/Netflix%20On%20TV%20with%20Remote.jpg)

Netflix (NFLX) stock skyrocketed on Friday, Jan. 20, 2023, after reporting much better-than-expected subscriber growth after the market on Thursday. It also reported massive free cash flow (FCF) generation as well as new stock buyback plans. This is attracting investors to its call options, both as a long play and also for out-of-the-money covered call income plays.

The company's addition of 7.66 million new paid memberships as well as its FCF growth was discussed in my article on Jan. 20. This surprised investors since they were not expecting such huge growth to come from the company so quickly just after the Q2 disaster when its membership numbers actually fell slightly.

Moreover, Netflix said it expects to make $3 billion in FCF during 2023. That puts its FCF margin at close to 8.9% based on analysts' forecasts of $33.88 billion in revenue during 2023.

In addition, Netflix said it will restart share buybacks in 2023. In the second half of 2021, it spent over $724 million in share repurchases.

So, assuming it spends at least $2.5 billion on buybacks during 2023 this represents a buyback yield of 1.64% based on its $152.4 billion market capitalization. As Netflix does not pay a dividend right now, this is how it returns cash to shareholders. The remaining shareholders will have a bigger stake in the company and its earnings per share will rise as a result.

Call Option Plays

As a result of the stock's recent spike, its call options have generated keen interest. For example, NFX stock closed at $342.50 on Friday, Jan. 11, up $26.72 or 8.42%.

Sometimes the best way to play this is to sell out-of-the-money (OTM) calls for a near-term period as investors feel bullish about the stock, pushing up the premiums.

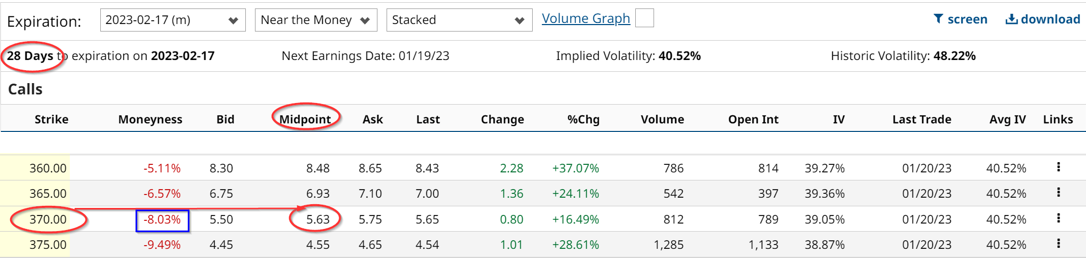

For example, the Feb. 17, 2023, call options at the $370 strike price, which is 8.03% higher than the Friday, Jan. 20 closing, trade for $5.63 per call option at the midprice. That represents an immediate yield of 1.64% to the investor who puts in an order to “sell to open.”

This also represents an annualized 19.7% return if the same covered call play can be repeated over a 12-month period. Moreover, even if the stock rises by 8.0% within the next 28 days, the covered call investor gets to keep that upside. If it doesn't rise exactly to $370 by the close of Feb. 27, the gain is an unrealized gain on top of the immediate 1.64% yield.

Moreover, some investors may want to go long with call options, especially if they think the stock will keep rising. There are two ways to do this effectively. One is to buy deep in the money calls, allowing the investor to have some downside risk protection. But it is usually better to do this for a longer period (at least three months forward). Astute investors might also wait until the stock comes down a bit after this recent spike. This is because it's best not to overpay for long-call options.

Another way to do this is as a hedge against a covered call play. For example, the Feb. 17 calls for the $375 calls trade for the $4.55 per call option. That still leaves a net income gain of $1.08 (i.e., $5.63-$4.55) and protects the investor should the stock rise over $370.00.

This is because if there is still time left in the expiration period, the price of the long call will rise or at least keep a good portion of its value if NFLX stock rises to $370. That way the investor could let the covered call be sold in the exercise but also sell the long OTM call which may still have a good deal of extrinsic value. This may depend on how much time is left in the expiration period.

Both the $370 and the $375 strike prices have large volume increases as the above option chain shows. There are now 812 contracts in the $370 period and 1,285 options traded in the $375 strike price. Both of these are over 100% more than the existing open interest in each of these contracts.

This shows that investors are paying very close attention to the call options for Netflix stock.

More Stock Market News from Barchart

- Earnings, GDP And Other Key Themes To Watch This Week

- Microsoft Put Options Continue to Trade at High Levels, Attracting Income Players

- Stocks Jump on Strength in Tech and Dovish Fed Comments

- Fed Debates on When to Pause Monetary Policy

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)