- Though many in the industry don't know this, markets can move up, down, or sideways.

- In the case of corn, long-term trends turned down last May meaning the ongoing selloff is a normal part of that trend.

- Eventually the market will bottom out, reverse, and move back into a long-term uptrend. It's just a matter of time.

Monday’s most popular question had to be, “What’s wrong with the corn market?” My reply was simply, “Nothing. In fact, it is doing exactly what it should be.” This highlights the brainwashing that has occurred in the industry over the decades. The vast majority of the reporter/commentator/broker industry uses “positive” or “negative” rather than “bullish” or “bearish” when talking about market action, if they can fit anything in while telling everyone just how important imaginary numbers from the government are. Regarding the former, back in the newsroom I tried to instill the idea of bullish/bearish with every analyst hired. As for the latter, no sooner had the ink dried on last week’s USDA foolishness when I saw some in the industry already counting down the weeks to one of the biggest piles of howdy-doody time of the year, USDA’s Prospective Plantings guess at the end of March.

But enough of that. Let’s talk about what matters. Markets can go three directions: Up, Down, or Sideways. Usually, not always, one can make more money faster by playing the downside. I call it market gravity. Others like to say markets take the stairs up but the escalator down. When I was trading, more often than not I looked for markets that were topping because I had no patience for a longer-term position betting on a market rallying. As I got older, I became more patient and willing to ride out long positions as well. The bottom line is there is nothing wrong with markets going down, no matter how many folks call in “negative”.

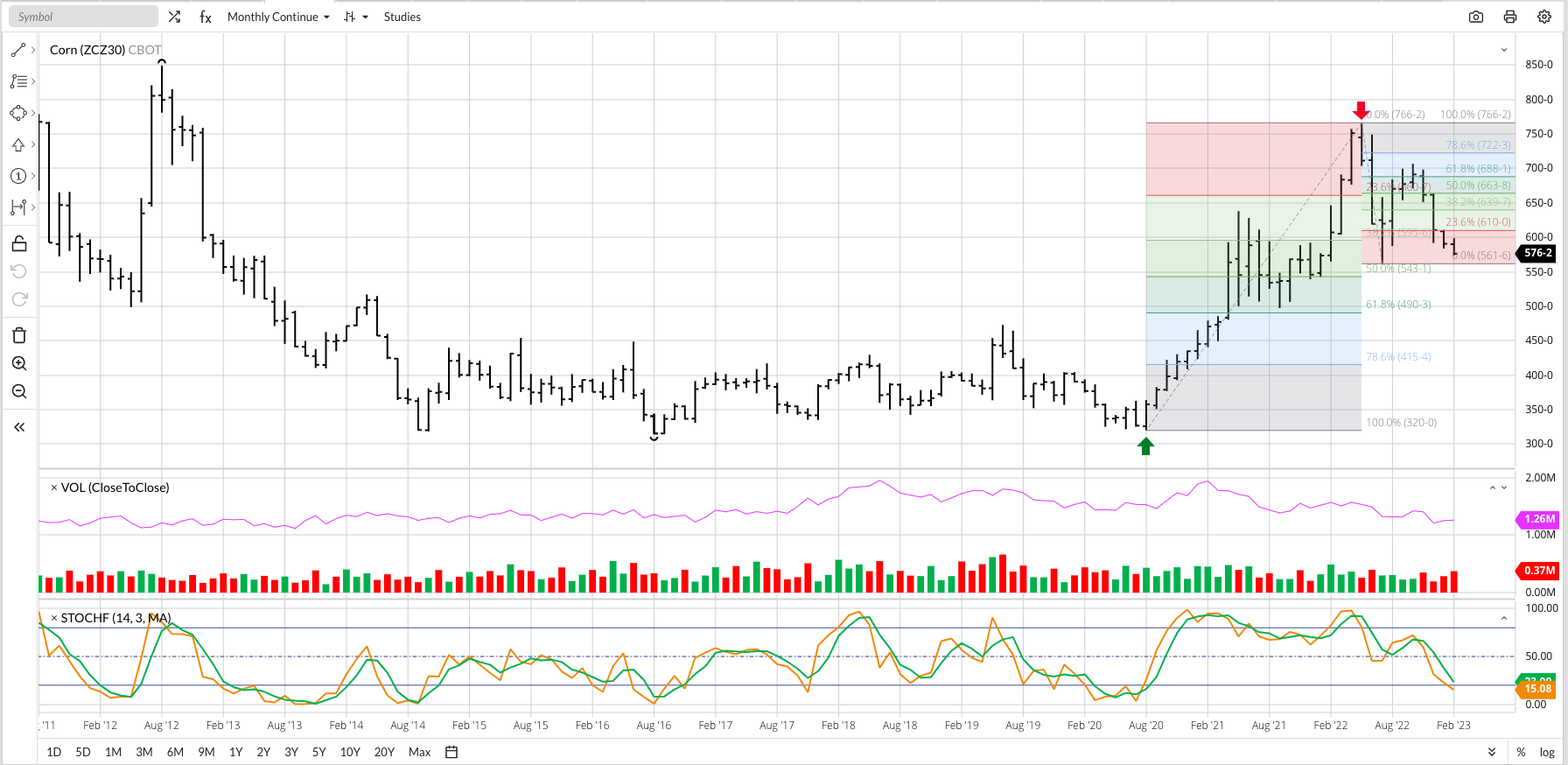

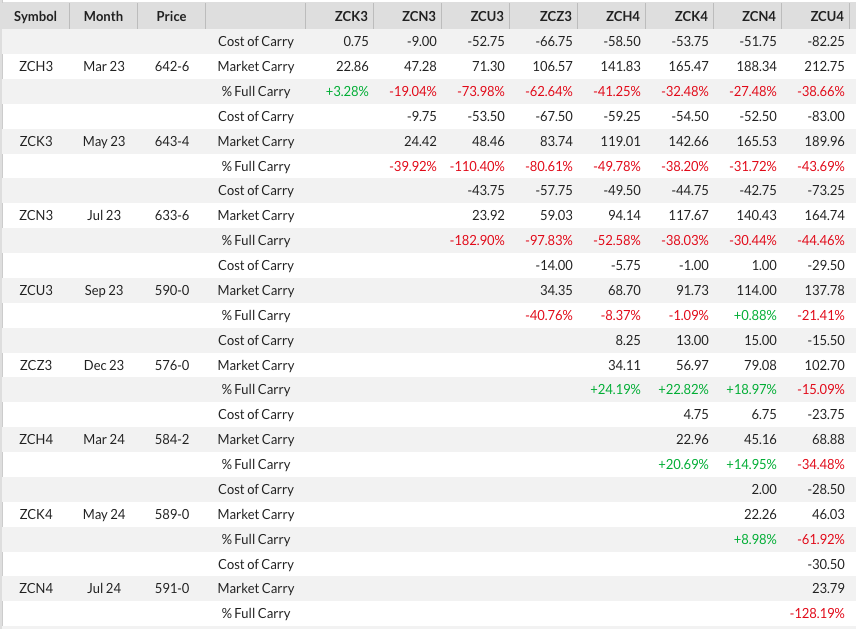

But what about corn? Those of you following along with Monthly Analysis on my website will recall both the cash and December futures markets reversed into major (long-term) downtrends last May. This was also true for the Teucrium CORN fund (CORN) if one likes to trade ETF’s rather than cash or futures. Most of the interest lately has been on Dec23 futures (ZCZ23), so let’s take a look at the Dec corn only continuous monthly chart. The 2022 edition posted a May high of $7.6625 before falling to a July low of $5.6175. This was Wave A (first wave) of the major 3-wave downtrend with Wave B (second wave) taking Dec22 back to a high of $7.0650. Wave C (third wave) began in November and included the roll from Dec22 to Dec23 during December. And as any Wave C should, the target was and has continued to be a move below the Wave A low of $5.6175. February has seen Dec23 trade down to $5.7425.

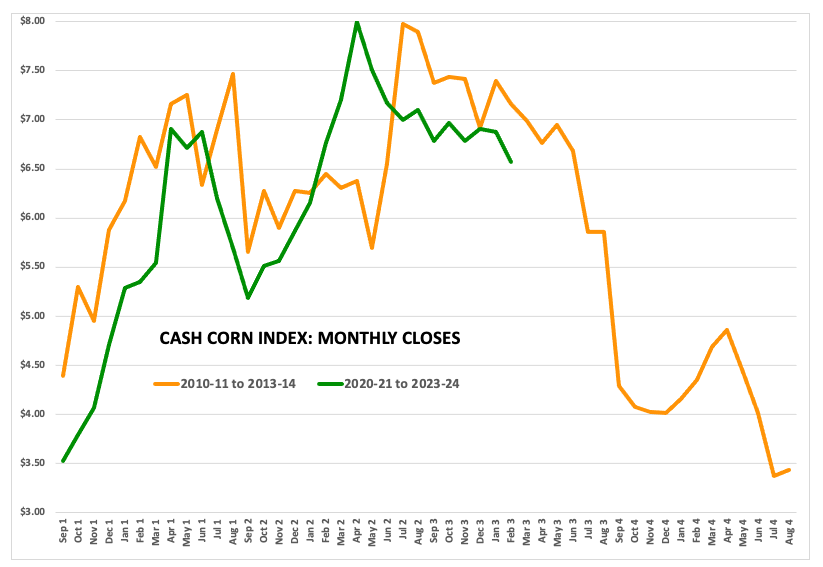

Where is the pressure coming from in new-crop corn? Again, for those who watch the market rather than USDA we know Dec23 corn spent the last 6 months buying acres away from Nov23 soybeans. The weekly close-only chart for the Nov23 soybean/Dec23 corn spread stayed below the 10-year average (favoring corn) from the first week of September through the last weekly close of February (last week). While I don’t believe in analogous years, the closest fit to what we saw with the 2023 edition was back in 2016 when US growers planted approximately 7% more corn acres and 1% more soybean acres. As always, weather will play a key role in what happens from here on out, but keep in mind what I talked about before with the 4-year pattern from 2010 through 2014 roughly repeating itself from 2020 through 2024.

But why is corn going down if long-term fundamentals are still bullish? After all, aren’t I the one who goes on and on about inverted futures spreads? I am, but don’t forget Newsom’s Market Rule #1: Don’t get crossways with the trend. There are a couple reasons I made this the first rule: To begin with, it fits with Newton’s First Rule of Motion applied to markets (A trending market will stay in that trend until acted upon by an outside force, with that outside force usually noncommercial money.), and it’s never smart to step in front of big money. Picture a train and you standing on those tracks betting the train will change direction and miss you. The outcome is usually grim.

What’s wrong with the corn market, other than most the folks who talk about it? Absolutely nothing. Let’s see how it finishes this major trend out and what comes next.

More Grain News from Barchart

- Midday Wheats Down by Double Digits

- Beans Dropping to Start the Week

- Follow-Through Corn Weakness through Monday

- Coffee Prices Fade as Flooding Concerns Ease in Brazil

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)