/Cencora%20Inc_%20chart%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Pennsylvania-based Cencora, Inc. (COR) is a leading global pharmaceutical distribution and healthcare solutions company. It connects drug manufacturers with pharmacies, hospitals, and healthcare providers worldwide. With a market cap of approximately $70.5 billion, the company distributes brand, generic, and specialty medicines and also offers logistics, data, and commercialization services.

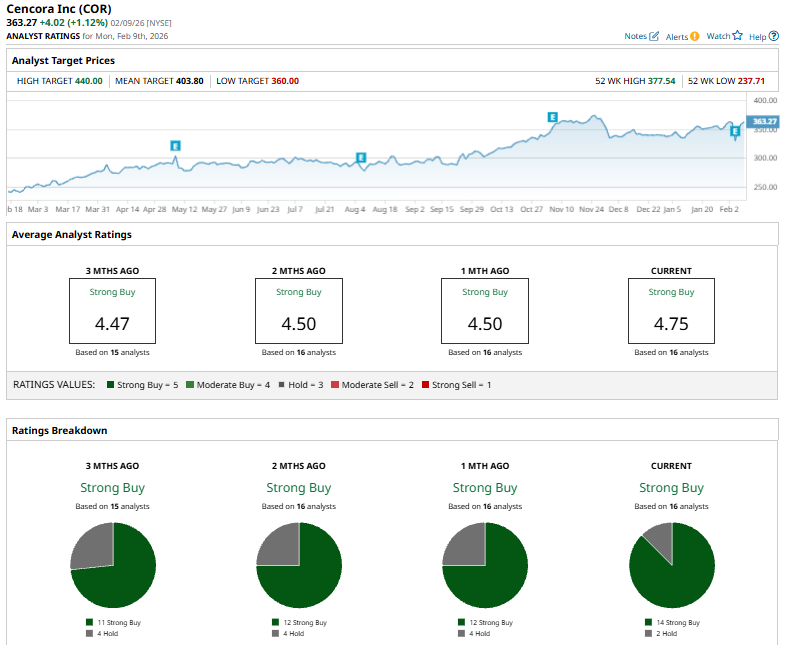

The pharma distributor has significantly outperformed the broader market over the past year. COR stock has soared 46.6% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 15.6% gains. In 2026, the stock is up 7.6%, surpassing the index’s 1.7% rise.

Narrowing the focus, Cencora has also outperformed the industry-focused VanEck Pharmaceutical ETF’s (PPH) 22.9% gains over the past 52 weeks and 6.5% return on a YTD basis.

On Feb. 4, Cencora reported its fiscal 2026 first-quarter results, with shares initially falling 8.8% before rebounding 6.7% in the following session. The company posted revenue of about $85.9 billion, up 5.5% year over year, and adjusted diluted EPS rose to $4.08, beating expectations and increasing roughly 9% from the prior year. Adjusted gross profit climbed to $3 billion, supported by strong volumes and favorable segment mix, and adjusted operating income grew nearly 12% to $1.1 billion.

For the current year ending in September, analysts expect COR to deliver an adjusted EPS of $17.57, up 9.8% year over year. Further, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

Among the 16 analysts covering the COR stock, the consensus rating is a “Strong Buy.” That’s based on 14 “Strong Buys” and two “Holds.”

This configuration is bullish than a month ago when the stock had 12 “Strong Buy” suggestions.

On Feb. 5, Evercore ISI lowered its price target on Cencora to $420 from $440 while maintaining an “Outperform” rating, noting that the recent 8% selloff appears overdone and that underlying business trends remain intact.

Cencora’s mean price target of $403.80 represents a premium of 11.2% from the current market prices. The Street-high target of $440 implies an upswing potential of 21.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)