My Q4 2022 soft commodity review on Barchart highlighted sugar’s close at 20.04 cents per pound on December 30, 2022. Looking forward to 2023, I wrote, “Soft commodities are agricultural products, and worldwide inflation is increasing production costs.” Nearby sugar futures reached a 17.20 cents per pound low in August 2022 and have made higher lows and higher highs over the past months. I expect the bullish trend to continue at the 21.32 cents per pound level on the expiring March futures on February 22, but the road to higher highs could be bumpy.

The Teucrium Sugar ETF (CANE) tracks the price of a portfolio of the sweet commodity futures higher and lower.

Sugar reaches a new multi-year high

As the global pandemic gripped markets across all asset classes in April 2020, nearby ICE world sugar futures fell to 9.05 cents per pound, the lowest price since August 2007.

The twenty-year chart highlights that world sugar futures have made higher lows and higher highs since the April 2020 low, with the latest peak in February 2023 at 20.89 cents per pound, the highest price since November 2016.

The forward curve displays supply tightness

The forward curve, or sugar futures prices for deferred delivery, reflects short-term supply concerns.

As the chart shows, sugar prices for deferred delivery are progressively lower. While the nearby contract was over the 21.40 cents per pound level on February 22, free-market sugar for delivery in October 2025 was below 16.30 cents.

The backwardation, or progressively lower prices, highlights nearby market tightness. Backwardation assumes that producers will increase output to address supply concerns, and it also reflects that higher nearby prices will dampen the demand, adjusting future prices lower.

Production costs are rising

Inflation is increasing production costs for all commodities, and sugar is no exception. Rising labor, energy, transportation, fertilizer, and other input costs put upward pressure on all agricultural commodities and other raw material prices.

The most recent January U.S. consumer and producer price index data showed that inflation remains at the highest level in decades, with CPI and PPI coming in above the consensus forecasts. Food and energy prices have played a central role in pushing inflation higher. While interest rate hikes and other monetary policy tools address the economic condition, which has declined over the past months, monetary policy is most effective in fighting demand-side inflationary pressures. The supply side can be immune to interest rate hikes and other central bank policies.

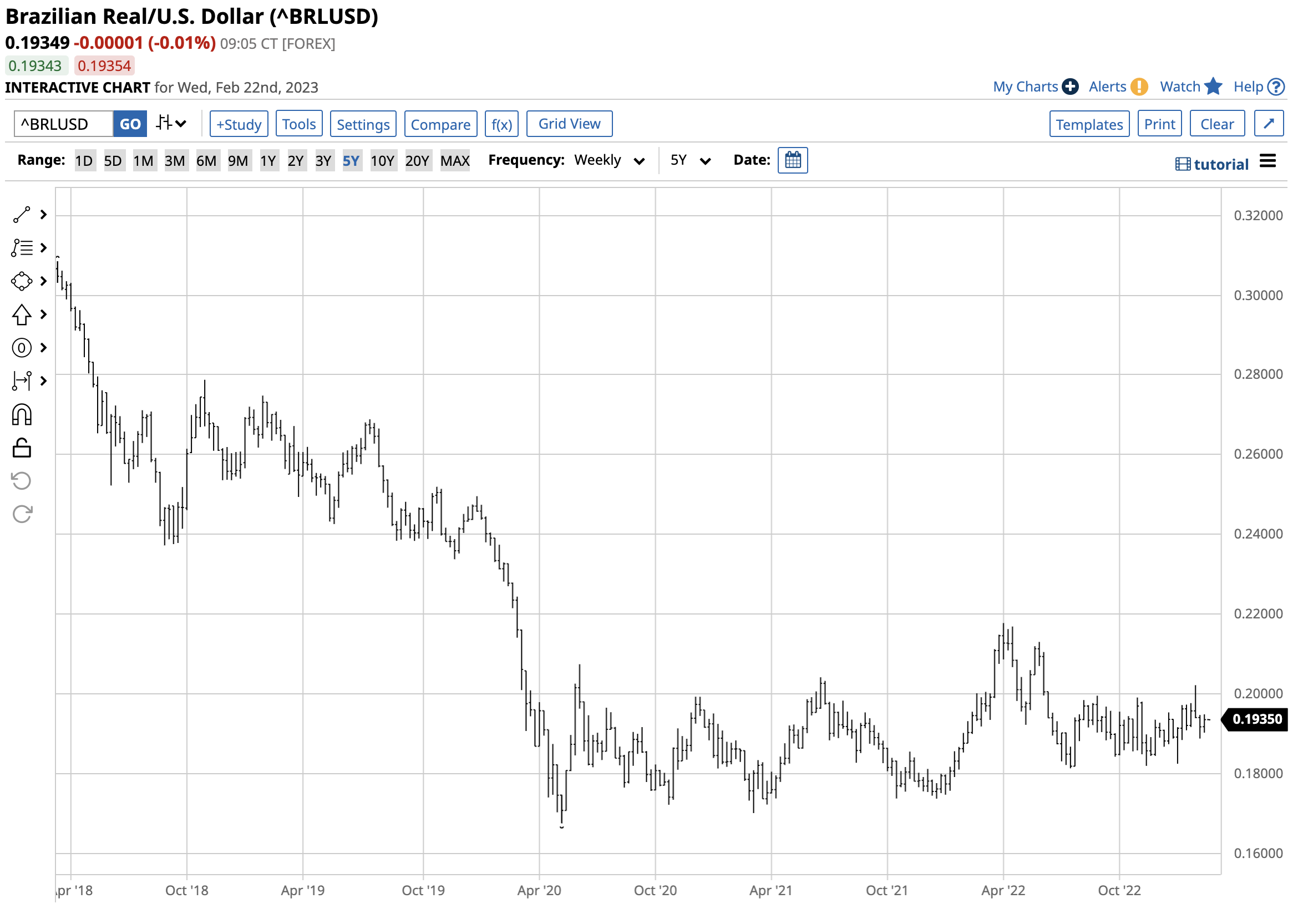

When it comes to world sugar, Brazil is the world’s leading producer and exporter. Labor and other costs are highly sensitive to the local currency, the Brazilian real. Since sugar futures trade in U.S. dollar terms, the currency relationship between the dollar and the real can impact sugar prices. When the real moves higher against the dollar, output costs rise.

The chart displays the gentle rise in the real versus the U.S. dollar since the May 2020 $0.16756 low. At $0.19349 on February 22, 2023, the real moved 15.5% higher against the U.S. currency, putting some upward pressure on production costs and sugar prices. The real has made higher lows over the past nearly three years.

The war in Ukraine could impact sugar beet supplies

While Brazil dominates sugarcane production, sugar beets are another supply source.

Source: Nationmaster.com

As the chart highlights, Russia was the top sugar beet producer, with Ukraine ninth, behind Egypt, and ahead of the United Kingdom. The war in Ukraine has interfered with agricultural production, which puts pressure on global sugar supplies. Moreover, the Black Sea Ports are a critical logistical export hub that has become a war zone over the past year.

The levels to watch in the sugar futures market- CANE is the sugar ETF product

World sugar futures have been in a bullish trend over the past two years. While the short-term technical resistance level stands at the recent 21.89 cents per pound high, the upside target now stands at the October 2016 23.90 high. Above there, sugar futures reached 36.08 cents per pound in February 2011.

On the downside, support is at 17.20 cents, the 2022 low, 14.67 cents, the March 2021 bottom, and 18.92 cents, the January 2023 low on the March futures contract. Long-term technical support is at the April 2020 9.05 cents low.

The most direct route for a risk position in the world sugar futures market is via the ICE futures and options. The fund summary for the Teucrium Sugar ETF product (CANE) states:

CANE holds a portfolio of actively traded world sugar futures contracts, minimizing the risk when one contract rolls to another. Since the most speculative activity tends to occur in the nearby contract, CANE tends to underperform the nearby contract on the upside and outperform when the price moves lower.

The most recent rally took March ICE sugar futures from 18.92 cents on January 9, 2023, to 21.89 cents on February 10, a 15.7% rise. March sugar futures corrected to 21.12 cents on February 13 or 3.5%. While sugar futures trade before the stock market opens and close before the U.S. stock market closes, CANE does not reflect the highs or lows occurring when the stock market is not operating.

CANE rose from $9.17 on January 6 to 10.41 cents on February 2 or 13.5%. On February 13, CANE corrected to 10.10 cents, a 3% decline. CANE slightly outperformed on the downside and underperformed on the upside.

CANE is an unleveraged ETF that does an excellent job tracking the world sugar futures price. At $10.32 per share, CANE had $23.641 million in assets under management and trades an average of 81,475 shares daily. CANE charges a 0.2% management fee.

While the trend in world sugar futures remains bullish, bull markets rarely move in straight lines. The first support level is just below 19 cents per pound, and the bullish trend will remain intact if sugar futures do not breach that level.

More Softs News from Barchart

- Wednesday Recovery for Cotton Market

- Mixed Close for Tuesday Cotton Market

- Coffee Prices Post Moderate Gains on Brazil Weather Concerns

- NY Sugar Moderately Higher on Smaller Sugar Exports from India

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)