Platinum is a rare precious metal, with most production coming from South Africa and Russia. While South African output comes from dedicated platinum mines, Russian production is a byproduct of nickel output in Siberia’s Norilsk region. Platinum futures trade on the CME’s NYMEX division. Platinum is a precious metal with many industrial applications. While gold and palladium, platinum’s sister metal, reached record peaks in March 2022, platinum continued to lag behind the precious metals.

As we move into 2023, platinum offers compelling value, but the price action has yet to respond. Platinum is far less liquid than gold, which could lead to significant price volatility when the metal decides to break to the upside. The Aberdeen Physical Platinum product (PPLT) is the most liquid platinum ETF that holds physical platinum bullion.

Platinum is less liquid than gold

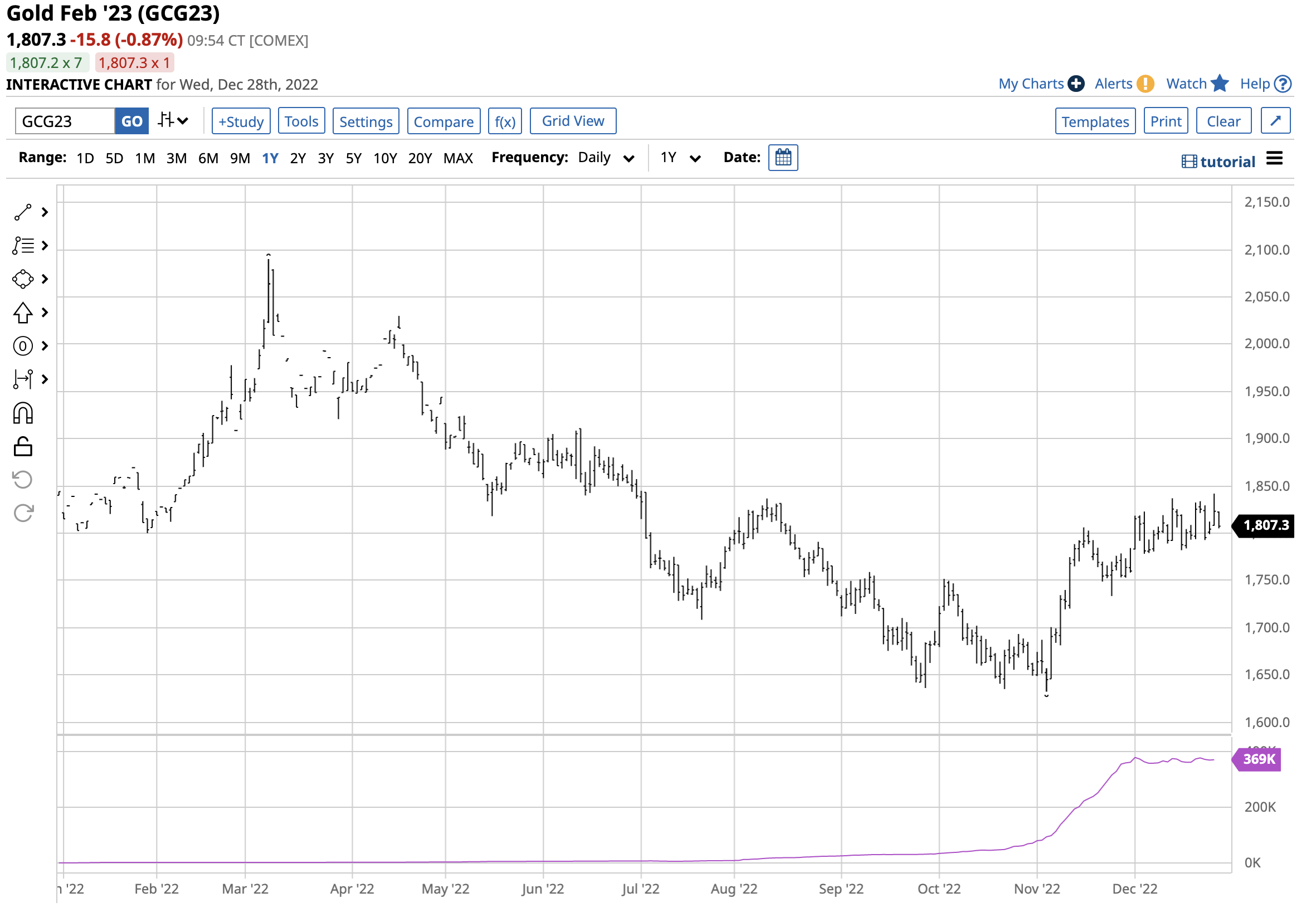

Platinum and gold trade on the CME’s NYMEX and COMEX divisions in the futures market. Open interest is the total number of open long and short positions in a futures market, and the metric measures liquidity.

The April NYMEX platinum futures chart highlights open interest at 59,855 contracts on December 27. Since a platinum futures contract contains 50 ounces of metal, the total size of the most active contract was 2,992,750 ounces worth $3.056 billion at $1,021 per ounce.

The chart of the nearby COMEX gold futures chart for February delivery shows open interest at 369,000 contracts. Each contract calls for 100 ounces, so open interest reflects 36.9 million ounces of gold, valued at $66.69 billion at $1,807.30 per ounce.

Based on the nearby contracts, gold open interest was around 12.3 times higher based on ounces and over 21.8 times higher based on value. Platinum is far less liquid than gold.

Platinum’s industrial applications

Gold has some industrial applications and is essential for jewelry manufacturing, but it is primarily a financial asset. Central banks validate gold’s role in the worldwide financial system by holding the metal as a foreign exchange asset.

Meanwhile, platinum is far more industrial than gold. Platinum catalysts produce silicones, high-octane gasoline, and petrochemical feedstocks used to make plastics, synthetic rubber, and polyester fibers. Platinum’s resistance to high temperatures makes the metal critical for jet engines and missiles. Platinum also has applications in optical fibers, wires, pacemakers, and compounds of platinum create chemotherapy treatments that battle cancer. Platinum jewelry is also very popular. Total platinum production from mines and as a byproduct of other metal output is around 5.222 million ounces. Total gold production in 2022 is approximately 4,791 tons or over 154 million ounces. Platinum is far rarer than gold.

Russia is critical for platinum production

In 2021, Russia produced approximately 19 tons of platinum, or 610,864 ounces of platinum. While Russia accounted for 11.7% of worldwide output, South Africa had produced 130 metric tons or 80% of the global mine supplies. Nearby 92% of the platinum supplies come from the two countries.

The war in Ukraine, sanctions on Russia, and Russian retaliation is creating supply concerns for the metal, but the price has not reacted accordingly. In March 2022, the war in Ukraine pushed gold to a record high of over $2,070 per ounce.

The chart illustrates that nearby NYMEX platinum futures rose to $1,154 per ounce in March 2022, but the peak was half the price as platinum’s March 2008 record high.

Platinum is a financial asset that offers value

After reaching $2,308.80 in March 2008, platinum futures fell 67% to a low of $761.80 seven months later in October 2008. The price collapse likely left a bad taste in many investors’ mouths. Markets with low liquidity can suffer from excessive price volatility as bids to buy evaporate when the price falls. The platinum market experienced another low liquidity event on the downside when the price fell below $600 per ounce in March 2020 as the global pandemic gripped markets across all asset classes.

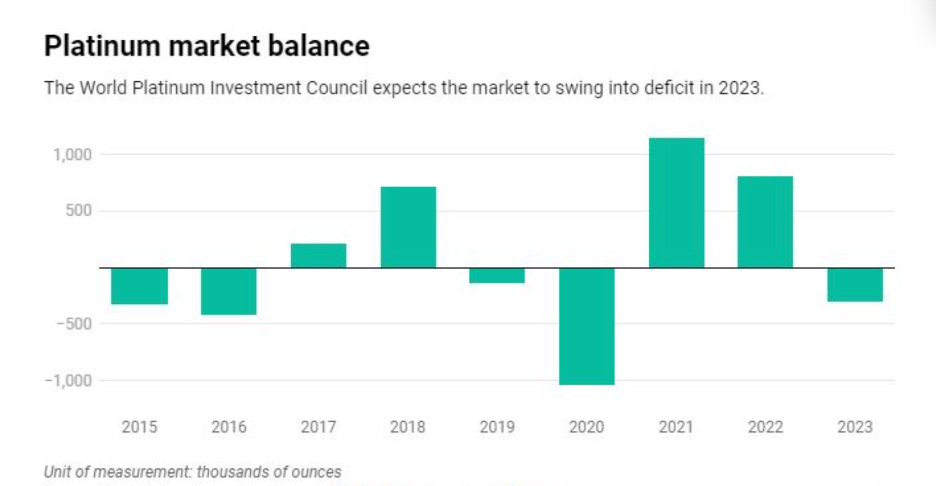

Conversely, during rallies, offers to sell can disappear, causing upside price explosions. On late November 2022, the World Platinum Investment Council said that after a significant platinum surplus in 2022, it forecasts the metal will move into a deficit in 2023. The Council expects automaker requirements to rise and investors reverse from net sellers to net buyers, pushing demand up 19% to 7.77 million ounces, the highest level since 2020.

Source: World Platinum Investment Council

The illiquid platinum market could offer compelling value at around the $1,000 per ounce level in late 2022.

PPLT is the platinum ETF

The most direct route for a long position or investment in platinum is via the physical market for platinum bars and coins. The NYMEX futures provide an alternative as it has a delivery mechanism. Meanwhile, the most liquid platinum ETF product is the Aberdeen Physical Platinum product (PPLT), as it holds platinum bullion. At $93.68 per share, PPLT had $1.074 billion in assets under management. PPLT trades an average of 103,405 shares daily and charges a 0.60% management fee.

April platinum futures rose from $807.40 on September 1, 2022, to a high of $1,067.70 per ounce on December 1, 2022, or 32.2%.

Over the same period, PPLT rallied from $76.09 to $97.50 per share, or 28.1%. Platinum trades around the clock during the business week, while PPLT is only available for trading when the stock market is operating. Therefore, the ETF can miss highs or lows outside the U.S. stock market hours.

Platinum could finally shine in 2023 as inflation, a developing supply-demand deficit, concerns over Russian supplies, and low liquidity may ignite a long-overdue rally that allows platinum to catch up with gold. Platinum has been in an ugly trend of lower highs and lower lows since 2008, but the odds could favor a significant recovery in 2023. The critical upside resistance level that would break the fifteen-year bear market is at the February 2021 $1,290.60 high.

More Metals News from Barchart

- Dollar Slips as the Yuan Rallies on China Reopening Optimism

- Higher Bond Yields Weigh on Tech Stocks

- Dollar Slightly Lower as U.S. Inflation Outlook Improves

- "Hi-ho, Silver! Away!"

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Space%20Technology%20by%20Rini_%20com%20via%20Shutterstock.jpg)

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)