/AI%20(artificial%20intelligence)/Hands%20of%20robot%20and%20human%20touching%20on%20big%20data%20network%20connection%20by%20PopTika%20via%20Shutterstock.jpg)

The renewed spotlight on space-based data centers has pushed lesser-known players into focus, and Voyager Technologies (VOYG) might benefit the most. Its CEO, Dylan Taylor, recently emphasized that while orbital data centers will become a reality, a two-year rollout would be “aggressive.”

Cooling, not launch capability or computing power, is the most critical bottleneck shaping development timelines and investment expectations. Interest surged after Tesla (TSLA) CEO Elon Musk cited space-based data centers as a motivation behind the proposed $1.25 trillion SpaceX–xAI merger.

While Taylor acknowledged that SpaceX’s heavy-lift rockets can efficiently transport hardware to orbit, he stressed that launch capability alone cannot solve the cooling problem. Against this backdrop, Voyager’s positioning stands out. The company is advancing Starlab, a next-generation space station intended to replace the International Space Station, developed alongside Palantir Technologies (PLTR), Airbus, and Mitsubishi (MHVIY).

Voyager is on track for a 2029 launch and already has its own cloud compute device on the ISS, supported by laser communication technologies that could underpin future space-based computing. Given this backdrop, VOYG stock rose 11.2% on Feb. 6 and another nearly 10% in today's trading session, prompting investors to assess whether the stock offers further upside.

About Voyager Stock

Voyager Technologies, headquartered in Denver, Colorado, builds advanced defense and space systems for government and commercial customers. With a market cap brushing $1.4 billion, its portfolio spans missile defense hardware, intelligence software, artificial intelligence (AI)-enabled navigation, propulsion, orbital infrastructure, mission operations, and a commercial space station supporting sustained in-orbit activity.

VOYG stock is up 11% year-to-date (YTD) and has gained 24% over the past three months. However, even factoring in today's reversal of momentum, the shares are still almost flat over the last five trading sessions.

From a valuation perspective, VOYG stock is trading at 9.54 times sales, a premium to the industry average. It might signal market confidence in Voyager’s long-term growth potential.

A Closer Look at Voyager’s Q3 Earnings

On Nov. 3, Voyager unveiled its Q3 2025 financial results, wherein the company reported net sales of $39.6 million, almost flat year-over-year (YoY) but slightly below the $40.42 million analyst estimate. More importantly, Voyager posted a net loss of $0.28 per share, outperforming forecasts of a $0.42 loss, while also narrowing losses 82.6% YoY.

The Defense and National Security business continued to strengthen, with net sales rising 31% YoY to $28.5 million. However, the Space Solutions segment faced challenges with a 41% YoY decline in net sales to $11.7 million, largely due to the planned wind-down of a NASA services contract.

Encouragingly, bookings reached $49 million during the quarter, translating into a healthy 1.25 book-to-bill ratio. The performance reinforces Voyager’s alignment with national defense priorities and validates the strength of its technology stack. Moreover, backlog expanded 10% sequentially to $189 million, enhancing long-term revenue visibility.

Looking ahead, Voyager’s role as the majority owner and lead developer of Starlab remains a defining growth pillar. Management expects the platform, once operational, to generate more than $4 billion in annual revenue and over $1.5 billion in free cash flow, supported by government, commercial, and international customers.

For the full year 2025, Voyager’s management has guided net sales toward the high end of its $165 million to $170 million range, with non-GAAP adjusted EBITDA projected between negative $63 million and negative $60 million.

Analysts expect near-term pressure to persist, with Q4 fiscal 2025 loss per share projected to widen 100% YoY to $0.42. Beyond the quarter, however, the outlook improves meaningfully, as full-year 2025 losses are forecast to narrow 62.1% to $2.66, followed by a further 52.6% reduction to $1.26.

What Do Analysts Expect for VOYG Stock?

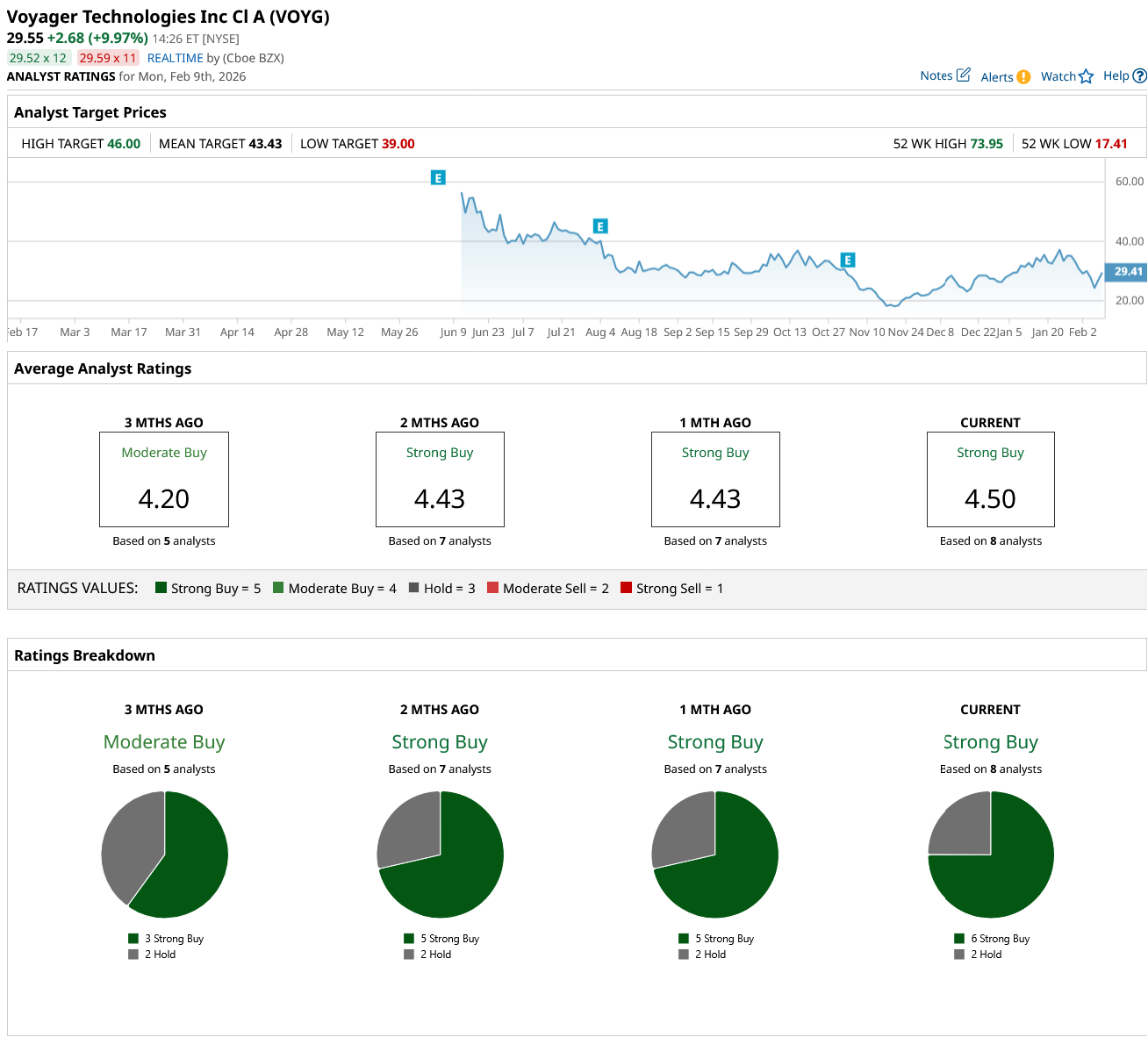

Wall Street continues to stand firmly behind Voyager Technologies, assigning VOYG stock a “Strong Buy” consensus rating. Among the eight analysts currently covering the stock, six recommend a “Strong Buy,” while the remaining two maintain a “Hold” rating.

From a price performance perspective, analysts continue to see clear upside potential in Voyager’s shares. The average price target of $43.43 signals a 61.6% appreciation from current levels. Meanwhile, the Street-high target of $46 points to a gain of 71.2% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)