Silver prices bottomed in September, while gold prices bottomed later in November. Gold usually gets all the acclamations in the metals markets, but silver wanted nothing to do with that this year.

Investors use silver as a haven investment, but because it is both an investment vehicle and industrial metal, there are significant differences in investment returns and uses. Silver can be found in jewelry, as is gold, and in medical equipment, electronic components, electrical wiring, and batteries.

Price per ounce, you find silver much less expensive than gold. An advantage of investing in silver using exchange-traded funds (ETFs) is that you don't have to store it physically. Storage of physical metals is more expensive with silver than gold because of the price discrepancy per ounce. The exact dollar value for each would have silver weighing more.

Traders should be aware that silver is less liquid than gold. Allowing for significant silver price swings and more slippage entering and exiting the market.

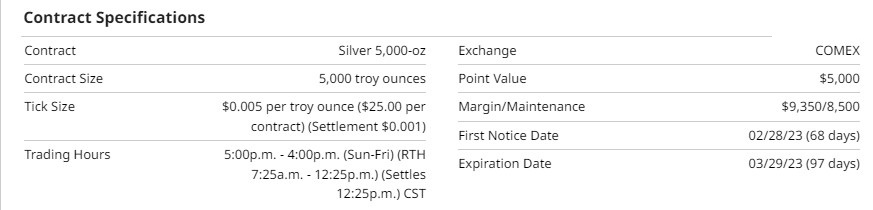

Specifications and statistics

Silver is a white, lustrous metallic element that conducts heat and electricity better than any other metal. Silver is the most malleable and ductile of all metals, apart from gold. Silver melts at about 962 degrees Celsius and boils at about 2212 degrees Celsius. Silver is not very chemically active, although tarnishing occurs when sulfur and sulfides attack silver, forming silver sulfide on the surface of the metal. Because silver is too soft in its pure form, a hardening agent, usually copper, is mixed into the silver. Copper is generally used as the hardening agent because it does not discolor the silver.

The world's largest mine producers in 2020 were Mexico with 22.4% of world production, Peru with 13.6%, China with 12.8%, Russia with 7.2%, and Poland, Chile, and Australia, each with 5.2%.

Source: CRB Yearbook – Barchart

Recent performance

Silver has dominated market returns over the prior three months, appreciating 20%, while it has been flat year-to-date. Forming a seasonal low three months earlier shows signs that this current price move could advance further than usual rallies off seasonal lows.

Technicals

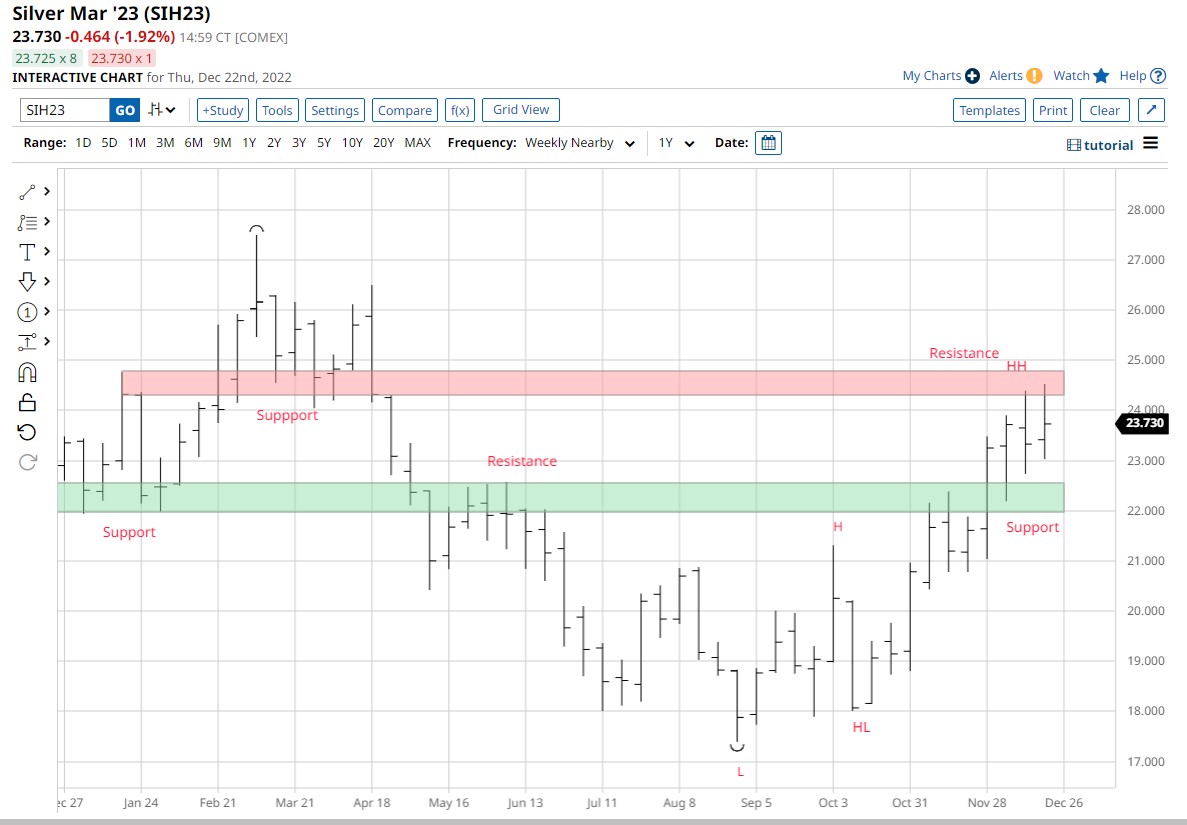

The weekly silver chart shows an intact uptrend with higher highs and higher lows from the early seasonal lows in September. After a 20% price rally, silver is trading at resistance from a previously broken $24.50 support level. Initially, the rally found resistance at the $22.00 per ounce level. A short time later, silver traded through that level, which will now become support if the price returns. Notice that both resistance levels were approached in uptrends and broken. Lesson: Do not sell in uptrends! Do not buy in downtrends!

The recent strength in silver may need to be corrected for a better entry price. The lower (green) level is now support and possibly a place to begin looking for entry prices.

Seasonality

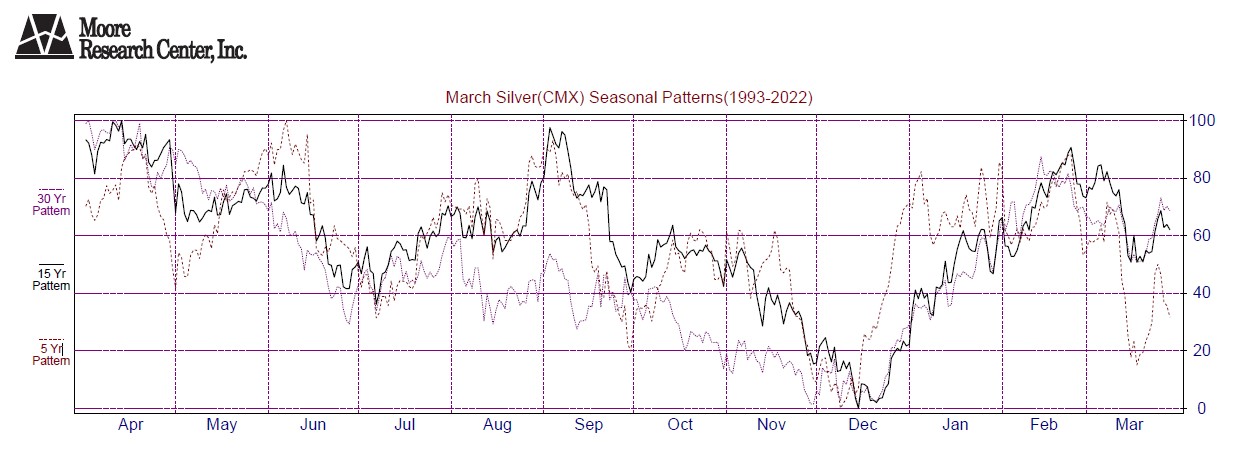

Source: Moore Research Center, Inc. (MRCI)

Due to the correlation between silver and gold, the seasonal patterns appear synonymous. MRCI research found that silver usually has its low yearly prices in December. This year the bulls came early and aggressively bought silver in September. MRCI has found that an early seasonal trough causes prices to have a longer uptrend duration than average. The January and February rallies are usually the strongest of the year and coincide with the Chinese New Year, where gold buying will support the closely correlated silver market.

The Commitment of Traders (COT) Report

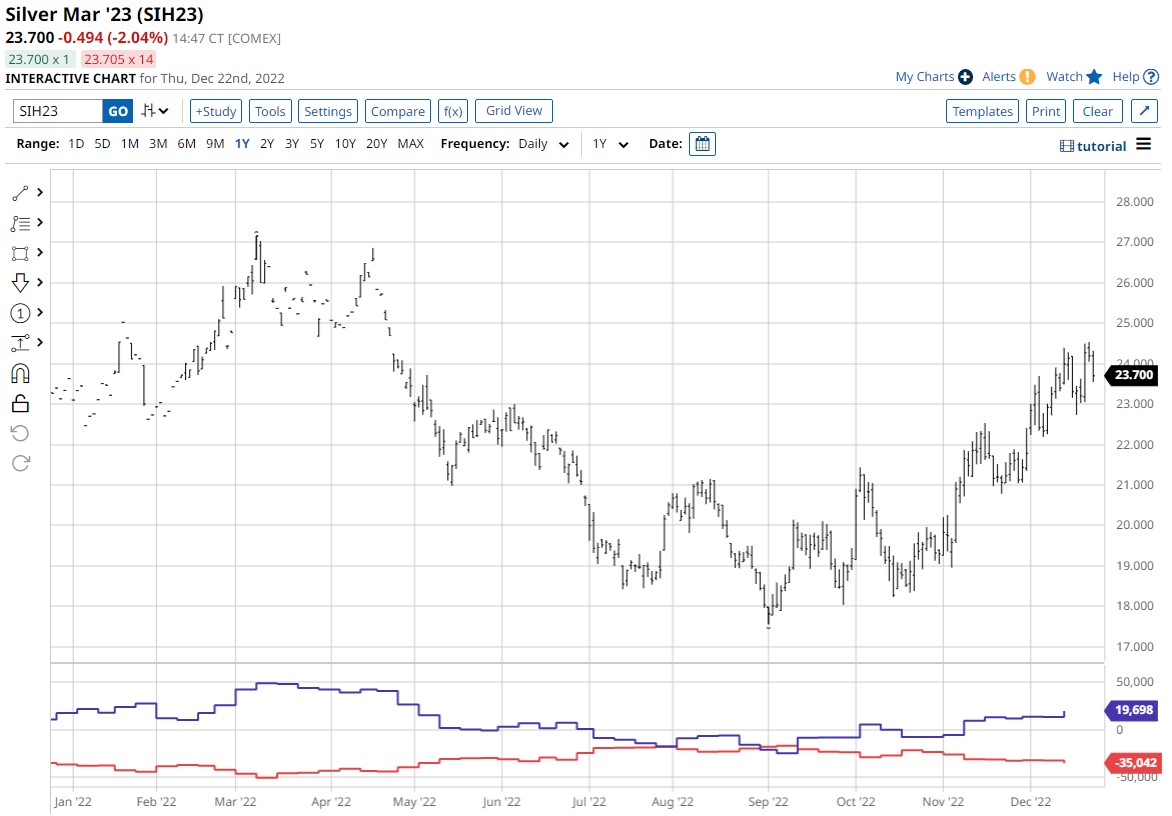

Reviewing the COT report for the past year of data illustrates how bullish the commercials (red line) were while building this year's seasonal low pattern. When the commercials accumulated long positions during this period, managed money (blue line) was selling in a downtrend. As evidenced by each week, the blue line went lower. The market went sideways after September, and the trend following managed money trading systems soon began firing buy signals. Since then, the blue line has steadily made higher highs each week.

The COT report can be used for a market sentiment of bullish or bearish extremes. Looking to the left of the chart around March 2022, we see silver prices topped out. At that time, managed money held approximately 50K more long positions than short. All trends need new contracts to keep advancing or declining. At some point, uptrends get to extremes where there are so many long positions that nobody is left to buy. The price must reverse and begin a correction in search of new buyers.

As traders, we know that the $27.00 price will be some form of resistance in the future. Currently, managed money has approximately 20K more longs than shorts. Using the COT report, we can monitor the bullish sentiment of this uptrend as it matures. If managed money gets too aggressive buying and their net long positions near the 50K net long amount, we may see a correction begin regardless of where the price is trading. Sometimes, it's not just the price we need to observe but the market sentiment.

Summary

Gold and silver look to be starting the new year on a bullish note. Goldman Sachs reported that they anticipate commodities to have returns of 43% in 2023. If this happens, both metals should perform well in that bullish environment.

There are multiple products available to participate in the silver market.

Buying the physical metal is an option. Silver is less liquid than gold, and selling might be more challenging due to the large bid/ask spread in the physical metals markets.

Equity traders can use an exchange-traded fund (ETF) (SLV) to trade silver. SLV follows the silver price. Other silver-related ETFs might track miners of silver, which do not track silver prices as closely as SLV.

Futures traders can trade the standard-size contract (SI). Beware, this contract is for 5,000 ounces of silver and can be very volatile and costly to trade. The CMEGroup does offer a micro silver contract (Barchart symbol SO, CME symbol SIL). The contract size is 1,000 ounces, and the capital requirements are 1/5 of the standard-size contract.

As always, before trading options, futures, or equities, seeking training first is recommended.

More Stock Market News from Barchart

- Stocks Stabilize after Positive U.S. Inflation News

- Markets Today: Stocks Slightly Higher after Positive U.S. Inflation News

- Puts for Luminar Technologies (LAZR) Tops Unusual Options Screener

- Microsoft Put Option Premiums Are at High Levels, Worth Shorting for Income

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

/Cloud%20Computing%20diagram%20Network%20Data%20Storage%20Technology%20Service%20by%20onephoto%20via%20Shutterstock.jpg)