With a market cap of $52.3 billion, ONEOK, Inc. (OKE) is a leading U.S. midstream energy company focused on the gathering, processing, storage, and transportation of natural gas and natural gas liquids (NGLs). Headquartered in Tulsa, Oklahoma, the company operates an extensive pipeline and infrastructure network across major energy-producing regions, including the Permian, Williston, and Mid-Continent basins.

Shares of the energy company have underperformed the broader market over the past 52 weeks. OKE stock has declined 13.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.6%. However, shares of ONEOK are up 13.1% on a YTD basis, surpassing SPX's 1.7% gain.

Looking closer, shares of the company have also lagged behind the State Street Energy Select Sector SPDR Fund's (XLE) 21.1% rise over the past 52 weeks and 20% gain in 2026.

On Jan. 21, ONEOK shares gained 2.4% after the company raised its quarterly dividend by 4% to $1.07 per share, implying an annualized payout of $4.28. The dividend is scheduled to be paid on Feb. 13, 2026, reflecting management’s confidence in cash flow stability.

For FY2025 that ended in December 2025, analysts expect OKE's EPS to rise 2.7% year over year to $5.31. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

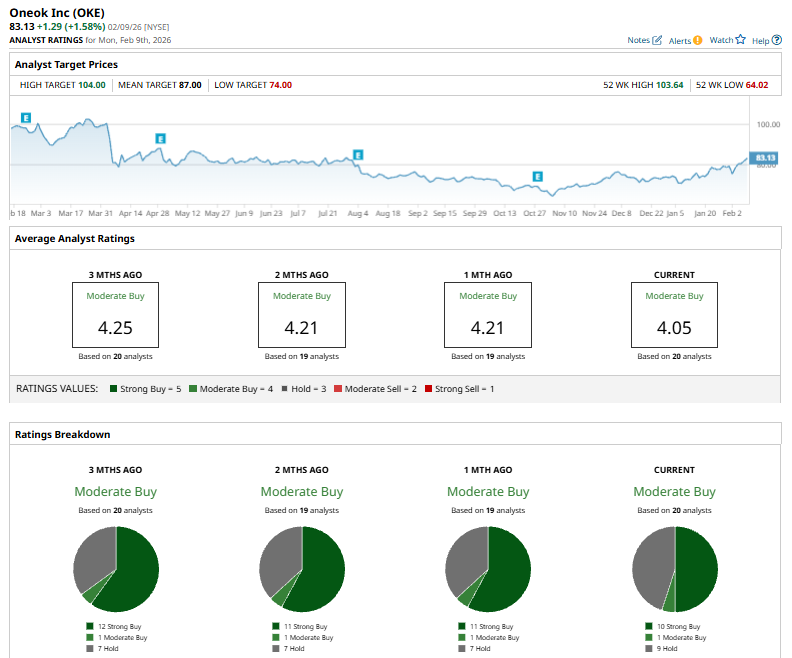

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” and nine “Holds.”

This configuration is slightly bearish than a month ago, with 11 “Strong Buy” ratings on the stock.

On Jan. 27, Jeremy Tonet of JPMorgan Chase & Co. (JPM) downgraded ONEOK to “Neutral” from “Overweight” and lowered his price target to $83 from $87. He noted that a sustained improvement in sentiment would likely require stronger oil prices and sees better opportunities elsewhere in the sector.

The mean price target of $87 represents a 4.4% premium to OKE’s current price levels. The Street-high price target of $104 suggests a 25.1% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)