’s trajectory.

Notably, MU stock is already trading above its mean price target of $329.92, reflecting how quickly fundamentals have outrun earlier models. Even so, the Street-high target of $500 represents a gain of 29.7% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)